Thinking of passing on a beloved car to a family member or a close friend? Gifting a vehicle can be a wonderfully generous gesture, saving the recipient the hassle of a down payment or monthly car notes. However, even when no money changes hands, the process isn’t as simple as just handing over the keys. There are important legal and administrative steps you need to take to ensure a smooth and proper transfer of ownership.

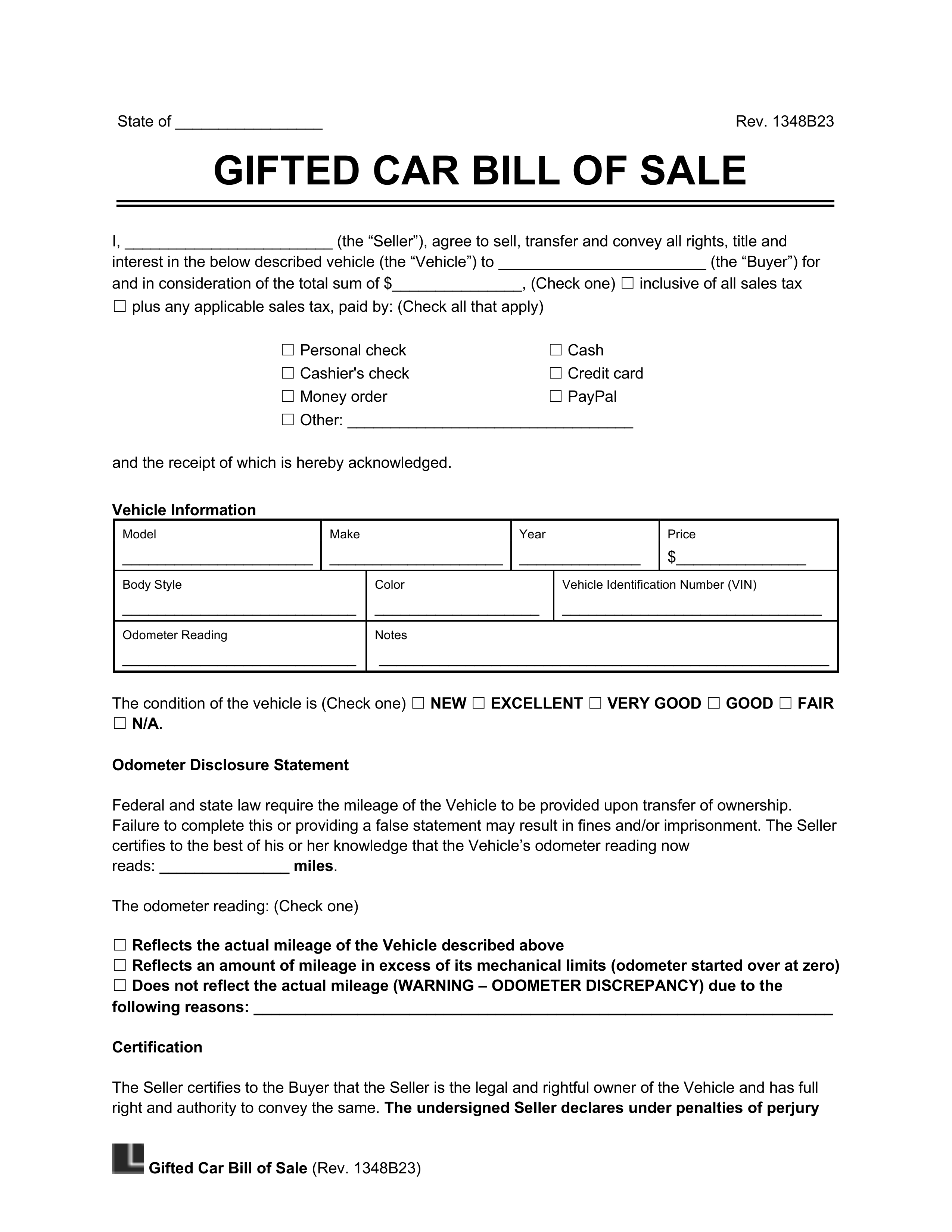

One of the most crucial documents in this process is a bill of sale. While you might associate bills of sale with monetary transactions, they are equally vital for documenting gifts, serving as official proof of the transfer and protecting both the giver and the receiver from potential headaches down the road. Understanding how a specific gifted car bill of sale template works can save you a lot of time and confusion later on.

Why You Need a Bill of Sale Even for a Gifted Car

It might seem counterintuitive to create a bill of sale when there’s no money involved, but trust us, it’s an essential step. Think of it less as a receipt for purchase and more as a legal declaration of ownership transfer. Without this formal document, proving that the vehicle legitimately changed hands as a gift can become incredibly difficult, leading to complications with registration, insurance, and even tax authorities. It ensures a clear paper trail for what might otherwise appear to be an informal exchange.

Legally, every vehicle on the road needs a registered owner, and that ownership needs to be verifiable. A bill of sale, even for a gifted car, provides the necessary documentation to update the vehicle’s title with the Department of Motor Vehicles (DMV) or equivalent state agency. It officially records the date of transfer and the identities of both the donor (the giver) and the recipient. This helps prevent any future disputes about who legally owns the vehicle.

Furthermore, tax implications are a significant reason to have a proper gifted car bill of sale template. Many states offer exemptions from sales tax when a vehicle is gifted between certain family members, but you’ll need clear documentation to prove that it was indeed a gift and not a sale disguised to avoid taxes. Without a formal bill of sale explicitly stating “gift,” the recipient might find themselves unexpectedly liable for sales tax on the vehicle’s market value, which can be a substantial amount. The donor might also need this document for their own tax records, especially if the gift value is high enough to approach federal gift tax thresholds, though this is rare for most car values.

Beyond legal and tax concerns, a bill of sale also protects both parties from liability. Once the car is gifted, the new owner assumes responsibility. If the car is involved in an accident or receives a parking ticket after the transfer, the bill of sale serves as proof that the previous owner is no longer liable. It also streamlines the process of getting the vehicle insured under the recipient’s name, as insurance companies require clear proof of ownership before issuing a policy.

Key Reasons to Document a Gifted Car Transfer

- Legal proof of ownership transfer from one party to another.

- Documentation for state motor vehicle departments to update title and registration.

- Evidence for potential sales tax exemptions on gifted vehicles.

- Protection for the donor from future liability related to the vehicle.

- Necessary paperwork for the recipient to obtain insurance coverage.

What to Include in Your Gifted Car Bill of Sale Template

Now that you understand the importance, let’s look at the essential components you should always include in your gifted car bill of sale template. Having all the correct information meticulously filled out will save both parties a great deal of trouble and ensure the document serves its intended purpose effectively. Missing key details can invalidate the form or lead to questions from state authorities.

First and foremost, you need comprehensive information about both the donor and the recipient. This includes their full legal names, current addresses, and contact details like phone numbers. It’s crucial that these details match the information on their government-issued identification, as this is how the DMV will verify their identities during the title transfer process. Accuracy here is paramount for a smooth transaction.

Next, detailed information about the vehicle itself is absolutely vital. This section should clearly list the vehicle’s make, model, year, body style (e.g., sedan, SUV, truck), and its Vehicle Identification Number (VIN). The VIN is a unique identifier for the car, much like a social security number for a person, and is critical for tracking its history and ownership. You should also include the current odometer reading at the time of the transfer. This helps confirm the mileage at the point of ownership change, which can be important for future sales or inspections.

The most critical part of a gifted car bill of sale template is the explicit declaration that the vehicle is being transferred as a gift. This statement must clearly state that no monetary exchange or other form of compensation is involved. Words like “gift,” “no monetary consideration,” or “transferred without payment” are crucial. This clause distinguishes it from a traditional sale and is what allows for potential sales tax exemptions in many jurisdictions. Without this specific language, the transaction could be mistakenly interpreted as a sale.

Finally, the document must include the date of the transfer and the signatures of both the donor and the recipient. The date stamps the moment ownership officially changes hands. Both parties’ signatures signify their agreement to the terms stated in the document and their acknowledgment of the transfer. Depending on your state’s requirements, you might also need to have the document notarized. A notary public’s seal adds an extra layer of legal authentication, confirming the identities of the signers and that they signed willingly. Always check your local DMV or Department of Revenue website for specific state requirements regarding notarization for gifted vehicles.

- Full legal names and addresses of both the donor (giver) and recipient.

- Detailed vehicle description: Make, model, year, body type.

- Vehicle Identification Number (VIN) for unique identification.

- Current odometer reading at the time of transfer.

- A clear and explicit statement that the vehicle is being transferred as a gift with no money exchanged.

- Date of the vehicle transfer.

- Signatures of both the donor and the recipient.

- Space for a notary public’s signature and seal, if required by your state.

Even though the act of gifting a car comes from a place of generosity, handling the accompanying paperwork with precision is a sign of true care. Ensuring all necessary fields are accurately filled out on a proper form can prevent a host of administrative headaches for the recipient, allowing them to enjoy their new vehicle without unforeseen complications.

Taking the time to prepare this crucial document correctly means the new owner can easily register the car, secure insurance, and confidently drive away knowing all legal bases are covered. It’s a small effort that yields significant peace of mind for everyone involved.