Navigating the waters of property transactions and ownership changes can often feel like a complex puzzle, especially when official documentation is involved. A bill of sale serves as a crucial legal document, recording the transfer of personal property from a seller to a buyer. It’s more than just a receipt; it’s a formal acknowledgment of a change in ownership, providing essential details about the transaction and the parties involved.

When you’re dealing with specific types of property or situations within a particular jurisdiction, like Travis County, understanding the nuances of these documents becomes even more vital. Whether it’s for a vehicle, a mobile home, or other personal assets, having the correct paperwork ensures clarity, protects both parties, and fulfills local legal requirements. This document acts as a safeguard, providing a clear record for future reference, tax purposes, and potential disputes.

Understanding the Travis County Tax Bill of Sale

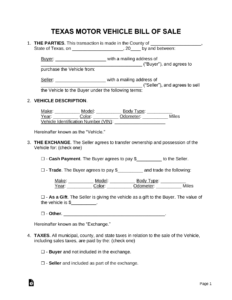

A travis county tax bill of sale template is a specialized document primarily used for the transfer of personal property, particularly items that might be subject to tax assessments or have been involved in tax-related proceedings, such as delinquent taxes leading to a sale. This is not typically for real estate, but rather for movable assets like vehicles, boats, or manufactured homes, where a clear chain of ownership is crucial for tax collection and registration purposes within the county. It provides a transparent record of the sale, detailing the asset, the transaction amount, and the identities of the buyer and seller, which is essential for updating county records and ensuring proper taxation.

Using a precise bill of sale helps to avoid future misunderstandings regarding ownership, financial obligations, and any potential liabilities. It serves as proof of the transaction date and terms, which can be invaluable when registering the property with the state, transferring titles, or dealing with any subsequent tax assessments. Without such a document, proving legitimate ownership or the terms of the sale can become incredibly challenging, potentially leading to legal complications down the line. It ensures that both parties have a clear understanding of the transfer and their respective responsibilities.

What to Include in Your Travis County Tax Bill of Sale

To ensure your Travis County tax bill of sale template is comprehensive and legally sound, it’s important to include several key pieces of information. Omitting critical details can invalidate the document or lead to future legal headaches. Here’s a breakdown of the essential components you should always aim to incorporate:

- Seller’s Full Legal Name and Contact Information: This includes their complete address and phone number, ensuring they can be identified and contacted if necessary.

- Buyer’s Full Legal Name and Contact Information: Similar to the seller’s details, the buyer’s full name, address, and phone number are crucial for official records.

- Detailed Description of the Property Being Sold: This requires specifics about the asset, such as its make, model, year, color, and any unique identifiers like a Vehicle Identification Number (VIN) for vehicles, or a serial number for other items. For manufactured homes, this would include the HUD tag number and manufacturer’s data plate information.

- The Purchase Price: Clearly state the agreed-upon amount in both numerical and written form to prevent any disputes regarding the sale price.

- Date of Sale: The exact date the transaction occurred is vital for legal and tax purposes, establishing when ownership officially transferred.

- Payment Method: Specify how the payment was made, whether it was cash, check, money order, or another agreed-upon method.

- Warranty Disclaimer: Most personal property sales, especially those resulting from tax proceedings, are “as-is” sales. This clause explicitly states that the seller makes no guarantees or warranties about the property’s condition after the sale.

- Signatures of Both Buyer and Seller: Both parties must sign and date the document to confirm their agreement to the terms.

- Notary Public Acknowledgment (Optional but Recommended): While not always legally required for a simple bill of sale, having the document notarized adds an extra layer of authenticity and can be beneficial in proving its validity in legal settings.

Ensuring all these details are accurately filled out and the document is signed by all parties creates a robust and legally defensible record of the transaction. Taking the time to be thorough at this stage can save significant time and stress in the future.

Navigating the Process and Post-Sale Steps

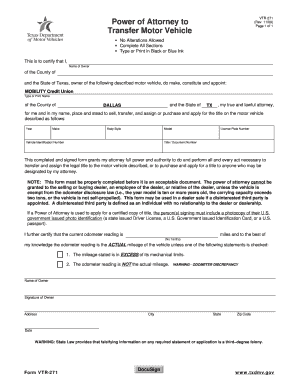

Finding a reliable travis county tax bill of sale template can be the first step in a smooth transaction. Many resources offer these forms, including online legal document providers, county clerk or tax assessor-collector websites, and sometimes even local stationery stores. While generic templates might be available, it is often beneficial to seek one tailored or recommended for use within Travis County, ensuring it adheres to any specific local requirements or common practices. Always verify the source of your template to ensure its accuracy and current relevance to Texas law and Travis County procedures.

Once you have your template, the next critical step is meticulously filling out every section. Double-checking names, addresses, and especially the detailed description of the property is paramount. Any discrepancies or errors could lead to delays in title transfers or registration, or even raise questions about the legitimacy of the sale. It’s always a good idea for both the buyer and seller to review the completed document together before signing, ensuring mutual understanding and agreement on all terms. Remember, this document legally binds both parties to the terms stated within.

After the bill of sale is fully executed, signed by both parties, and potentially notarized, the responsibilities don’t end there. For vehicles or mobile homes, the buyer will typically need to take the bill of sale, along with the existing title (if applicable), to the Travis County Tax Assessor-Collector’s office to officially transfer ownership and register the property. This step is crucial for ensuring the property is correctly registered in the new owner’s name and that any future tax bills are sent to the appropriate party. Timeliness in this step is important to avoid penalties or confusion.

Keeping a copy of the signed bill of sale is just as important for both the buyer and the seller. The buyer needs it for registration and proof of ownership, while the seller needs it as proof they are no longer the owner and are absolved of future liabilities or tax obligations for that specific property. Consider keeping both a physical copy and a digital scan for safekeeping. This due diligence ensures that both parties are protected and that the transfer of ownership is legally sound and fully documented within Travis County’s records.

Understanding the role of a bill of sale, especially when tailored for specific local jurisdictions like Travis County, is key to successful property transactions. These documents protect the interests of both buyers and sellers, providing a clear and indisputable record of the transfer of ownership. By meticulously preparing and managing these forms, individuals can ensure a smooth process for all involved.