Navigating the financial close at the end of each month can feel like a high-stakes race against the clock. Accountants and finance professionals often find themselves juggling multiple tasks, chasing down information, and battling tight deadlines, all while striving for impeccable accuracy. It is a period that can be fraught with stress and the potential for errors, making a smooth and efficient process seem like a distant dream for many organizations.

However, it does not have to be this way. Imagine a world where every step is clearly defined, responsibilities are assigned, and nothing falls through the cracks. This organized approach is not just wishful thinking; it is entirely achievable with the right tools. A well-structured month end close checklist template can transform this often-dreaded period into a manageable, predictable, and even empowering part of your financial calendar.

Why a Robust Month End Close Checklist Template is Your Business’s Best Friend

The monthly financial close is the backbone of any business’s understanding of its performance. It is where all transactions are reconciled, accounts are adjusted, and financial statements are prepared. Without a clear and consistent process, this critical function can quickly become chaotic. Errors might proliferate, deadlines could be missed, and the integrity of your financial reporting could be compromised, leading to poor decision-making and potential compliance issues.

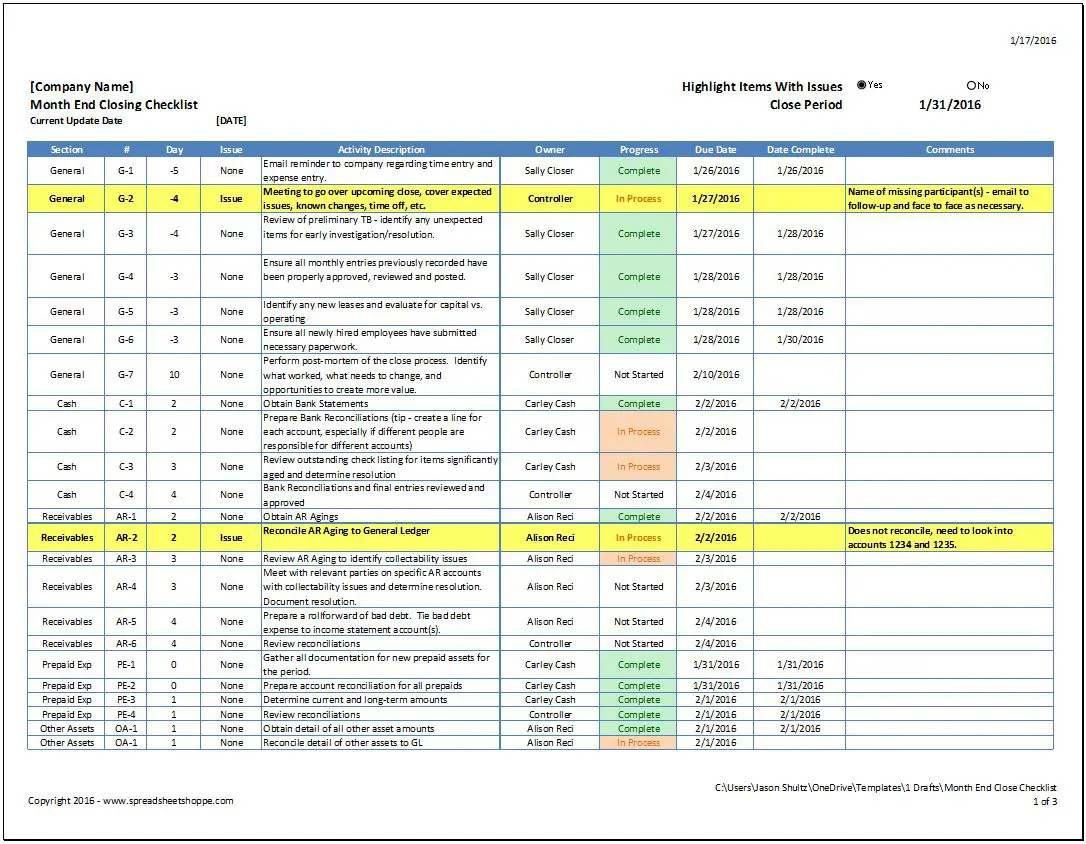

A comprehensive checklist acts as your roadmap, guiding every team member through the necessary steps. It ensures that no task is overlooked, from the smallest bank reconciliation to the most complex accrual entries. This level of detail and standardization is crucial for maintaining accuracy, especially when dealing with high volumes of transactions or when different team members are responsible for various aspects of the close.

Beyond just task management, a detailed month end close checklist template fosters accountability. Each item can be assigned to a specific individual or team, along with a deadline, making it clear who is responsible for what. This transparency not only speeds up the process but also reduces the time spent on chasing updates, allowing team leaders to monitor progress at a glance and address bottlenecks proactively.

Furthermore, a standardized checklist significantly reduces the learning curve for new employees. Instead of relying on tribal knowledge or ad hoc training, new hires can quickly get up to speed on the company’s month-end procedures by following a clear, documented process. This consistency is invaluable for business continuity, ensuring that the close process remains efficient even with staff changes.

Ultimately, adopting a robust checklist is about more than just checking boxes; it is about building a foundation for financial excellence. It empowers your team to work more efficiently, reduces stress, and provides management with timely, reliable financial information needed to make informed strategic decisions.

Key Benefits You Will Experience

- Enhanced Accuracy and Reduced Errors

- Streamlined Workflow and Time Savings

- Improved Compliance and Audit Readiness

- Better Decision Making Through Timely Reports

- Reduced Stress for Your Team

Building Your Ideal Month End Close Checklist Template: Essential Components

Creating an effective checklist involves more than just listing tasks; it requires a thoughtful approach to categorize, assign, and review each step. Start by breaking down the entire close process into logical sections. Typically, these might include cash and bank activities, accounts receivable, accounts payable, payroll, fixed assets, general ledger adjustments, and financial reporting. Within each section, detail the specific tasks that need to be completed.

For each task, it is vital to specify who is responsible for its completion. This clear assignment of duties eliminates confusion and ensures that every part of the close process has an owner. Additionally, setting realistic deadlines for each task, or even subtasks, helps keep the entire process on track and allows for proactive management of any potential delays. These deadlines should align with the overall target date for the financial statement release.

Do not forget the crucial step of review and approval. Once tasks are completed, they often need to be reviewed by a more senior member of the finance team. Your template should include dedicated slots for reviewer sign-offs, ensuring an extra layer of scrutiny and quality control. This not only catches potential errors before they become problems but also serves as an important internal control mechanism.

Finally, remember that your template is not a static document. Financial processes can evolve, new regulations might emerge, or your business operations could change. Therefore, schedule regular reviews of your month end close checklist template to ensure it remains relevant, comprehensive, and efficient. Gather feedback from your team on what works well and what could be improved, fostering a culture of continuous improvement within your finance department.

- Bank Reconciliations

- Accounts Receivable and Payable Reconciliation

- Accruals and Prepayments

- Payroll Reconciliation

- Fixed Asset Depreciation

- Journal Entries Posting

- Financial Statement Generation

- Review and Approval

By embracing a well-designed month end close checklist, your organization can move beyond the reactive chaos that often characterizes this period. It provides a structured, repeatable framework that empowers your finance team, minimizes errors, and delivers critical financial insights with confidence and speed. This proactive approach ensures that your financial reporting is not just accurate, but also a reliable asset for strategic planning and operational excellence.

Implementing and continually refining such a system means investing in the overall health and stability of your business. It allows you to transform a historically challenging period into an opportunity for growth and clearer decision-making, ultimately contributing to a more efficient and resilient financial operation for years to come.