Let’s face it, month-end closing can often feel like a frantic race against the clock, fraught with the potential for missed entries, reconciliation headaches, and last-minute stress. For many finance teams, it’s a period that tests patience and organizational skills, leading to late nights and a general sense of unease until the books are finally tied up. But what if there was a way to transform this monthly scramble into a smooth, predictable, and even calm process?

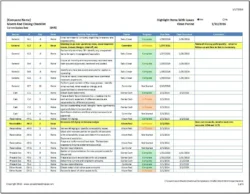

This is where a robust and well-structured month end closing checklist template comes into play. It’s more than just a list; it’s your strategic blueprint for efficiency, accuracy, and peace of mind. By systematizing your closing procedures, you not only reduce errors and save valuable time but also empower your team to focus on insightful analysis rather than just data entry, setting the stage for more informed business decisions.

Why a Robust Month End Closing Checklist Template is Your Accounting Superpower

Imagine a month-end close where every task is clearly defined, assigned, and tracked, where bottlenecks are identified proactively, and where the entire team operates with a shared understanding of what needs to be done and when. Without a standardized checklist, it’s easy for critical steps to be overlooked, for reconciliations to be delayed, or for adjustments to be forgotten until the very last minute. This often leads to rushed work, increased stress, and a higher probability of errors that can ripple through your financial statements.

A well-designed month end closing checklist template transforms this potential chaos into an orderly workflow. It provides a standardized framework that ensures consistency across all closing periods, regardless of personnel changes or unexpected challenges. This standardization is crucial for maintaining accuracy in financial reporting and for fostering a culture of accountability within your finance department. Everyone knows their role, their responsibilities, and the specific steps required to complete their tasks effectively.

Furthermore, a comprehensive checklist significantly reduces the learning curve for new team members, allowing them to quickly grasp the intricacies of your specific closing process. It acts as an invaluable training tool, documenting the institutional knowledge that might otherwise reside in the heads of a few experienced individuals. This knowledge transfer ensures continuity and resilience, making your finance operations less vulnerable to disruption.

By meticulously following a checklist, your team can move away from reactive problem-solving and towards proactive management. It encourages a disciplined approach to accounting, ensuring that all revenue and expenses are properly recorded, accounts are reconciled, and necessary accruals and deferrals are made on time. This meticulousness is not just about compliance; it’s about building a solid foundation for reliable financial data that stakeholders can trust.

Ultimately, leveraging a powerful month end closing checklist template allows finance professionals to shift their focus from the repetitive mechanics of closing the books to the more strategic aspects of their role. With the foundational tasks automated and streamlined through the checklist, teams gain the bandwidth to delve into financial analysis, identify trends, forecast future performance, and provide valuable insights that drive business growth. It’s about empowering your finance department to be a true strategic partner to the rest of the organization.

Key Stages of the Month End Close

Understanding the natural flow of the month end close is crucial for structuring your checklist effectively. While specific tasks will vary, these general stages provide a universal framework:

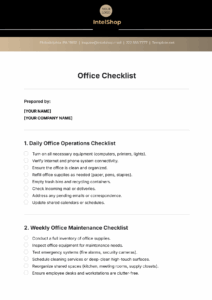

- Pre-Closing Preparations: Gathering necessary documents, communicating deadlines, and ensuring all transactional data is ready for processing.

- Recording Transactions: Ensuring all invoices, payments, payroll, and other daily transactions for the month are entered into the accounting system.

- Reconciliations: Matching internal records with external statements for bank accounts, credit cards, accounts receivable, and accounts payable to ensure accuracy.

- Accruals and Adjustments: Recording expenses incurred but not yet paid, revenues earned but not yet received, and other non-cash adjustments to reflect the true financial position.

- Financial Statement Generation: Producing the income statement, balance sheet, and cash flow statement based on the finalized data.

- Review and Analysis: Scrutinizing the financial statements for unusual trends, discrepancies, or errors before official sign-off.

Essential Components to Include

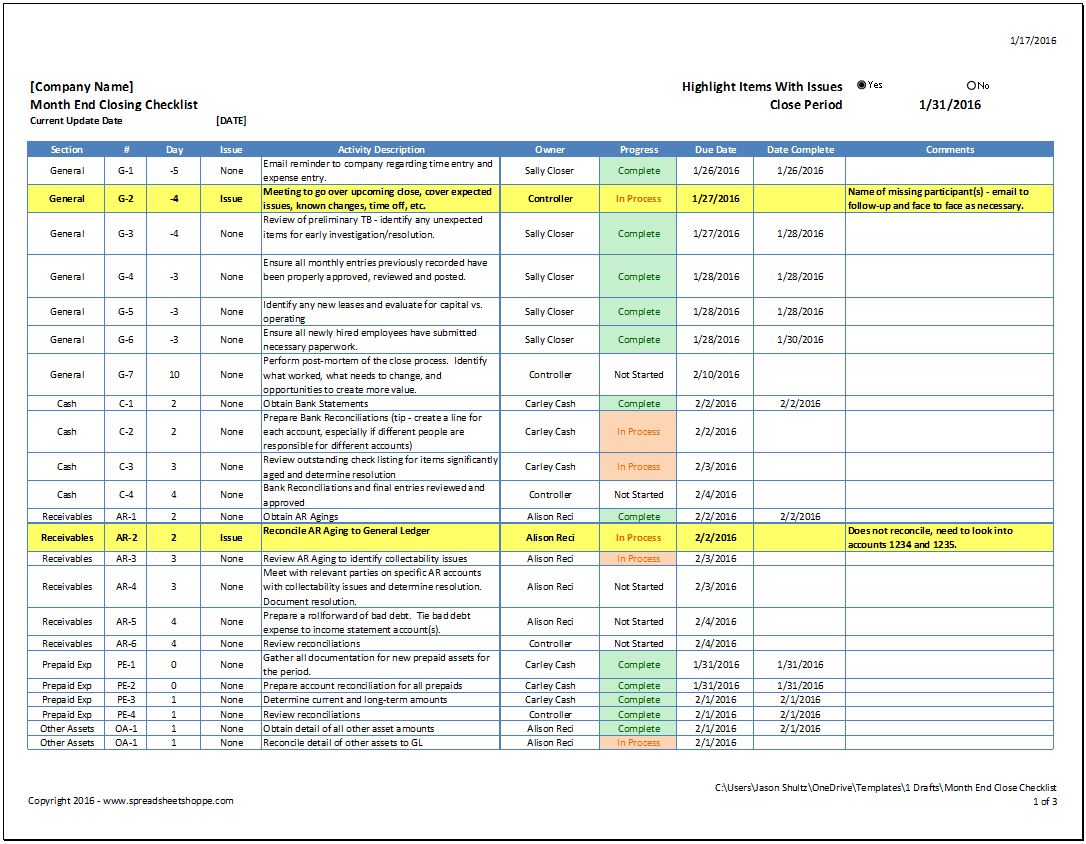

An effective checklist goes beyond just listing tasks. It needs to provide clarity and facilitate accountability:

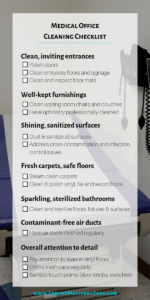

- Specific tasks with clear instructions: Avoid ambiguity; describe exactly what needs to be done.

- Responsible party for each task: Assign clear ownership to ensure accountability.

- Due dates: Establish a timeline for each task to manage the closing schedule effectively.

- Status updates: Allow for tracking progress (e.g., not started, in progress, completed, reviewed).

- Reference to supporting documentation: Indicate where relevant files, reports, or data can be found.

- Sign-off sections: Require initials or electronic signatures for completion and review steps.

Building Your Customized Month End Closing Workflow

While a generic month end closing checklist template can serve as an excellent starting point, the true power comes from customizing it to fit the unique rhythm and requirements of your specific business. Every organization has different operational nuances, accounting systems, and reporting needs. Taking the time to tailor your checklist ensures it addresses your precise challenges and optimizes your internal processes rather than imposing a one-size-fits-all solution that might not fully integrate with your workflow.

The customization process often begins with a thorough review of your current closing procedures. What works well? What are the recurring pain points or bottlenecks? Engage your finance team in this exercise, as those on the front lines often have the most valuable insights into where efficiencies can be gained or where clarity is lacking. Their input is crucial for developing a checklist that is not only comprehensive but also practical and user-friendly for everyone involved.

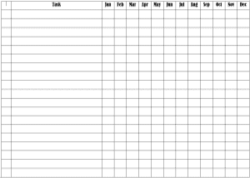

Consider breaking down your month-end tasks by department, account type, or even by a timeline (e.g., tasks to complete in the first week, second week, etc.). This segmentation can make a large checklist feel more manageable and ensures that related tasks are grouped logically. For example, all cash-related reconciliations might be grouped together, followed by accounts receivable, then accounts payable, and so on. This logical flow helps prevent tasks from being missed and streamlines the review process.

Remember to integrate any specific compliance requirements or industry-specific adjustments that your business might need. This could include unique tax considerations, grant reporting requirements, or particular industry standards that dictate how certain transactions are recognized. Your customized checklist should be a living document, subject to periodic review and refinement. As your business evolves, so too should your month end closing checklist template, ensuring it remains a relevant and powerful tool for financial management.

By meticulously crafting and consistently following a tailored checklist, finance teams can confidently navigate the complexities of their monthly close. This methodical approach not only reduces stress and minimizes errors but also significantly improves the accuracy and timeliness of financial reporting. It allows businesses to gain clearer insights into their performance, enabling more strategic decisions and fostering a culture of financial excellence. Investing time in developing and adhering to a comprehensive checklist truly transforms the monthly closing process from a hurdle into a strategic advantage, paving the way for more informed and confident business operations.