Embarking on an acquisition journey is an exhilarating experience, brimming with potential for growth and strategic advantage. However, beneath the surface of exciting prospects lies a labyrinth of complexities and risks. Navigating this landscape requires more than just enthusiasm; it demands meticulous examination and a keen eye for detail to ensure that the anticipated value truly materializes.

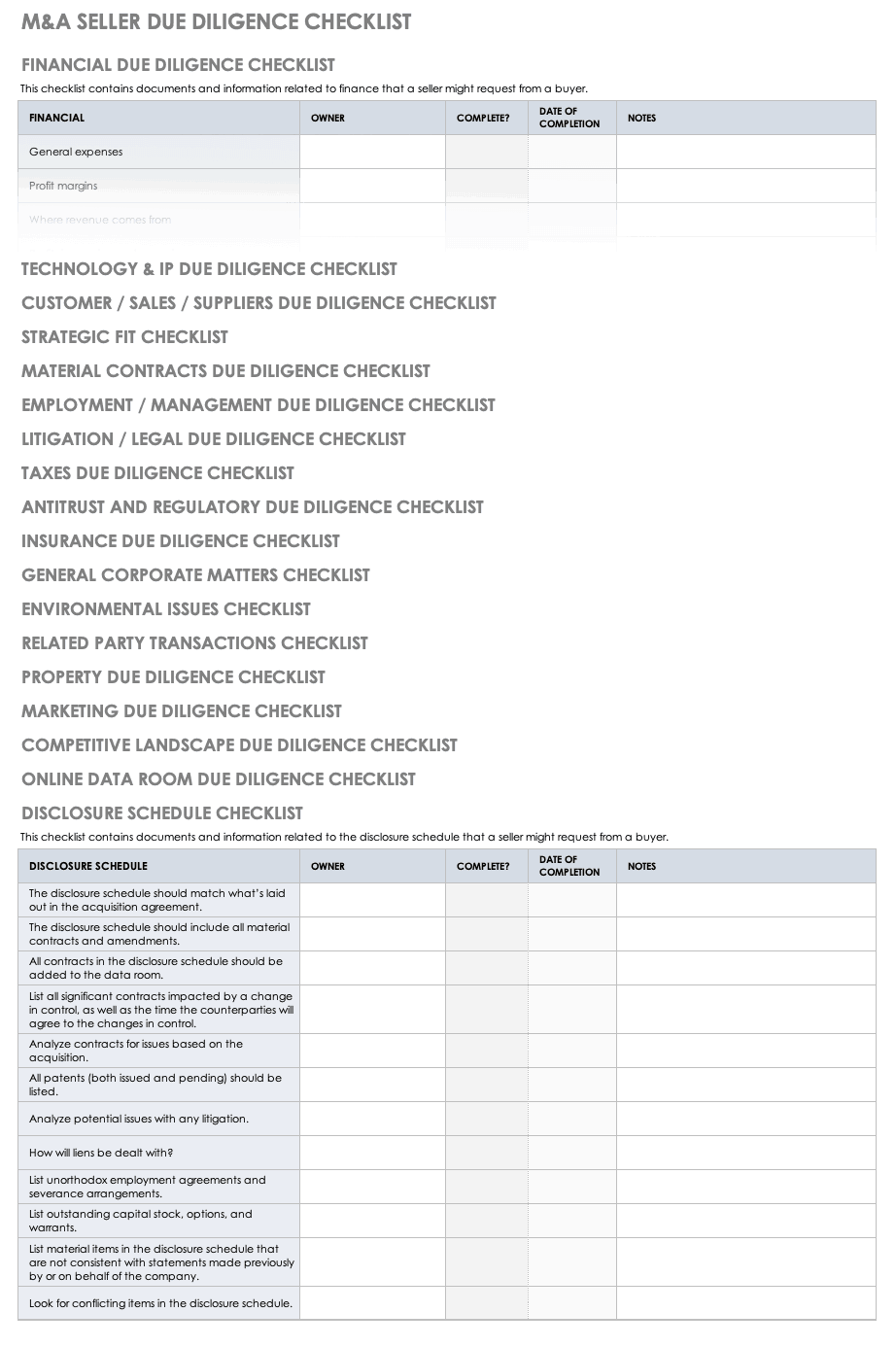

This is precisely where robust due diligence becomes indispensable. It’s the critical process of thoroughly investigating a target company before finalizing a deal, helping buyers understand what they’re truly acquiring. A well-structured acquisition due diligence checklist template can be your compass, guiding you through the intricate layers of a business and safeguarding your investment against unforeseen pitfalls.

Navigating the Depths: Core Areas of Acquisition Due Diligence

When you’re considering bringing another company into your fold, you’re not just buying assets or a customer list; you’re adopting an entire operational entity. This means scrutinizing every corner, from the balance sheet to the boardroom culture. A comprehensive due diligence process is designed to uncover potential liabilities, validate assumptions, and identify opportunities for synergy and growth. It’s about building a complete picture before committing.

Financial Health and Projections

Understanding the target company’s financial story is often where many buyers begin. It’s about much more than just looking at the bottom line; it’s about dissecting historical performance, scrutinizing current financial health, and critically evaluating future projections. You want to see consistent revenue, healthy profit margins, and a clear path to sustained growth. Are the numbers truly telling the story, or are there hidden accounting practices that could inflate value or obscure risks?

Key financial elements to scrutinize include:

- Audited financial statements for the past 3-5 years, including income statements, balance sheets, and cash flow statements

- Detailed revenue recognition policies and customer concentration analysis

- Operating expenses, cost structures, and profitability trends

- Working capital analysis and capital expenditure plans

- Debt schedules, contingent liabilities, and off-balance-sheet items

- Tax returns and compliance records

- Forecasts, budgets, and the underlying assumptions driving future projections

Legal Landscape and Regulatory Compliance

Beyond the numbers, the legal framework of the target company presents its own set of potential landmines or opportunities. This phase delves into all contractual obligations, potential litigation, intellectual property, and adherence to regulatory standards. It’s about ensuring the company operates within the law and that its assets are truly its own, free from encumbrances. Unresolved legal issues can lead to significant post-acquisition costs and reputational damage.

Important aspects here often include:

- Corporate governance documents, including articles of incorporation, bylaws, and board minutes

- Material contracts with customers, vendors, employees, and lessors

- Pending or threatened litigation, judgments, and settlements

- Intellectual property: patents, trademarks, copyrights, and licenses

- Regulatory approvals, permits, and compliance history, especially in regulated industries

- Environmental, Social, and Governance (ESG) considerations and related compliance

- Data privacy and security policies and compliance (e.g., GDPR, CCPA)

Operational Efficiency and Market Position

Operational and commercial due diligence shifts the focus to how the business actually runs and where it stands in its market. This involves evaluating the business model, market opportunities, customer base, sales channels, supply chain, and technological infrastructure. It’s less about historical records and more about future viability and integration potential. You need to understand the engines that drive the company’s daily operations and its ability to compete and grow in its chosen market.

Consider the following:

- Market analysis: size, growth trends, competitive landscape, and market share

- Customer concentration, retention rates, and acquisition strategies

- Sales pipeline, marketing effectiveness, and brand reputation

- Supply chain dependencies and resilience, including key suppliers and agreements

- Technology stack, IT infrastructure, cybersecurity posture, and software licenses

- Key operational processes, efficiency, and scalability

- Synergy analysis and integration challenges post-acquisition

Beyond the Balance Sheet: People, Culture, and Integration

While financial, legal, and operational aspects are foundational, a company’s true heart often lies in its people and its culture. Neglecting this “human element” can derail even the most promising acquisition. After all, you’re not just buying a business; you’re acquiring a team of individuals, their collective expertise, and the unspoken norms that govern their interactions and productivity. Understanding this dimension is crucial for long-term success.

Evaluating the human capital means delving into the leadership team, key employees, and the broader workforce. What is the talent depth? Are there critical individuals whose departure would significantly impact the business? Compensation structures, benefits packages, and employee retention plans are all vital considerations. A thoughtful approach to these areas can prevent a post-acquisition exodus of valuable talent.

Furthermore, cultural fit is paramount. Imagine two companies with vastly different operating philosophies suddenly merging. Misaligned values, communication styles, and decision-making processes can lead to friction, decreased morale, and lost productivity. Due diligence in this area involves understanding the target company’s culture, its core values, and how employees interact. It’s about assessing how well the two organizations can integrate and form a cohesive unit.

Ultimately, successful integration hinges on a clear understanding of the human dynamics. This involves not just identifying potential challenges but also developing proactive strategies for communication, change management, and talent retention. A comprehensive look at the people and cultural aspects through your acquisition due diligence checklist template will pave the way for a smoother transition and a more successful combined entity.

Thorough due diligence isn’t merely a bureaucratic hoop to jump through; it’s a strategic imperative. It empowers you with the knowledge needed to make informed decisions, negotiate effectively, and mitigate risks before they manifest. By meticulously working through a comprehensive acquisition due diligence checklist template, you transform uncertainty into clarity, ensuring that your investment is sound and poised for future success. This diligent preparation is the cornerstone of creating lasting value and realizing the full potential of your acquisition.