Giving a vehicle as a gift can be a wonderfully generous gesture, whether it’s for a family member, a close friend, or a charitable organization. It’s a significant asset, and transferring ownership, even when no money changes hands, requires a proper legal process. Just like any other vehicle transaction, clear documentation is crucial to ensure a smooth and legal transfer of ownership.

While the spirit of a gift is often informal and heartfelt, the legalities involved are anything but. Many people assume a simple handshake or a note is enough, but to protect both the giver and the recipient, a formal document is necessary. This is where a vehicle gift bill of sale template becomes an invaluable tool, providing the framework for recording all the necessary details to make the transfer legitimate and hassle-free.

Understanding the Importance of a Gift Bill of Sale

When you’re gifting a vehicle, it might seem counterintuitive to create a “bill of sale,” a document usually associated with monetary transactions. However, this specific type of document serves as official proof that the vehicle’s ownership has been transferred from one party to another, explicitly stating that it was a gift rather than a purchase. This distinction is vital for a variety of reasons, primarily to avoid future legal complications and ensure both parties are protected. It clearly outlines that no money was exchanged, which is crucial for tax purposes and avoiding any misunderstandings down the line.

Without a properly executed gift bill of sale, the recipient might face difficulties registering the vehicle in their name with the Department of Motor Vehicles (DMV) or equivalent state agency. Many states require this document as part of their vehicle registration process, even for gifted vehicles, to verify the change of ownership. Moreover, it protects the original owner from any liabilities that might arise after the vehicle is no longer in their possession, such as traffic violations or accidents. It formally marks the end of their legal responsibility for the vehicle.

Furthermore, a well-prepared vehicle gift bill of sale template can help navigate potential tax implications. While many jurisdictions offer exemptions for gifts between certain individuals (like immediate family), others might require reporting, and having clear documentation that the vehicle was a gift (and its declared fair market value at the time of transfer) is essential. This prevents the state from erroneously classifying the transfer as a sale, which could lead to unexpected sales tax assessments for the recipient or other tax complications for the donor.

Ultimately, using a tailored vehicle gift bill of sale template provides peace of mind for everyone involved. It eliminates ambiguity, provides a clear paper trail, and ensures that the transfer aligns with state laws and regulations. It’s a small effort that yields significant protection and clarity, preventing potential headaches and legal battles in the future.

Key Information to Include

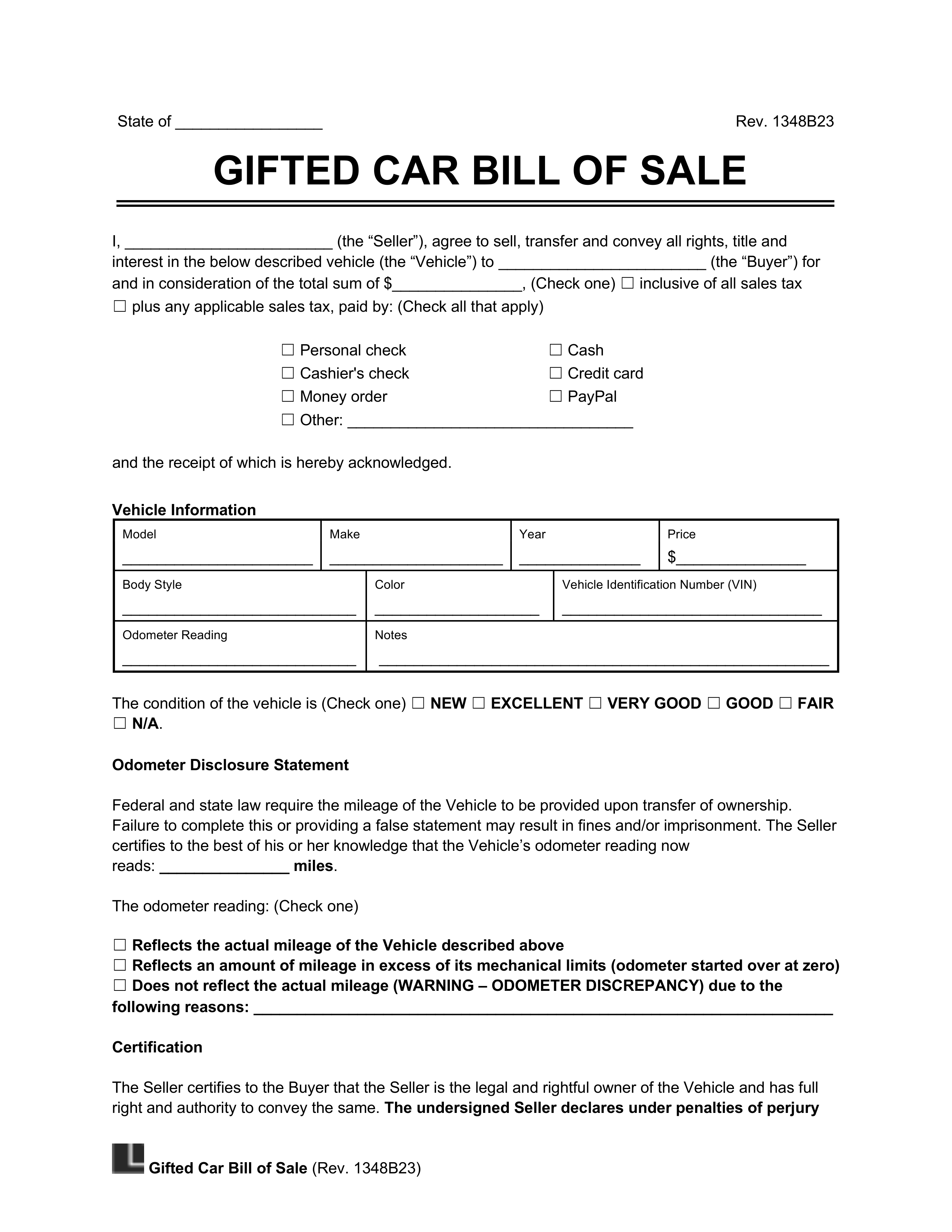

- Detailed information about the donor (giver), including full name, address, and contact details.

- Detailed information about the recipient (receiver), including full name, address, and contact details.

- Comprehensive vehicle description: This includes the make, model, year, vehicle identification number (VIN), odometer reading at the time of transfer, and license plate number (if applicable).

- A clear declaration stating that the vehicle is being transferred as a gift, with no monetary compensation involved.

- The date of the gift transfer.

- Signatures of both the donor and the recipient, and often a witness or notary public, depending on state requirements.

Where to Find and How to Use Your Template

Finding a suitable vehicle gift bill of sale template is easier than you might think, with numerous reputable sources available online. Government websites, particularly those of state DMVs, often provide downloadable forms specific to their state’s requirements. Legal document service websites and reputable automotive resources also offer generic or customizable templates that can be adapted to your specific situation. When searching, prioritize sources that seem official or have strong reviews, and always double-check if the template aligns with the regulations of the state where the recipient will register the vehicle.

Once you have chosen a template, the next crucial step is accurately filling it out. Take your time to ensure all fields are completed precisely and legibly. Gather all necessary information about both the donor and the recipient, as well as the vehicle itself, especially the Vehicle Identification Number (VIN) and current odometer reading. Any discrepancies or missing information could lead to delays or rejection when the recipient attempts to register the vehicle. It is often wise to print out a practice copy first to avoid errors on the final document.

After completing the template, review it carefully with both the donor and the recipient present. Ensure that all parties agree with the details as presented. In many states, a gift bill of sale must be notarized to be legally valid. A notary public will verify the identities of the signers and witness their signatures, adding an extra layer of authenticity to the document. Do not sign the document until you are in front of a notary if notarization is required in your state.

Finally, once the vehicle gift bill of sale is fully executed and notarized (if necessary), make sure both the donor and the recipient receive original copies. The recipient will undoubtedly need their copy to present to the DMV when registering the vehicle and transferring the title. The donor should retain a copy for their personal records, especially for tax purposes or in case any future questions about ownership arise. Proper documentation ensures a smooth transition and provides legal protection for both parties, solidifying the generous act with appropriate formality.