Managing your business finances often feels like a delicate dance between paying bills on time and ensuring every penny is accounted for. Amidst the flurry of invoices and outgoing payments, one small but mighty tool often gets overlooked: the bill payment stub. This seemingly minor detail plays a crucial role in maintaining clear records, simplifying reconciliation, and fostering good relationships with your vendors. It provides a straightforward, organized record of each transaction.

For businesses relying on QuickBooks for their financial management, understanding how to effectively create and utilize a quickbooks bill payment stub template can be a game-changer. It’s not just about proof of payment; it’s about creating an efficient, accurate, and easily retrievable trail for every financial interaction. Let’s explore how a well-designed stub can transform your accounts payable process from a chore into a streamlined operation.

The Indispensable Role of a Payment Stub in Business Operations

In the busy world of commerce, every transaction, whether incoming or outgoing, requires careful documentation. A payment stub, often overlooked, is far more than just a tear-off slip from a check. It serves as a vital record, providing immediate proof that a bill has been paid and detailing exactly what was covered by that payment. This clarity is crucial for both the payer and the payee, preventing misunderstandings and disputes down the line. For your business, it acts as a foundational element for robust record-keeping, enabling quicker reconciliation against vendor statements and offering an undeniable paper or digital trail for audit purposes. Imagine trying to verify dozens of payments without a clear corresponding stub; it would be a nightmare of cross-referencing and guesswork.

Moreover, a well-structured payment stub streamlines your internal accounting processes significantly. When your accounting team receives vendor statements, having an accessible quickbooks bill payment stub template means they can quickly match payments to outstanding invoices, identifying discrepancies swiftly. This proactive approach minimizes errors and ensures your financial statements accurately reflect your liabilities and cash flow. Beyond internal benefits, these stubs enhance vendor relations. Providing a clear, detailed stub with your payment shows professionalism and helps your suppliers process your payments efficiently on their end, contributing to a smoother, more trusting business relationship.

Essential Components of an Effective Payment Stub

To be truly effective, a bill payment stub needs to contain specific pieces of information. Omitting even one detail can lead to confusion. Here are the key elements that should always be present:

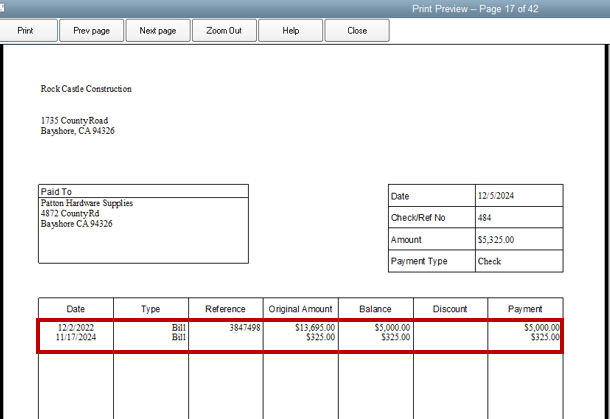

- Your Business Name and Address: Clearly identifies the payer.

- Vendor Name and Address: Specifies who the payment is for.

- Payment Date: Crucial for accurate record-keeping and reconciliation.

- Check Number or Payment Reference: A unique identifier for the transaction.

- Invoice Number(s): Links the payment directly to the specific invoices being paid. This is perhaps the most critical detail for reconciliation.

- Amount Paid per Invoice: Details how much was applied to each individual invoice.

- Total Payment Amount: The sum of all amounts paid.

- Discount Taken (if any): Important for accurate tracking of net payments.

- Memo Field: Useful for adding any specific notes or additional context.

By including these details on every stub, you ensure that anyone reviewing the document, whether internally or externally, has a complete picture of the payment transaction. This meticulous approach to documentation might seem like a small task, but its cumulative impact on financial clarity and operational efficiency is immense.

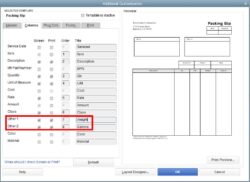

Customizing and Leveraging Your Bill Payment Stubs in QuickBooks

QuickBooks offers powerful tools to manage your accounts payable, and its functionality extends to generating professional payment stubs. While the software provides standard layouts, the true advantage comes from customizing these templates to fit your specific business needs and branding. This isn’t just about aesthetics; it’s about making your financial documentation as clear and functional as possible. Customization can involve adding your company logo, adjusting font sizes for readability, or even reordering fields to prioritize the most important information for your vendors or internal processes. Taking the time to refine your template ensures that every payment stub you issue is consistent, professional, and easy to understand.

Leveraging your customized quickbooks bill payment stub template effectively means integrating it seamlessly into your payment workflow. When you pay bills through QuickBooks, the system can automatically generate these stubs, often allowing you to print them along with your checks or save them as digital records. For those moving towards paperless operations, the ability to generate PDF stubs that can be emailed directly to vendors or stored securely in a cloud-based document management system is invaluable. This not only saves on printing costs but also speeds up delivery and reduces the chances of lost mail.

Beyond the immediate act of paying a bill, these stubs become critical for future reference. During month-end closes, tax preparation, or internal audits, having readily available, well-organized payment stubs simplifies the verification process dramatically. Instead of sifting through stacks of paperwork, you can quickly pull up digital records or locate the precise stub you need, complete with all necessary details. This efficiency translates directly into time and cost savings for your accounting department.

Consider these best practices for making the most of your payment stub system:

- Consistency is Key: Always use the same template and fill it out completely for every payment.

- Digital Archiving: Save digital copies of all payment stubs. This provides an easily searchable backup.

- Clear Labeling: When printing, ensure checks and stubs are clearly paired and filed. For digital, use a consistent naming convention.

- Regular Reconciliation: Use your stubs during your regular bank and vendor statement reconciliations to quickly spot any discrepancies.

- Vendor Communication: Encourage vendors to notify you if a stub is unclear or missing, ensuring they receive the information they need.

By adopting these practices, your business can elevate its financial record-keeping from a necessary chore to a strategic asset. A meticulous approach to bill payment stubs, empowered by QuickBooks, ensures accuracy, fosters stronger vendor relationships, and provides a clear audit trail for every single transaction, contributing to overall financial health and operational smoothness.