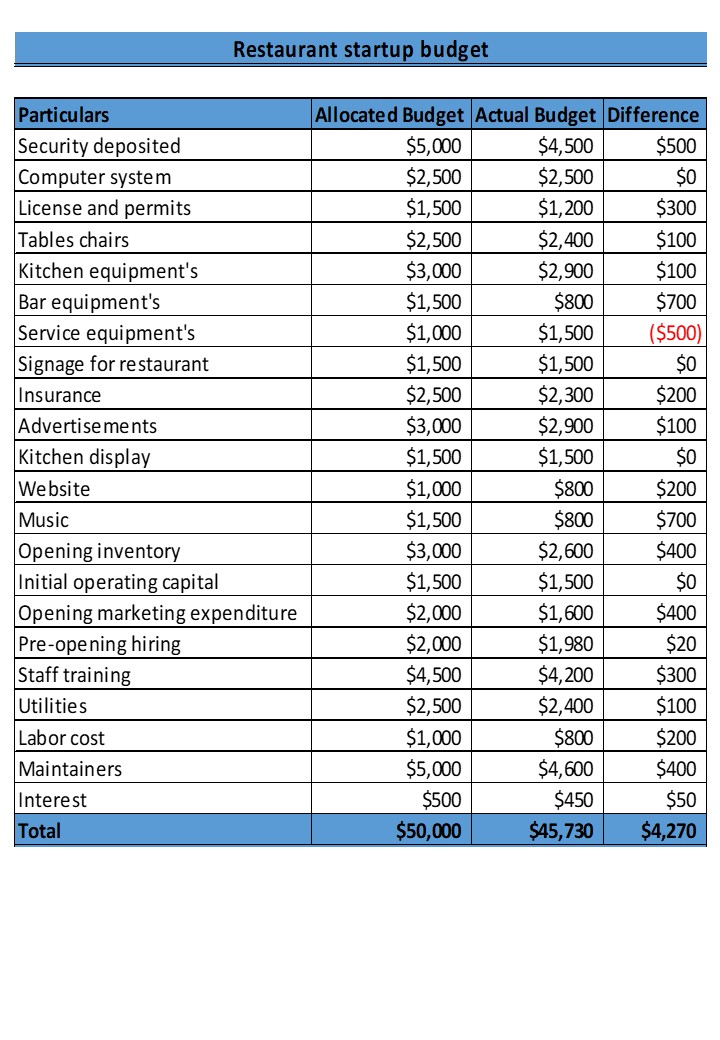

Embarking on the journey of opening a restaurant is an exciting dream, filled with visions of delicious food, happy customers, and a bustling atmosphere. However, transforming that dream into a successful reality hinges significantly on meticulous financial planning. That’s where a comprehensive restaurant startup budget costs checklist template becomes your most valuable tool, guiding you through the intricate financial landscape before you even serve your first dish.

Many aspiring restaurateurs underestimate the sheer volume and variety of expenses involved, leading to unforeseen financial strain down the line. From securing the perfect location to stocking your pantry and hiring your dream team, every step requires careful consideration of its monetary implications. A clear financial roadmap isn’t just a good idea; it’s a critical foundation for stability and growth.

Understanding and itemizing every potential cost upfront empowers you to make informed decisions, negotiate effectively, and avoid common pitfalls. This article will walk you through the essential components of a robust restaurant startup budget, ensuring you’re well-equipped to manage your finances from concept to grand opening and beyond.

Decoding Your Restaurant’s Financial Blueprint: Essential Startup Costs

Opening a restaurant is a multifaceted endeavor, and its financial demands reflect that complexity. Beyond the obvious expenses like rent and equipment, there’s a myriad of less apparent costs that can quickly deplete your budget if not accounted for. A detailed breakdown helps you allocate funds wisely and anticipate potential financial hurdles.

Real Estate and Location Costs

Securing the right physical space is often the largest initial investment. This includes not just the monthly rent or lease payments, but also a security deposit, potential broker fees, and significant build-out or renovation expenses to transform the space into your vision. Don’t forget architectural design fees, utility connection costs, and potential impact fees if you are building new or significantly altering a structure.

Kitchen Equipment and Technology

The heart of any restaurant is its kitchen, and outfitting it requires a substantial budget. Think professional ovens, refrigerators, freezers, fryers, griddles, dishwashers, and ventilation systems. Beyond the heavy machinery, you’ll need smaller wares like pots, pans, utensils, and serving dishes. On the technology front, investing in a robust Point-of-Sale POS system, kitchen display screens KDS, reservation software, and possibly inventory management systems is crucial for modern operations.

Licensing, Permits, and Legal Fees

Before you can legally open your doors, you’ll need a host of licenses and permits. This typically includes a general business license, food service permits, health department inspections, fire safety permits, and potentially a liquor license, which can be quite costly and time-consuming to acquire. Legal consultation for lease agreements, business structure, and employee contracts is also an indispensable upfront expense.

Initial Inventory and Supplies

You can’t open a restaurant without food and beverages. Your initial inventory involves stocking your pantry, walk-in coolers, and bar with all the ingredients, drinks, and consumables needed for your opening menu. This also extends to cleaning supplies, paper products, guest amenities, uniforms for your staff, and office supplies for administrative tasks.

Marketing and Branding

Generating buzz and attracting your first customers is vital. Budget for creating a distinctive brand identity, which includes logo design, menu design, interior signage, and exterior signage. Initial marketing efforts could involve developing a website, setting up social media profiles, local advertising, public relations outreach, and hosting a grand opening event to make a memorable splash.

Working Capital and Contingency Fund

One of the most common reasons new restaurants fail is insufficient working capital. This fund covers your operating expenses during the initial months when revenue might not yet cover costs, including salaries, utilities, and ongoing supply orders. Furthermore, always allocate a contingency fund, typically 15-20 percent of your total budget, for unexpected issues or delays that inevitably arise in any complex project.

Creating Your Personalized Restaurant Budget Checklist

While a general framework is helpful, your restaurant startup budget costs checklist template needs to be tailored to your unique concept, location, and operational model. Think of it as your financial blueprint, guiding every expenditure and keeping you accountable. The goal isn’t just to list costs, but to understand them, track them, and manage them proactively.

To begin, research extensively. Talk to other restaurateurs, consult with contractors, and get multiple quotes for every item and service. Break down your budget into granular categories and subcategories. For example, under “equipment,” list each specific item you need with its estimated cost. This level of detail helps prevent oversight and provides a clearer picture of where your money is going.

A template is most effective when it is a living document, reviewed and updated regularly. As you progress through the startup phase, some costs may fluctuate, and new ones might emerge. Maintaining flexibility and the discipline to adjust your budget is crucial. Consider using a spreadsheet program to easily track actual expenses against your projected budget, ensuring you stay on track.

- Thoroughly research market rates for rent, labor, and supplies in your chosen area.

- Obtain at least three quotes for major purchases like equipment and construction services.

- Always include a contingency fund of 15-20 percent for unforeseen expenses.

- Review and update your budget weekly or bi-weekly during the startup phase.

- Seek professional advice from a financial advisor or an experienced restaurant consultant.

Navigating the financial intricacies of launching a restaurant can feel overwhelming, but with a meticulously planned budget, the path becomes much clearer. By diligently itemizing, researching, and monitoring every expense, you lay a strong financial foundation that can withstand the inevitable challenges of a new business. This comprehensive approach transforms potential risks into manageable steps, paving the way for sustained success.

Ultimately, the effort you invest in robust financial planning now will pay dividends in the long run. It ensures you have the resources to not only open your doors but to thrive, adapt, and grow your culinary vision. With careful preparation and a clear understanding of your financial needs, your dream of a bustling, profitable restaurant is well within reach.