Embarking on a merger, acquisition, or significant investment can be an exhilarating journey, but it’s also fraught with potential hidden pitfalls. One area that often holds surprising risks and opportunities is taxation. This is precisely why a robust tax due diligence process is indispensable. Having a well-structured tax due diligence checklist template can be the cornerstone of a successful transaction, ensuring that you uncover all pertinent tax-related information before committing.

Tax due diligence goes beyond merely reviewing past tax returns; it’s a comprehensive examination designed to identify historical non-compliance, assess future tax liabilities, uncover potential tax savings, and evaluate the overall tax risk profile of a target company. Without thorough due diligence, buyers might inherit unexpected tax burdens that could significantly erode the value of their investment or even lead to legal complications down the line.

Understanding the intricate world of tax implications requires a systematic approach. Whether you’re a buyer, seller, or an advisor, having a clear roadmap helps streamline the information gathering process, ensures consistency across different transactions, and most importantly, provides a clear picture of the tax health of the entity in question. This proactive stance is crucial for making informed decisions and negotiating favorable terms.

The Crucial Role of Tax Due Diligence in Transactions

Tax due diligence is far more than a bureaucratic hurdle; it’s a critical risk management tool that provides invaluable insights into the financial health and future prospects of a business. When considering a significant transaction like an acquisition, the financial statements alone don’t tell the whole story. Hidden tax liabilities, unrecorded tax assets, or ongoing tax disputes can dramatically alter the real value of a target company. This in-depth review helps to quantify these potential impacts, allowing parties to adjust purchase prices, include indemnities, or even walk away from a deal if the risks are too high.

Beyond identifying liabilities, due diligence can also uncover opportunities. For instance, a target company might have unused net operating losses (NOLs) that could be leveraged post-acquisition, or specific tax elections that could be optimized. Discovering these assets can add significant value to the transaction, potentially offsetting some of the identified risks. It’s about getting a complete picture, not just finding problems.

Moreover, the process ensures compliance. Tax laws are complex and constantly evolving, with variations across jurisdictions and industry sectors. A diligent review helps confirm that the target company has been adhering to all applicable federal, state, local, and international tax regulations. Non-compliance, even if unintentional, can result in significant penalties, interest, and reputational damage. Knowing the target’s compliance history is vital for predicting future obligations and avoiding unexpected regulatory scrutiny.

Understanding the target’s tax structure also aids in post-acquisition integration. By analyzing their existing tax policies, procedures, and systems, the acquiring entity can better plan for the seamless integration of financial operations. This foresight helps prevent disruptions, ensures continuity, and can contribute to a smoother transition period following the deal’s close.

Key Areas of Focus in Tax Due Diligence

When diving into the specifics, tax due diligence typically covers a broad spectrum of tax types and operational areas. This often includes scrutinizing income tax filings for corporate and individual entities, depending on the business structure. Reviewers will look for proper revenue recognition, deductible expenses, depreciation schedules, and the accurate calculation of taxable income. Any tax credits claimed or losses carried forward will also be thoroughly vetted to ensure their validity and usability post-transaction.

Sales and use tax is another critical area, especially for businesses with widespread operations or those involved in e-commerce. Non-compliance here can quickly accumulate into substantial liabilities, particularly if the target has nexus in numerous states but hasn’t been collecting or remitting sales tax appropriately. Property taxes, payroll taxes, and international tax considerations for multinational entities also come under intense scrutiny. Each of these areas presents unique challenges and potential exposures that need to be carefully evaluated to build a comprehensive risk profile.

Building Your Own Effective Tax Due Diligence Template

Creating a reliable tax due diligence checklist template isn’t just about having a list; it’s about systematically ensuring that no stone is left unturned. A well-designed template serves as a consistent framework, guiding your team through the complexities of tax review, reducing the chance of oversight, and standardizing the information-gathering process. It helps delineate responsibilities and provides a clear structure for reporting findings, making the entire due diligence process more efficient and effective for all parties involved.

The beauty of a template lies in its adaptability. While core items will always be present, it can be customized to suit the specific industry, size, and geographic footprint of the target company. For instance, a technology startup will have different tax considerations than a manufacturing plant, necessitating a tailored approach to ensure relevance and depth. This flexibility ensures that the template remains a powerful tool across diverse transaction scenarios.

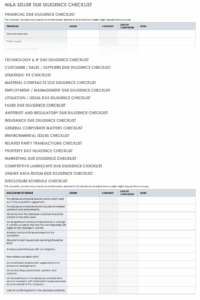

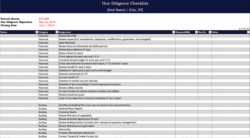

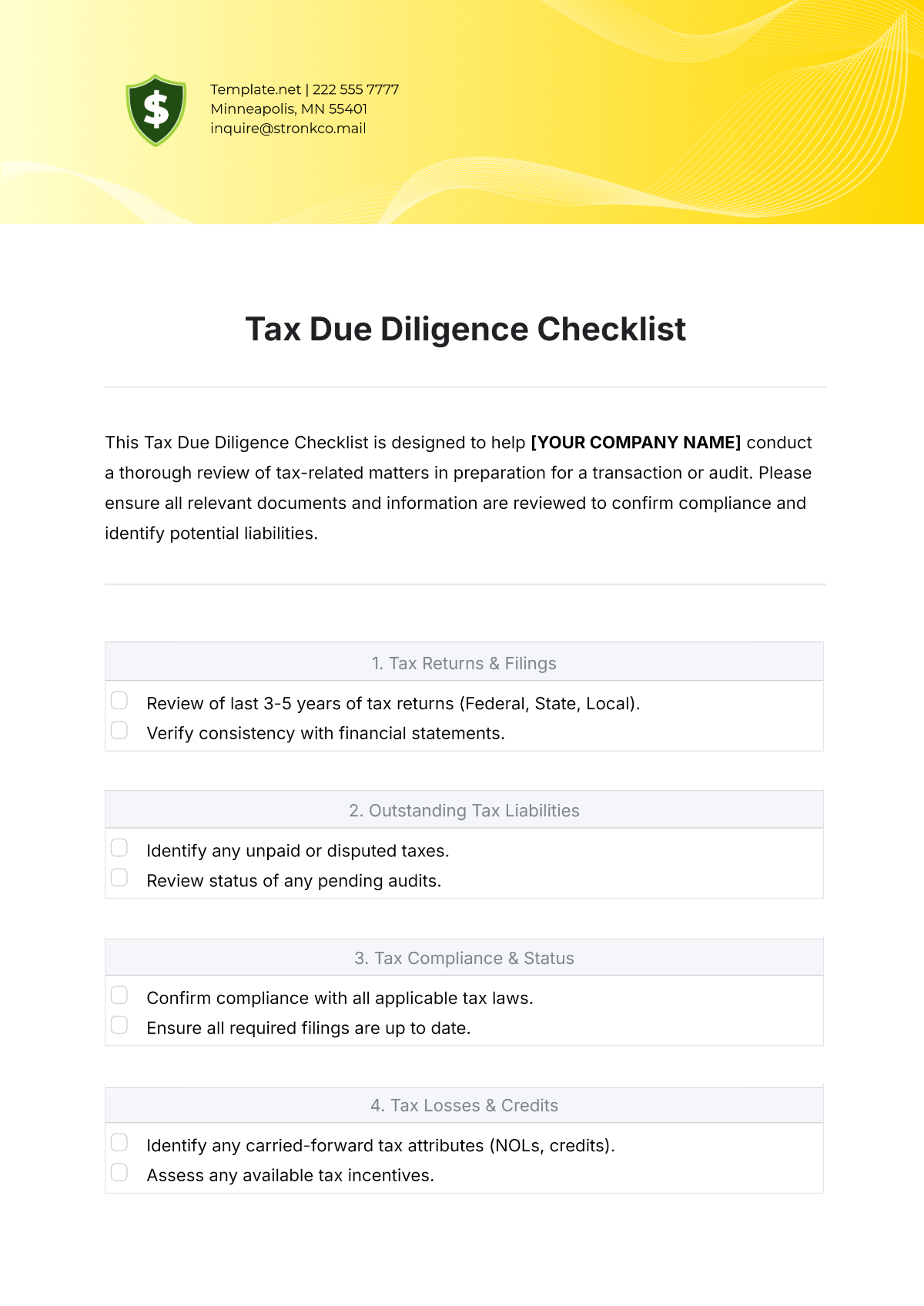

Here are some essential categories and items that should typically be included in a robust tax due diligence checklist template:

- Copies of federal, state, and local income tax returns for the past 3-5 years, along with all supporting schedules and workpapers.

- Details of any ongoing or past tax audits, examinations, or disputes with tax authorities, including correspondence and settlement agreements.

- Information regarding net operating loss (NOL) carryforwards, tax credit carryforwards, and any limitations on their use.

- Sales and use tax returns, permits, and registration information for all jurisdictions where the company operates.

- Payroll tax returns and related documentation, including information on employee benefits and compensation plans.

- Property tax assessments and payment records for all real and tangible personal property.

- Documentation related to tax elections, accounting methods, and any significant tax positions taken.

- Copies of intercompany agreements and transfer pricing policies for companies with related party transactions.

- Information on any foreign operations, including foreign tax returns, foreign tax credits, and compliance with international tax regulations.

- Details of any significant transactions or events that have tax implications, such as reorganizations, mergers, or asset sales.

Implementing a comprehensive review of these items will significantly enhance your understanding of the target’s tax landscape, allowing for better decision-making and a smoother transaction. It’s about turning potential unknowns into manageable facts, ensuring you proceed with confidence and a clear understanding of the tax implications.

By diligently utilizing such a detailed checklist, you empower your team to systematically uncover critical tax information, assess risks, and identify opportunities that might otherwise remain hidden. This meticulous approach not only safeguards your investment but also lays a strong foundation for future financial success. It truly becomes an invaluable asset in the complex world of mergers and acquisitions.