Managing your monthly finances can sometimes feel like a juggling act, with due dates, varying amounts, and different payment methods all vying for your attention. It is easy to feel overwhelmed, perhaps even leading to missed payments or unnecessary late fees. But what if there was a simple, systematic way to keep all your financial obligations in check, ensuring you never miss a beat?

That is precisely where a well-designed monthly bill pay schedule template comes into play. It is more than just a list of bills; it is a strategic tool that brings clarity, organization, and peace of mind to your financial life, transforming a potentially stressful task into a straightforward, manageable routine.

The Unseen Benefits of a Structured Bill Pay Approach

Adopting a systematic approach to your bill payments goes far beyond simply avoiding late fees. It is about gaining control, fostering financial stability, and reducing a significant source of everyday stress. When you have a clear overview of what needs to be paid and when, you eliminate guesswork and the constant nagging worry of overlooking an important deadline. This proactive stance empowers you to make informed decisions about your spending and saving, rather than reacting to bills as they arrive.

Imagine the feeling of knowing exactly where every dollar needs to go each month before it even leaves your account. This level of financial foresight is precisely what a dedicated payment schedule provides. It allows you to align your income with your expenditures, ensuring that sufficient funds are always available for your commitments. No more last-minute scrambles or unexpected overdrafts.

Moreover, a consistent payment record, facilitated by a reliable schedule, can positively impact your credit score. Timely payments are a cornerstone of good credit, which in turn can open doors to better loan rates, lower insurance premiums, and a more secure financial future. It is a ripple effect that starts with a simple organizational tool. This proactive management also frees up mental space, allowing you to focus on other aspects of your life without the underlying hum of financial anxiety.

In essence, embracing a structured bill payment system is an investment in your financial well-being and overall peace of mind.

Key Benefits You Will Enjoy

Creating Your Personalized Monthly Bill Pay Schedule Template

Setting up your own monthly bill pay schedule template might seem like a daunting task at first, but it is surprisingly straightforward once you gather your information. The goal is to create a system that works for you, one that you can easily maintain and adapt as your financial situation evolves. Whether you prefer a digital spreadsheet, a dedicated budgeting app, or even a simple paper planner, the core principles remain the same: clarity, completeness, and consistency.

Start by gathering all your recurring bills and financial statements. This includes everything from rent or mortgage payments, utility bills, loan payments, credit card statements, subscriptions, and even regular savings contributions. The more comprehensive your list, the more effective your template will be in providing a full financial picture. Don’s forget those less frequent, but still important, annual or quarterly payments that can sometimes slip through the cracks.

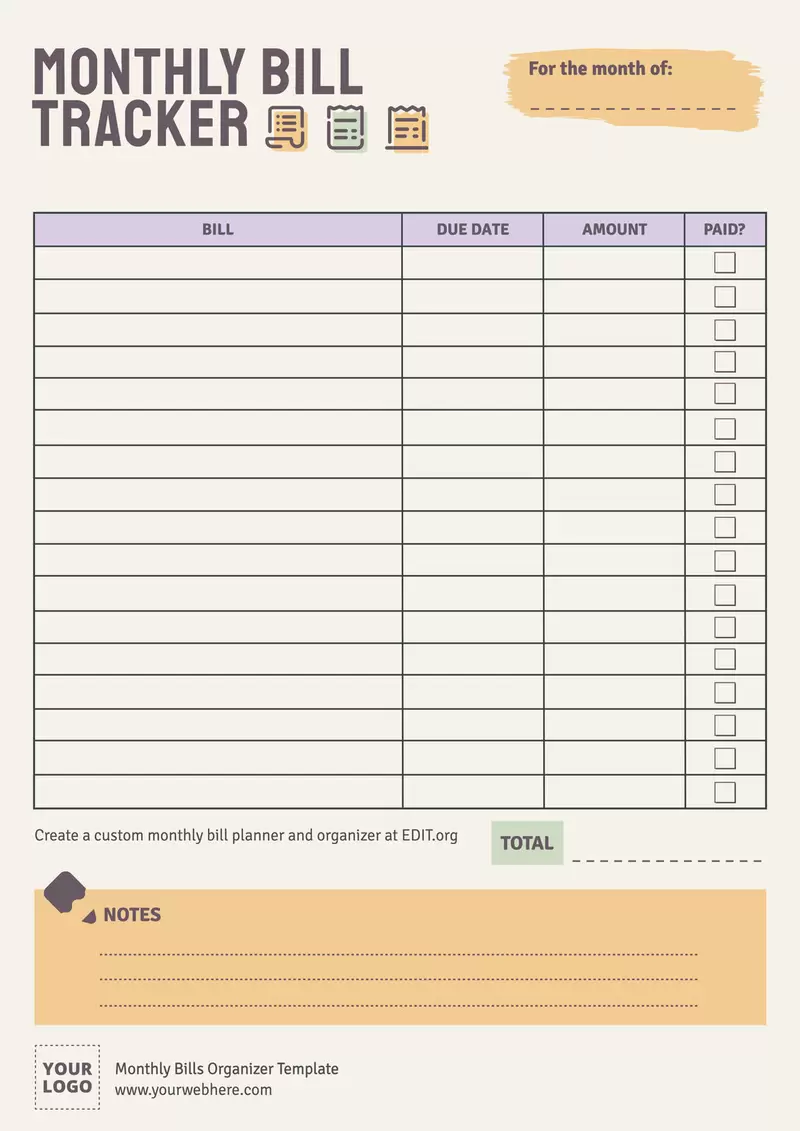

Once you have your comprehensive list, you will want to input key details for each item into your chosen monthly bill pay schedule template. Essential columns typically include the name of the bill, the due date, the approximate amount (or a range if it varies), the payment method (e.g., auto-pay, manual online, check), and a column to mark when it has been paid. You might also add a notes section for any specific details or reminders.

The power of this template lies in its ability to give you a bird’s-eye view of your financial obligations for the entire month. You can then strategically plan your payments around your income dates, perhaps grouping bills together to pay on specific days of the month. This minimizes the risk of overspending and ensures you always have funds allocated for essential outgoings. Regularly reviewing and updating your template, especially when new bills arise or old ones change, will ensure it remains a powerful and accurate financial tool.

Embracing a systematic approach to your bills is one of the most effective steps you can take toward achieving financial peace. By laying out your monthly obligations clearly, you transform what can be a source of stress into a manageable, predictable process. This simple act of organization empowers you to take charge of your money, ensuring that every payment is made on time and that your financial future is built on a solid foundation.

So, take the initiative today to set up your own bill payment system. You will find that the clarity and control it provides are invaluable, allowing you to navigate your financial landscape with confidence and less worry about forgotten due dates or unexpected fees.