Navigating the world of small business transactions can sometimes feel like a maze, full of important details that are easy to overlook. Whether you are buying new equipment, selling old assets, or even transferring ownership of an entire small enterprise, having proper documentation is absolutely essential. It’s not just about shaking hands; it’s about having a clear, legal record of what changed hands, for how much, and under what conditions.

This is precisely where a bill of sale steps in as your reliable guide. Think of it as a formal receipt for a significant transaction, one that protects both the buyer and the seller. It eliminates ambiguity and provides a clear record, preventing misunderstandings down the line. Without this crucial document, you could find yourself in a tricky situation with little to no legal recourse should a dispute arise.

The Indispensable Role of a Bill of Sale in Small Business Transactions

A bill of sale isn’t just a formality; it’s a foundational document for nearly any transaction involving the transfer of goods or ownership in the business world. For small business owners, understanding its importance can save significant headaches and potential legal battles. It serves as undeniable proof that a sale or purchase occurred, detailing the specifics of the exchange between two parties. This record is invaluable for a variety of reasons, from legal protection to tax compliance.

Firstly, a well-drafted bill of sale acts as a critical piece of evidence. In the unfortunate event of a dispute, such as questions about ownership, payment, or the condition of the items sold, this document provides a clear, written account of the agreement. It outlines the responsibilities and expectations of both the buyer and the seller, minimizing the chances of misinterpretation. Without it, resolving disagreements can become a subjective battle of words, often leading to costly litigation.

Moreover, a bill of sale is essential for record-keeping and financial transparency. When you acquire new assets for your business, this document serves as proof of ownership, which is crucial for insurance purposes, asset tracking, and depreciation calculations. Conversely, when selling assets, it provides a paper trail for accounting, helps determine capital gains or losses, and ensures you have a record for tax reporting. This organized approach is vital for maintaining healthy financial records and smooth audits.

Finally, the bill of sale provides crucial details about the item being transferred. This can include specific identifiers, the agreed-upon price, and any conditions of the sale, such as "as-is" clauses or warranties. This level of detail helps prevent future claims regarding the item’s condition or undisclosed issues. It solidifies the terms, ensuring both parties are on the same page regarding the transaction’s specifics.

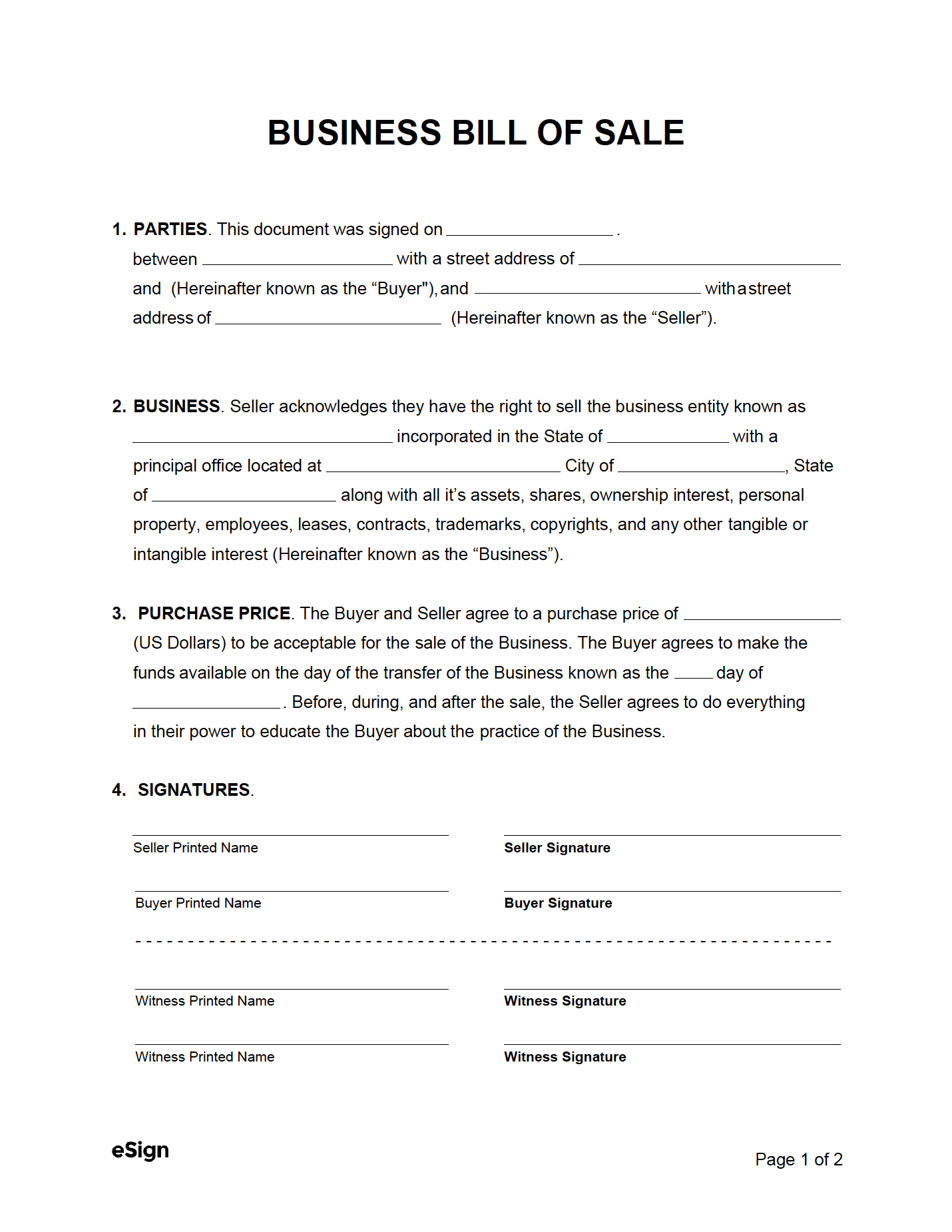

Key Elements of a Robust Bill of Sale

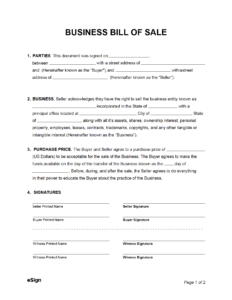

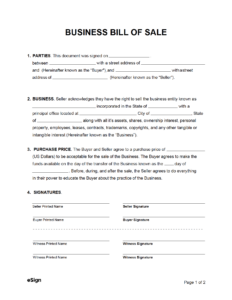

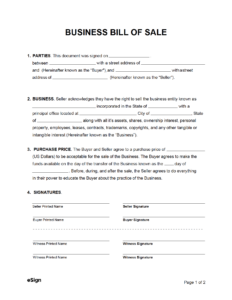

- **Identification of Parties:** Full legal names and addresses of both the seller and the buyer.

- **Detailed Item Description:** A clear and specific description of the item(s) being sold, including serial numbers, model numbers, make, and any other relevant identifiers.

- **Purchase Price and Payment Terms:** The agreed-upon sale price and how payment was made (e.g., cash, check, electronic transfer).

- **Date of Sale:** The exact date the transaction took place.

- **”As-Is” Clause (if applicable):** A statement indicating whether the item is being sold without any warranties.

- **Signatures:** Signatures of both the seller and the buyer, ideally with a witness, to signify their agreement to the terms.

How to Effectively Use a Small Business Bill of Sale Template

Using a bill of sale template for your small business transactions is not just about filling in blanks; it’s about understanding the nuances and customizing it to fit your specific needs. The beauty of a template lies in its structured format, which guides you through the essential information required for a legally sound document. However, simply downloading one and signing it without careful consideration can lead to significant oversights. The goal is to make the template work for you, not the other way around.

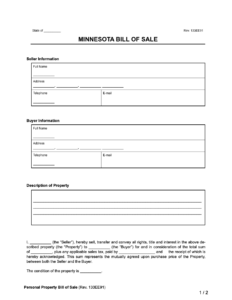

Start by choosing a reliable and comprehensive small business bill of sale template. There are many available online, but ensure the one you select covers all the basic legal requirements and allows for customization. Once you have your template, the most critical step is to accurately and thoroughly fill in all the requested information. This includes the full legal names and contact details of both the buyer and seller, a precise description of the asset being sold (including any unique identifiers like serial numbers), the exact purchase price, and the date of the transaction. Ambiguity in any of these areas can undermine the document’s effectiveness.

Beyond the basic details, consider any specific conditions or terms pertinent to your transaction. For instance, if the sale involves a down payment, a payment schedule, or specific delivery arrangements, these should be clearly outlined in the document. If you are selling an asset "as-is," without any warranties, it’s crucial to include a clear "as-is" clause to protect yourself from future claims about the item’s condition. The more specific and comprehensive your bill of sale, the better it serves its purpose of protecting both parties.

Finally, ensure that all involved parties review the completed document thoroughly before signing. It’s always a good practice to have a legal professional review significant transactions, especially those involving substantial assets or complex terms. Once signed, make sure both the buyer and the seller receive original copies of the bill of sale for their records. Keeping a digital copy, along with the physical one, in a secure location is also highly recommended for easy access and long-term retention.

Having a meticulously prepared bill of sale for every significant transaction gives you peace of mind. It’s a proactive measure that safeguards your interests and provides a clear, undeniable record of what occurred. Embracing this level of diligence in your operations can prevent many potential headaches and ensure your business dealings are always conducted on solid ground.