Do you ever feel like you’re constantly juggling bills, trying to remember what’s due when, and sometimes even missing a payment or two? It’s a common source of stress for many of us. The monthly avalanche of invoices can feel overwhelming, leading to late fees, budget surprises, and a general sense of financial anxiety. What if there was a simpler, more manageable way to keep track of your financial obligations and ensure everything gets paid on time?

That’s where breaking down your bill payments into smaller, more frequent chunks can make a world of difference. Instead of facing a daunting pile once a month, imagine tackling your bills week by week. This approach can transform your financial management from a stressful sprint into a series of steady, easy steps. It’s all about creating a system that works with your life, not against it, and a well-designed weekly bill payment schedule template can be your guiding light.

Why a Weekly Schedule Makes Perfect Sense for Your Bills

Shifting from a monthly to a weekly bill payment strategy might seem like more work at first glance, but it actually simplifies your financial life considerably. The core idea is to distribute your financial responsibilities throughout the month, preventing that overwhelming feeling when multiple large bills hit at once. This method is especially beneficial if you get paid weekly or bi-weekly, as it allows you to align your payments directly with your income, creating a smoother cash flow.

By breaking down your larger monthly expenses into smaller, more digestible portions, you gain better control over your money. Instead of one big payout, you’re making several smaller ones. This makes it easier to notice if you’re overspending or if there’s a discrepancy with a bill, giving you more time to address it before it becomes a problem. It’s a proactive approach that helps you stay ahead of your finances rather than constantly playing catch-up.

Moreover, adopting a weekly payment routine can significantly reduce the risk of late fees. When you’re constantly aware of upcoming payments, even small ones, it builds a habit of financial vigilance. You’re less likely to forget a bill that’s due in a week if you’re already checking your schedule every few days. This consistent engagement with your finances fosters better money habits, leading to improved financial health over time.

Ultimately, a weekly system isn’t just about paying bills; it’s about building discipline and clarity around your money. It transforms a potentially stressful task into a routine, almost automatic process. And with the right tools, like a structured template, setting this up is much easier than you might think.

Key Advantages of a Weekly System:

- Reduces lump-sum anxiety by spreading payments out.

- Aligns perfectly with weekly or bi-weekly pay cycles.

- Improves cash flow visibility and helps prevent overdrafts.

- Helps catch errors or discrepancies in bills faster.

- Builds consistent financial habits and reduces the chance of missed payments.

Crafting Your Own Weekly Bill Payment Schedule Template

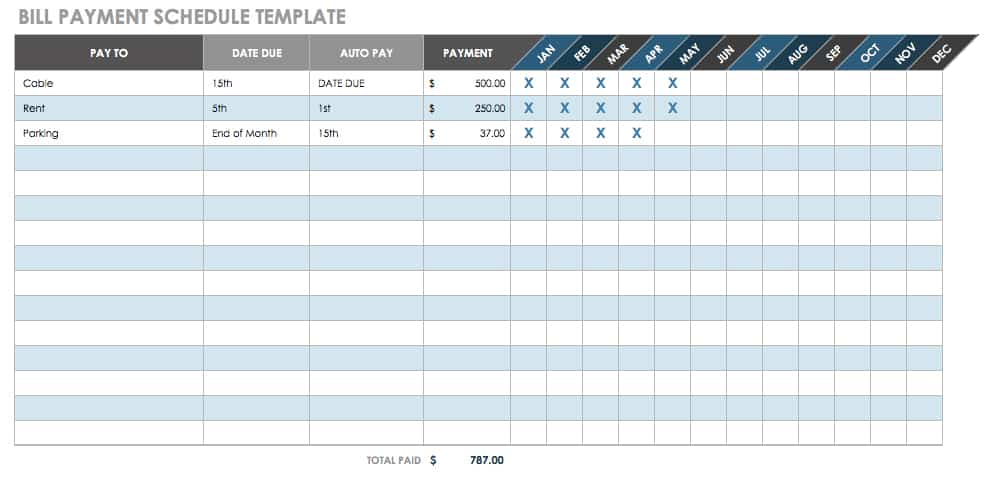

Creating your personalized weekly bill payment schedule template doesn’t have to be complicated. The goal is to build a clear, actionable plan that fits your unique financial situation. Start by gathering all your current bills, statements, and any recurring expenses you have. This includes everything from rent or mortgage payments, utility bills, credit card statements, loan payments, insurance premiums, and even subscriptions like streaming services or gym memberships. Don’t forget those quarterly or annual bills – you’ll want to factor those in too, perhaps by setting aside a small amount each week.

Once you have a comprehensive list, identify the due date for each bill and its typical amount. Now, the fun part begins: assigning these bills to specific weeks within the month. Look at your paydays and try to align larger payments with the weeks you receive income. For example, if your rent is due at the beginning of the month and you get paid on Fridays, you might assign rent to the first full week after your payday. Then, spread out your other bills, ensuring no single week feels too burdened. You might dedicate Week 1 to housing-related bills, Week 2 to utilities, Week 3 to credit cards and loans, and Week 4 to subscriptions and miscellaneous expenses.

Remember that flexibility is key. Your financial situation isn’t static, and neither should your template be. Life happens, and sometimes you might need to adjust which week a certain bill falls into. The beauty of a template is that it provides a framework, but you can always tweak it as needed. Consider adding columns for “Paid (Yes/No)” and “Date Paid” to your template so you can easily track your progress throughout the month.

Finally, once your weekly bill payment schedule template is set up, make it a habit to review it regularly – perhaps every Sunday evening or Monday morning. This quick check will keep you on track and give you peace of mind. You might even set up reminders on your phone or calendar for each payment, adding an extra layer of security. The goal is to create a system that feels effortless, allowing you to focus on other aspects of your life without the constant worry of forgotten bills.

Taking control of your finances doesn’t have to be a daunting task. By breaking down your monthly obligations into smaller, weekly steps, you can transform a source of stress into a manageable routine. This systematic approach provides clarity, reduces anxiety, and empowers you to make more informed financial decisions every single day.

Embracing a more structured way to manage your expenses is a powerful step towards achieving greater financial well-being. It’s about building habits that serve you, ensuring your hard-earned money goes where it needs to, and fostering a sense of calm and control over your financial future. What a great way to live!