Managing your finances can sometimes feel like juggling a dozen flaming torches while riding a unicycle. Bills arrive from every direction, each with its own due date and amount, and it is incredibly easy for one or two to slip through the cracks. The stress of potentially missing a payment, incurring late fees, or even damaging your credit score can be overwhelming, turning what should be a simple task into a source of constant anxiety.

Imagine, though, a world where all your bills are neatly organized, their due dates clearly visible, and their payment status always up to date. This is not a financial fairy tale; it is the reality a well-designed monthly bill paying organizer template can create for you. It transforms chaotic bill management into a streamlined, stress-free process, giving you back control and peace of mind over your hard-earned money.

Why a Monthly Bill Paying Organizer Template is Your Financial Best Friend

In the whirlwind of daily life, it is remarkably common for bills to become unmanageable. You might have electricity bills, credit card statements, rent or mortgage payments, student loan dues, car payments, and subscriptions all vying for your attention. Without a central system, you might rely on memory, sticky notes, or scattered emails, which inevitably leads to missed deadlines and the frustrating sting of late fees that eat into your budget. The mental energy spent constantly worrying about what is due next is also a significant drain.

This is precisely where a dedicated monthly bill paying organizer template steps in as your invaluable ally. It provides a structured, visual roadmap for all your financial obligations, eliminating the guesswork and the frantic last-minute scramble. Instead of reacting to bills as they arrive, you become proactive, understanding your financial commitments for the entire month at a glance.

Beyond the practical benefits, using a template offers significant psychological advantages. The act of recording and tracking each bill instills a sense of control and accomplishment. You move from a state of financial anxiety to one of empowerment, knowing exactly where your money is going and when. This clarity reduces stress, allowing you to focus on other important aspects of your life without the constant hum of financial worries in the background. It is about building a habit of financial vigilance without it feeling like a chore.

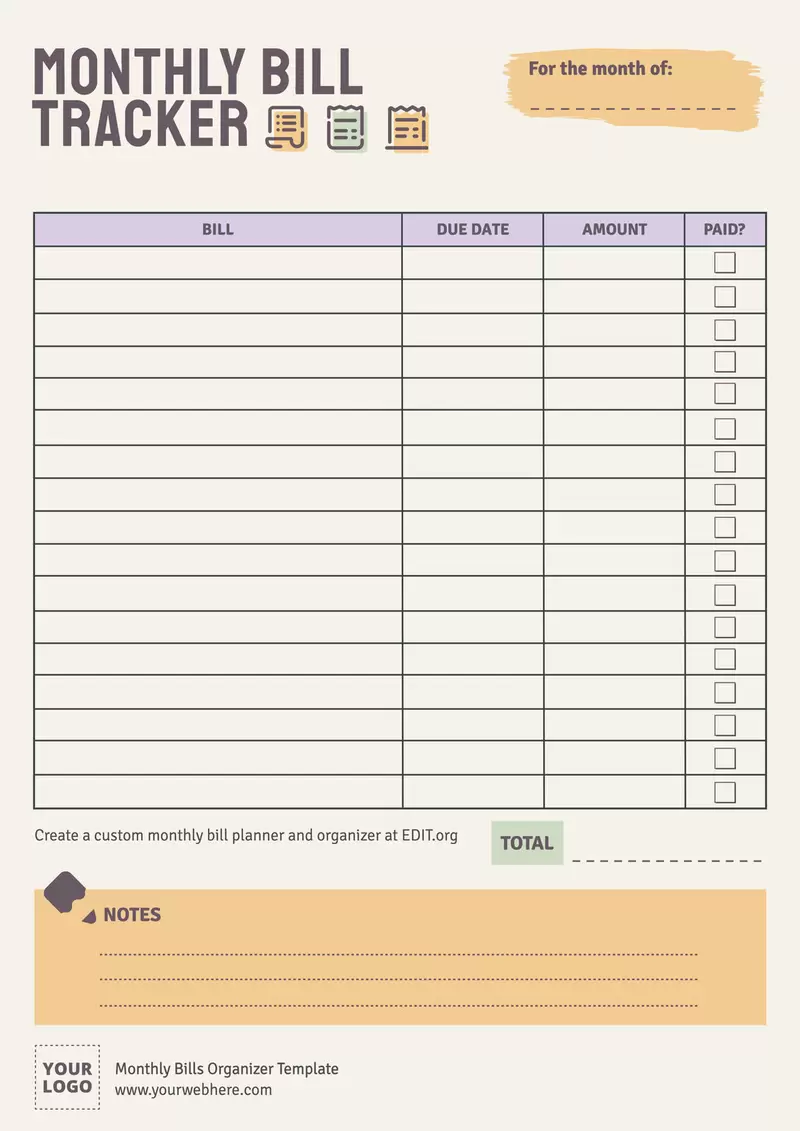

A truly effective monthly bill paying organizer template is designed to capture all the critical information you need to stay on top of your payments. It goes beyond just listing the bill name, prompting you to include details that are crucial for comprehensive tracking and future reference.

Key Elements to Look For

By including these elements, your template transforms into a comprehensive financial dashboard. For instance, the confirmation number can be a lifesaver if there is ever a dispute about a payment, while tracking the actual amount paid helps you reconcile your bank statements accurately. The notes section allows you to jot down reminders about specific payment terms or call references, making sure no detail is ever forgotten.

Steps to Effectively Use Your Monthly Bill Paying Organizer Template

Having a monthly bill paying organizer template is the first step; using it consistently and effectively is the key to unlocking its full potential. Think of it as a tool that needs regular maintenance and engagement to deliver its best results. The process is straightforward, but its power lies in its routine application.

Start by gathering every single bill you have, whether it comes in the mail, via email, or is accessible through an online portal. This includes utilities, credit cards, loans, subscriptions, insurance premiums, and even recurring personal payments. Dedicate a specific time each month, perhaps the first day or weekend, to sit down and meticulously input all these details into your monthly bill paying organizer template. Fill in the bill name, due date, and the minimum amount due for each item. This initial brain dump ensures nothing is overlooked.

Once your template is populated, establish a payment routine. Some people prefer to pay all bills on a single “bill day” each month, usually shortly after their primary income arrives. Others prefer to check their template weekly and pay bills as their due dates approach within that week. Whichever method you choose, consistency is paramount. Set reminders on your phone or calendar if necessary, so you never miss your dedicated bill management time.

After each payment is made, immediately update your template. Mark the bill as “paid,” enter the actual amount you paid, the method used, and, most importantly, the confirmation number if you paid online. This step is crucial for accurate record-keeping and provides a sense of closure for each transaction. At the end of the month, or before the new month begins, take a few moments to review your completed template against your bank and credit card statements. This reconciliation helps catch any errors, duplicate payments, or missed charges.

Remember, your template is a living document. As new bills arise or old ones are retired, update it accordingly. You can also customize it further by adding columns for budgeted amounts versus actual spending, or notes on payment history. Whether you prefer a digital spreadsheet or a physical printout, adapting the template to your personal preferences will make it even more effective and enjoyable to use.

Embracing a systematic approach to bill management through a dedicated template will significantly reduce financial stress and help you avoid unnecessary late fees. It empowers you with clear visibility into your financial obligations, fostering a proactive rather than reactive stance toward your money. This clarity allows for better budgeting, saving, and overall financial health, providing a solid foundation for your financial future. Start leveraging this simple yet powerful tool today, and experience the profound positive impact it has on your peace of mind and financial well-being.