Ever found yourself in a situation where a customer is ready to buy your amazing product, but they’re not quite ready to take delivery? Maybe they have storage issues, or they’re coordinating with other aspects of a larger project. This is precisely where a “bill and hold” arrangement comes into play. It allows you to invoice the customer and recognize revenue now, while the goods remain at your facility until they’re ready to receive them.

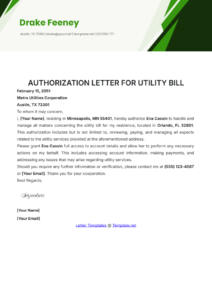

While this sounds straightforward, there’s a lot more to it than just holding onto some inventory. To ensure everything is above board, especially when it comes to financial reporting and revenue recognition, you need clear, undeniable documentation. This is where having a robust and well-drafted bill and hold letter template becomes not just useful, but absolutely essential. It’s your foundational document for establishing the terms and protecting both parties.

Understanding Bill And Hold Arrangements

A bill and hold arrangement essentially means that you, the seller, bill a customer for goods, but you retain physical possession of those goods for a specified period. The customer takes legal title and risk of loss, but you hold onto the items until they are ready for shipment. This isn’t just a casual agreement; it’s a formal transaction with significant implications for how and when you can recognize revenue, which is crucial for your financial statements.

Companies typically enter into bill and hold agreements for a variety of legitimate reasons, usually at the customer’s request. Perhaps the customer lacks adequate storage facilities, is experiencing delays in their construction project, or needs to time the delivery precisely with other components or phases of their operation. Whatever the reason, it must be substantive and not merely an attempt by the seller to boost current period revenue without genuinely transferring control of the goods.

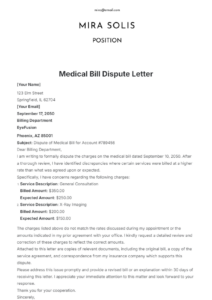

From an accounting perspective, specifically under ASC 606 (Revenue from Contracts with Customers), recognizing revenue from bill and hold sales isn’t automatic. There are stringent criteria that must be met to ensure that control of the goods has genuinely transferred to the customer, even though you still have them on your premises. This is why the documentation, particularly the bill and hold letter template, is so vital. Without clear evidence that these conditions are met, your auditors or regulators might disallow the revenue recognition, leading to financial restatements.

Key Criteria for Revenue Recognition

- The reason for the bill and hold arrangement must be substantive (e.g., at the customer’s request).

- The product must be identified separately as belonging to the customer, ready for shipment.

- The product must currently be ready for physical transfer to the customer.

- The entity (seller) cannot have the ability to use the product or direct it to another customer.

- The customer must have taken legal title to the product.

- The customer must have accepted the risks and rewards of ownership of the product.

Crafting Your Effective Bill And Hold Letter Template

So, what exactly should go into this pivotal document? Think of your bill and hold letter template as a comprehensive agreement that leaves no room for ambiguity. It’s designed to clearly outline the terms, responsibilities, and risks associated with the transaction, ensuring compliance with revenue recognition standards and protecting both parties from potential disputes down the line.

Firstly, the letter needs to precisely identify the goods in question, including quantities, descriptions, and any unique identifiers. It’s also crucial to state the customer’s specific reason for the bill and hold request. This demonstrates the “substantive reason” required for revenue recognition. The letter should clearly stipulate the agreed-upon delivery date or specify that delivery will occur upon the customer’s request within a certain timeframe. Clarity on when the goods will physically move is paramount.

One of the most critical elements is the transfer of risk and title. The letter must explicitly state that the customer assumes all risks of loss or damage to the goods from the moment they are billed, even though they remain at your facility. Furthermore, it should confirm that legal title has passed to the customer. To solidify the fact that the goods are truly the customer’s, the letter should detail how the goods are being segregated, identified, and made ready for shipment, separate from your other inventory.

Finally, the letter should include the payment terms, confirming that the invoice is due per the standard terms, regardless of physical delivery. Having a pre-approved and legally vetted bill and hold letter template ensures consistency and reduces the risk of overlooking critical details. It streamlines your process, provides clear documentation for auditors, and establishes a transparent understanding with your customers. Investing time in perfecting this template now will save you countless headaches and potential compliance issues in the future.

In essence, a carefully constructed bill and hold letter is more than just a piece of paper; it’s a testament to the integrity of your revenue recognition practices and a cornerstone of your customer relationships. It provides the necessary audit trail and peace of mind that all parties are operating under a clear and mutually understood agreement. This level of diligence ensures that your financial reporting remains robust and defensible.

Ensuring your bill and hold agreements are watertight is crucial for maintaining financial integrity and avoiding compliance pitfalls. By utilizing a comprehensive template and adhering to established criteria, you can confidently navigate these arrangements, recognizing revenue appropriately while accommodating your customers’ unique needs. It’s about being precise, transparent, and always on the right side of the rules.