When you’re involved in a transaction where goods are changing hands but the payment isn’t happening all at once, you need a clear, legally sound way to document everything. This is where the mighty duo of a bill of sale and a promissory note comes into play. While they serve different purposes, combining their power provides a robust framework for transactions that involve deferred payments, ensuring clarity and protection for both the buyer and the seller.

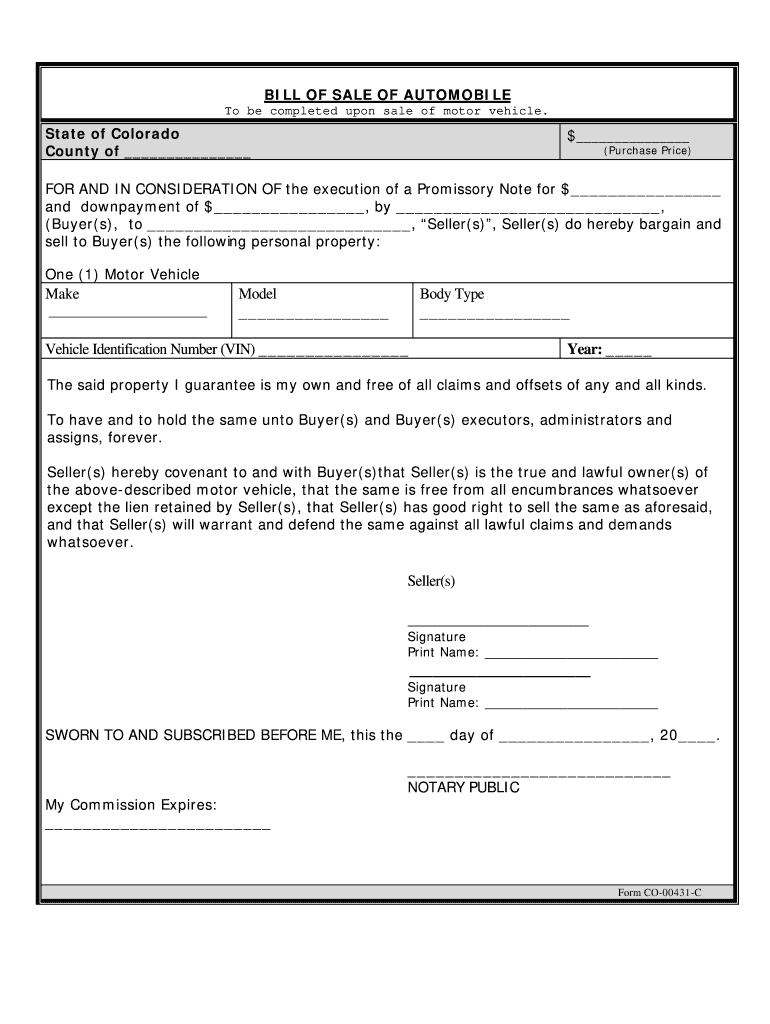

Imagine selling something valuable, like a used car or a piece of equipment, and the buyer agrees to pay you in installments over time. You need a document to transfer ownership immediately (the bill of sale), but you also need a separate, binding agreement that outlines the payment terms and promises repayment (the promissory note). Creating a single, cohesive bill of sale promissory note template streamlines this process, making it simpler and more secure for all parties involved.

Diving Deep: What Makes Up a Bill of Sale and a Promissory Note?

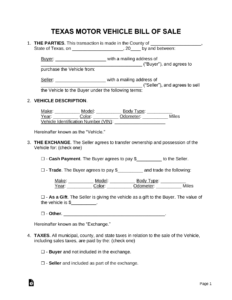

Understanding the individual components of these documents is crucial before seeing how they harmoniously blend into a single, comprehensive template. A bill of sale is fundamentally a legal document that records the transfer of ownership of personal property from a seller to a buyer. It serves as proof of purchase and defines the terms of the sale, including who the parties are, what is being sold, and for what price. It acts as your receipt and title combined for tangible goods.

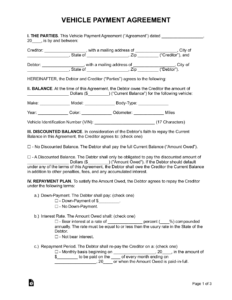

On the other hand, a promissory note is a written promise by one party (the maker or borrower) to pay a definite sum of money to another party (the payee or lender) at a specified future date or on demand, under specific terms. It is essentially an IOU, but with legally binding stipulations regarding the repayment schedule, interest rates, late fees, and what happens in the event of default. It formalizes a debt and the commitment to repay it.

Key Elements of a Bill of Sale

- Identification of Buyer and Seller: Full legal names, addresses, and contact information for both parties.

- Description of Property: A detailed account of the item being sold, including make, model, serial number, condition, and any unique identifiers.

- Purchase Price: The agreed-upon amount for the item.

- Date of Sale: The exact date when the transfer of ownership occurs.

- Signatures: Signatures of both the buyer and the seller, and often a witness, to validate the agreement.

Key Elements of a Promissory Note

- Principal Amount: The total sum of money being borrowed or owed.

- Interest Rate: The percentage charged on the principal amount over time.

- Payment Schedule: Details on how and when payments will be made (e.g., monthly installments, lump sum, specific dates).

- Due Dates: The specific dates by which payments are expected.

- Late Fees: Penalties for missed or late payments.

- Default Terms: What constitutes a default and the consequences, such as acceleration clauses (requiring immediate full payment).

- Collateral (if applicable): Any assets pledged by the borrower to secure the loan.

- Signatures: Signatures of the borrower and, ideally, the lender.

When you combine these elements into a single document, such as a bill of sale promissory note template, you create an incredibly powerful tool. It ensures that the transfer of ownership is clearly documented while simultaneously establishing a formal, legally enforceable plan for any outstanding payments. This dual functionality is invaluable for safeguarding the interests of both parties in complex transactions.

The Power of Combination: Why You Need a Single Template

Using a comprehensive bill of sale promissory note template offers unparalleled clarity and legal protection that separate documents simply can’t match as effectively. Instead of juggling two distinct agreements, potentially leading to discrepancies or omissions, a combined template ensures that all related terms and conditions are housed within a single, coherent document. This reduces the risk of miscommunication and provides a straightforward reference point for both the asset transfer and the payment agreement.

One of the primary advantages is the legal synergy created. The bill of sale establishes the rightful ownership of the item, protecting the buyer’s investment, while the integrated promissory note clearly defines the buyer’s obligation to pay and the seller’s right to receive funds according to the agreed schedule. This combination is particularly beneficial for sellers, as it provides a concrete legal instrument to enforce payment if the buyer defaults, safeguarding their financial interest even after the asset has been transferred.

Think about common scenarios like buying a used vehicle from a private seller with payments, purchasing expensive equipment for a small business on credit, or even financing a boat. In each case, ownership needs to be transferred quickly, but the full payment might take months or even years. A well-crafted bill of sale promissory note template addresses both aspects simultaneously, providing immediate proof of ownership and a clear, legally binding repayment plan.

Furthermore, a reliable template ensures that all necessary legal disclosures and clauses are included, helping both parties navigate the transaction with confidence. It minimizes the need for costly legal consultation for basic transactions, as the template itself incorporates best practices and standard legal language. It’s a proactive step to prevent future disputes by laying out all terms explicitly from the outset.

Here are some key benefits of opting for a unified approach:

- Streamlined Documentation: Combines two essential legal documents into one, simplifying record-keeping.

- Enhanced Legal Protection: Clearly defines ownership transfer and repayment obligations, protecting both buyer and seller.

- Reduced Risk of Disputes: Eliminates ambiguity by housing all terms in a single, comprehensive agreement.

- Increased Efficiency: Saves time and effort compared to creating and managing separate documents.

- Customization Capability: A good template allows for easy adjustment to specific terms, interest rates, and payment schedules unique to each transaction.

In essence, having a robust and easy-to-use template at your disposal provides peace of mind. It transforms potentially complicated transactions into straightforward, secure agreements, ensuring that assets are properly transferred and financial commitments are clearly understood and legally enforceable.

Navigating private sales or business transactions involving credit can be complex, but equipping yourself with the right tools simplifies the process immensely. A thoughtfully prepared document, combining the definitive transfer of ownership with a clear commitment to payment, offers a sturdy foundation for any agreement. It promotes transparency and security, allowing both parties to proceed with confidence. Choosing a template that addresses both facets ensures a smooth transaction and provides a legal safety net, making sure that every detail is accounted for from the very beginning.