Navigating a private sale can sometimes feel a bit like uncharted waters, especially when the item you’re selling or buying comes with a significant price tag. While a simple bill of sale documents the transfer of ownership, what happens when the full amount isn’t paid upfront? This is where things can get a little tricky, and it’s precisely why having the right documentation is crucial for both parties involved.

Whether you’re selling a vehicle, a boat, a piece of art, or even expensive equipment, extending payments can make a sale feasible for a buyer, but it also introduces an element of risk for the seller. A robust bill of sale that clearly outlines a payment plan isn’t just a formality; it’s a legal safeguard that provides peace of mind and clear expectations for everyone.

Why a Bill of Sale with a Payment Plan is Essential

When you’re dealing with a private transaction that involves multiple payments over time, relying solely on a verbal agreement is a recipe for potential misunderstandings and disputes. Imagine selling a used car to a friend, agreeing they’ll pay you in three installments. Without a proper document, if a payment is missed or the car develops an unforeseen issue, resolving it can become a messy, uncomfortable situation that strains your relationship and leaves you without your money. A written agreement clarifies the terms from the outset, protecting both the seller’s right to receive payment and the buyer’s right to ownership under defined conditions.

This type of document legally binds both parties to the agreed-upon terms, turning a casual arrangement into a formal, enforceable contract. It acts as a clear record of the transaction, detailing the item being sold, its condition, the total purchase price, and, most importantly, the schedule and terms of the deferred payments. This level of detail removes ambiguity and provides a clear pathway for resolution should any issues arise down the line.

Moreover, a well-structured document will anticipate potential problems and outline solutions. What happens if a payment is late? Is there a penalty? What if the buyer defaults entirely? A comprehensive bill of sale with payment plan template will include clauses addressing these scenarios, ensuring that everyone knows their responsibilities and the consequences of not fulfilling them. It transforms a potentially risky venture into a secure and transparent process.

By laying out all the specifics in black and white, this template ensures that there are no surprises for either party. It covers everything from the initial down payment to the final installment, including any interest charged or late fees that might apply. This meticulous approach helps prevent disputes and provides a solid legal basis if a dispute does occur.

Key Components to Include

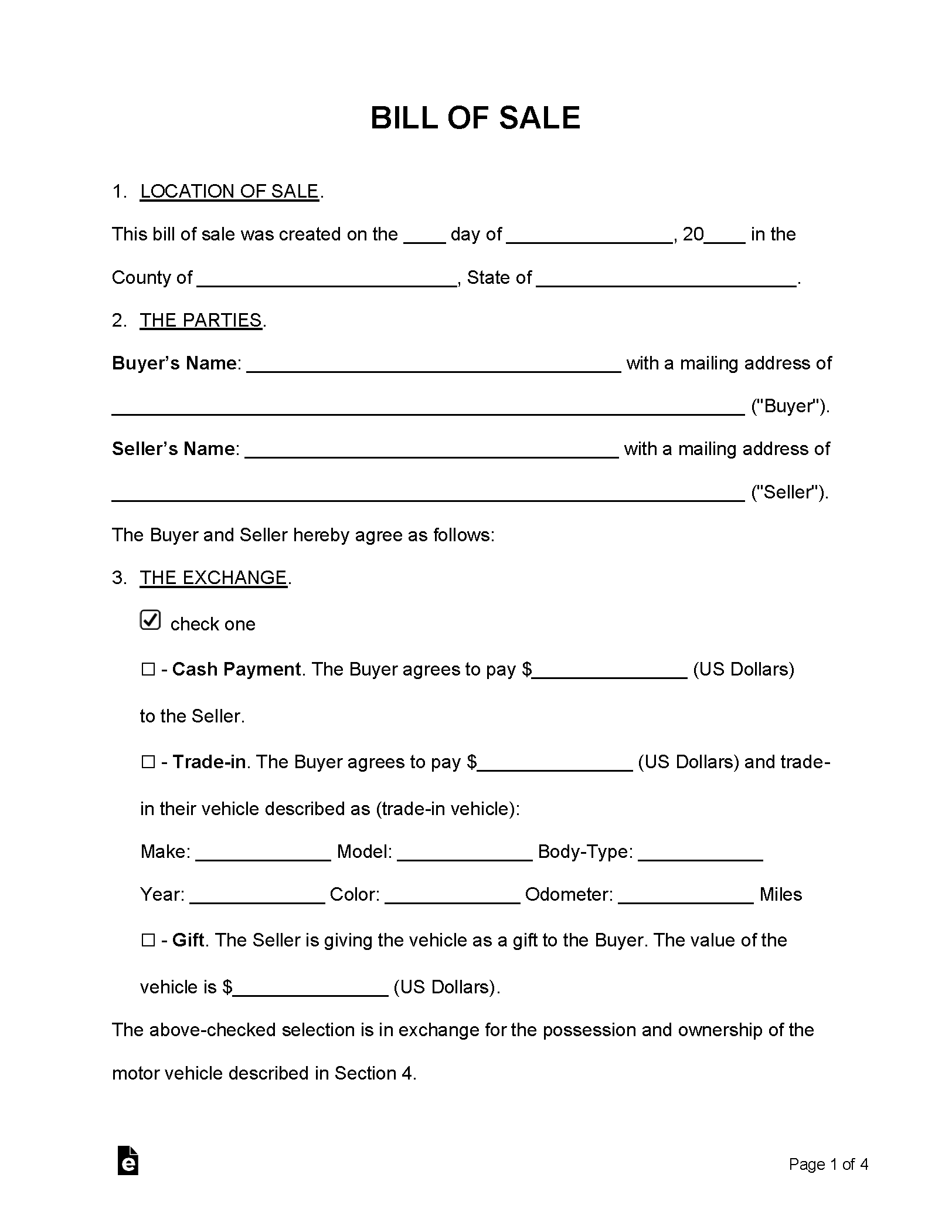

- Buyer and Seller Information: Full legal names, addresses, and contact details for all parties involved.

- Item Description: A detailed description of the item being sold, including make, model, VIN (for vehicles), serial numbers, and any unique identifying features.

- Purchase Price and Payment Schedule: The total agreed-on price, the amount of the down payment, the amount of each installment, the due dates for each payment, and the total number of payments.

- Interest Rate (if any): Clearly state if any interest is being charged on the outstanding balance and how it is calculated.

- Late Payment Penalties: Specify any fees or penalties that will be incurred if a payment is not made on time.

- Default Clauses: Outline the consequences if the buyer fails to make payments as agreed, including the seller’s rights (e.g., repossession of the item, legal action).

- Condition of Item: A statement about the item’s condition at the time of sale, often sold “as-is.”

- Signatures and Dates: Spaces for all parties to sign and date the agreement, signifying their acceptance of the terms.

How to Effectively Use Your Bill of Sale with Payment Plan Template

Once you have your bill of sale with payment plan template, the next crucial step is filling it out accurately and completely. Take your time to ensure all fields are correctly populated with the right information. Double-check names, addresses, item descriptions, and especially the payment schedule. Any missing information or inaccuracies could potentially weaken the document’s enforceability, so precision here is key. It’s often helpful to have both the buyer and seller go through the document together, line by line, to ensure mutual understanding and agreement on every single term.

Before any signatures are put to paper, make sure both parties fully understand and agree to all the terms and conditions outlined in the document. This includes the payment schedule, any interest rates, and the repercussions for late or missed payments. Open communication at this stage can prevent future disagreements. Don’t hesitate to negotiate any terms that one party finds unfavorable before the document is finalized; it’s much easier to adjust details now than to try and resolve a dispute later.

For added security, especially for high-value items, consider having the document signed in the presence of a witness, or even better, a notary public. A notary’s seal confirms the identities of the signers and that the signatures are authentic, adding an extra layer of legal validity and making the document harder to dispute in court. While not always required, this small step can provide significant peace of mind for complex transactions.

Finally, once the bill of sale is signed and dated, ensure that both the buyer and the seller receive a signed copy. Keeping meticulous records is vital. The seller will need it to track payments and as proof of the agreement, while the buyer will need it as proof of purchase and a record of the payment terms. These copies serve as the definitive record of the transaction and can be invaluable if there’s ever a question or disagreement down the line, ensuring that both parties are protected and clear on their obligations.

Utilizing a well-crafted document for transactions involving installment payments significantly reduces risk for both parties. It provides a clear, legally binding framework that protects interests and facilitates smooth, professional sales. Having this critical document ensures that complex transactions can proceed with confidence and transparency, allowing both buyers and sellers to achieve their goals securely.