As the final days of the month approach, many businesses find themselves in a familiar rush. Tasks pile up, deadlines loom, and the pressure to close the books accurately and on time can feel overwhelming. What if there was a simpler way to navigate this crucial period? That’s exactly where a reliable month end accounting checklist template comes into play, providing a structured roadmap to ensure every financial detail is meticulously handled and nothing falls through the cracks.

The month-end close is more than just a routine; it’s a vital process that provides a comprehensive snapshot of your company’s financial health. It’s about ensuring all transactions are recorded, accounts are reconciled, and financial statements accurately reflect the business’s performance. Without a systematic approach, this period can become a source of stress, errors, and missed opportunities for insightful financial analysis.

A well-designed checklist doesn’t just list tasks; it empowers your accounting team with clarity, efficiency, and a standardized process. It transforms a potentially chaotic scramble into a smooth, predictable operation, freeing up valuable time and resources. Let’s explore what makes such a template indispensable and how it can revolutionize your financial operations.Crafting the Ultimate Month-End Accounting Checklist

Building an effective month-end accounting checklist involves more than just jotting down a few items. It requires a thoughtful understanding of your business’s unique financial processes, compliance requirements, and reporting needs. A truly ultimate checklist is comprehensive yet adaptable, detailed yet easy to follow, ensuring consistency and accuracy with every close.

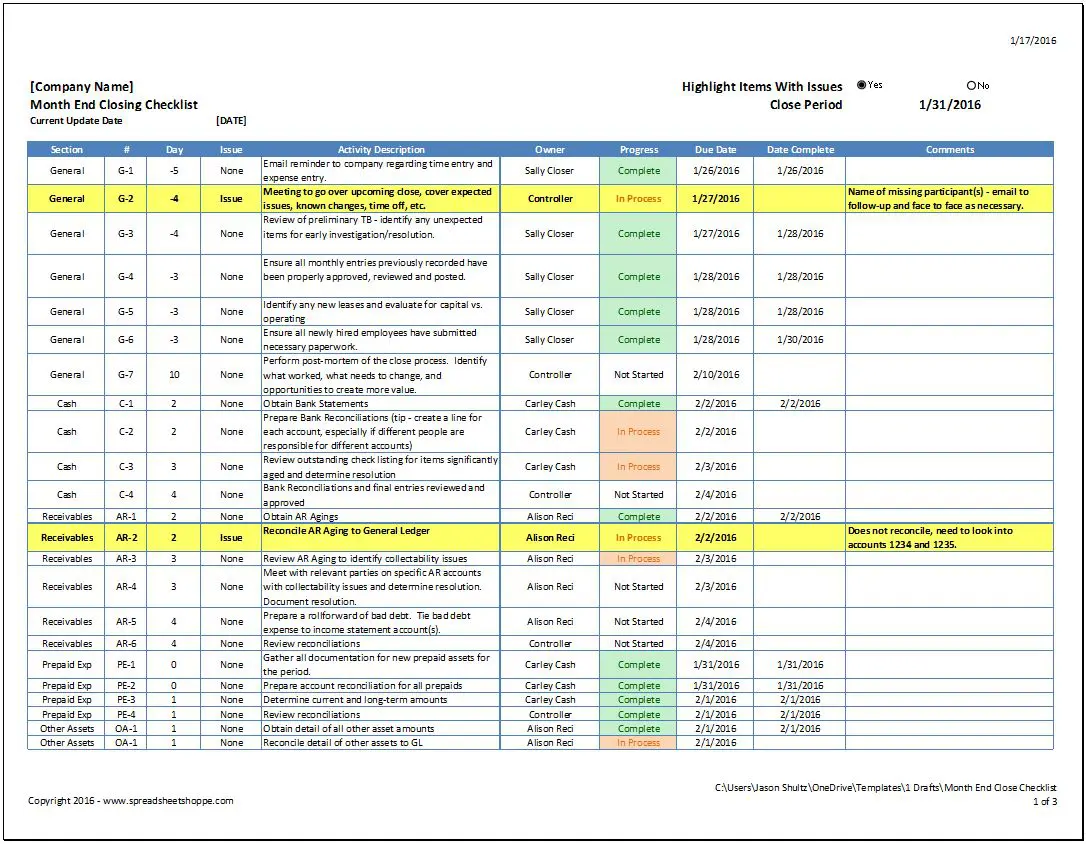

One of the foundational elements of any robust checklist is the reconciliation of cash and bank accounts. This involves comparing your company’s cash balances with bank statements to identify and resolve any discrepancies. Are all deposits recorded? Have all checks cleared? This step is crucial for catching errors, preventing fraud, and ensuring that your cash balance accurately reflects available funds. It often extends to reconciling credit card statements as well, ensuring all business expenses are properly accounted for.

Next on the agenda is a thorough review of accounts receivable. This means examining all outstanding invoices to ascertain their current status. Are there any overdue accounts that need follow-up? Are bad debts being identified and appropriately reserved? Maintaining a clear picture of what your customers owe is vital for managing cash flow and projecting future income. Similarly, a close look at accounts payable is necessary to confirm all vendor invoices are processed, approved, and scheduled for payment, avoiding late fees and maintaining good supplier relationships.

Payroll processing and employee expense reimbursements also typically fall within the month-end tasks. Confirming that all employees have been paid correctly, taxes have been withheld, and benefits contributions are accurate is paramount. Equally important is the timely processing of employee expense reports, ensuring employees are reimbursed accurately and within company policy, while also capturing these costs for financial reporting.

A critical, often overlooked, component involves journal entries and accruals. This is where transactions that span multiple periods or haven’t yet involved cash are accounted for. Think about things like prepaid expenses, accrued revenue, depreciation, and amortization. Making these adjusting entries ensures that your financial statements adhere to the matching principle, accurately reflecting revenues and expenses in the period they occurred, regardless of when cash was exchanged.

Finally, the checklist culminates in the preparation and review of financial statements. This includes generating the income statement, balance sheet, and cash flow statement. These reports are the culmination of all the previous steps, offering a holistic view of the company’s financial performance and position. A diligent review is essential to spot any unusual fluctuations or errors before the statements are finalized and distributed to stakeholders. An excellent month end accounting checklist template should guide you through each of these critical stages with precision.

Transforming Your Financial Close with a Strategic Approach

Implementing a strategic approach to your month-end close using a well-structured template goes far beyond mere task management; it’s about embedding efficiency and accuracy into the very fabric of your financial operations. This methodical framework provides a consistent roadmap, ensuring that every necessary step is taken, not just for compliance but for robust financial insight. It minimizes the risk of human error, streamlines the workflow, and dramatically reduces the time spent chasing down missing information or correcting mistakes that could have been avoided.

Moreover, a standardized month-end process fosters greater transparency and accountability within your team. Each member knows their responsibilities, and the progression of tasks is easily trackable. This clarity helps in identifying bottlenecks, cross-training staff, and ensures a smoother handover of duties if personnel changes. It also lays a strong foundation for internal controls, safeguarding your assets and ensuring the reliability of your financial data, which is crucial for both internal decision-making and external audits.

The strategic benefits extend to your ability to make informed business decisions. When your financial data is accurate, timely, and reliably produced each month, you gain a clearer picture of your company’s performance, profitability drivers, and areas needing improvement. This empowers leadership with the confidence to allocate resources effectively, plan for future growth, and respond swiftly to market changes. Consider some of the key advantages:

Embracing a systematic approach to your month-end close is a game-changer. It elevates your accounting function from a reactive necessity to a proactive powerhouse, driving accuracy, efficiency, and invaluable insights. By investing in a clear, comprehensive checklist, you’re not just organizing tasks; you’re building a more resilient and financially intelligent business.

The journey to a more streamlined and stress-free month-end doesn’t have to be complicated. With the right tools and a commitment to process, your accounting team can move beyond the monthly scramble and focus on delivering strategic value. This foundational consistency not only improves daily operations but also strengthens your entire financial framework for sustainable success.