Welcome to the world of efficient client management! If you run a bookkeeping practice, you know that the initial phase with a new client sets the tone for the entire relationship. Getting off on the right foot isn’t just about making a good first impression; it’s about establishing clear expectations, gathering essential information, and building a foundation of trust and seamless collaboration. Without a structured process, you risk miscommunication, delays, and a less-than-stellar client experience right from the start.

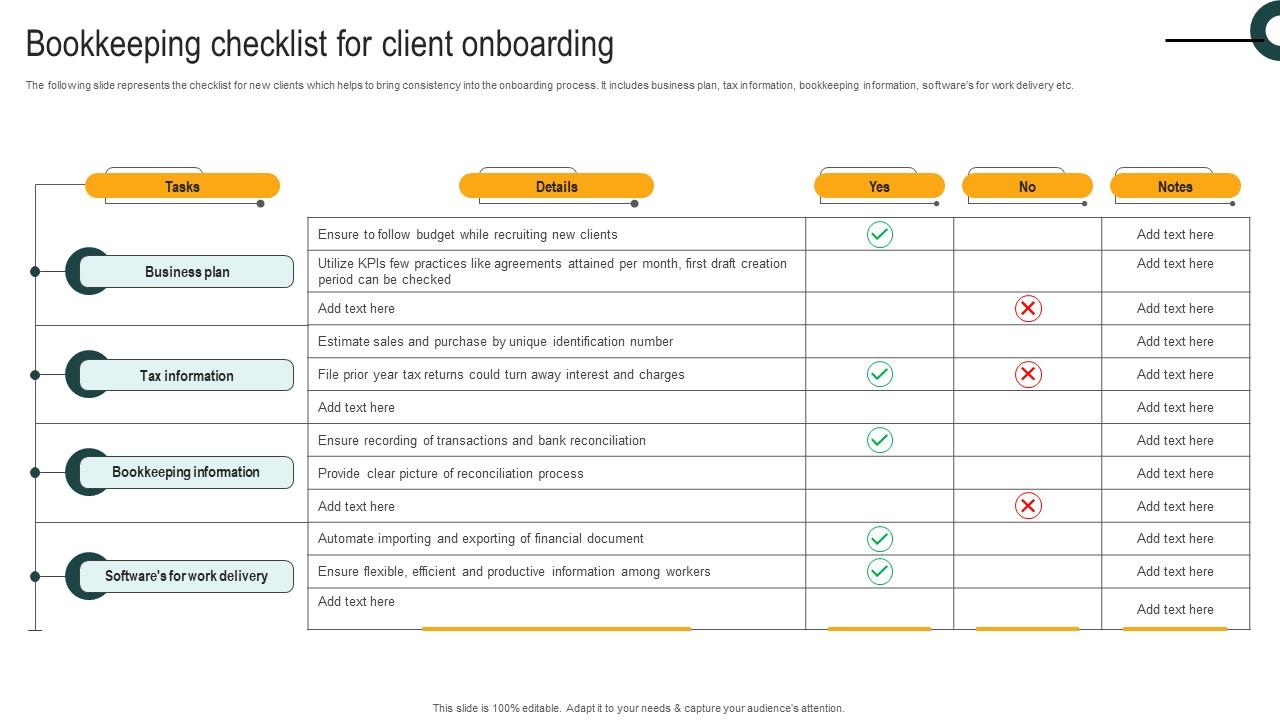

That’s where a robust bookkeeping client onboarding checklist template comes in. Imagine having a step-by-step guide that ensures no crucial detail is overlooked, every document is collected, and every system is properly set up. It transforms what could be a chaotic period into a streamlined, professional, and positive experience for both you and your new client. This article will walk you through the key elements of an effective onboarding process and how to make the most of such a template.

The Essential Stages of a Seamless Bookkeeping Onboarding Process

Building a strong, lasting relationship with your clients begins long before the first financial transaction is recorded. It starts with a well-defined onboarding process that guides both parties through the initial setup, ensuring clarity, compliance, and comfort. A chaotic or incomplete onboarding can lead to headaches down the line, from missing documents to misunderstandings about service scope, ultimately costing you time and potentially damaging the client relationship. Conversely, a smooth process elevates your professional image and sets the stage for a productive partnership.

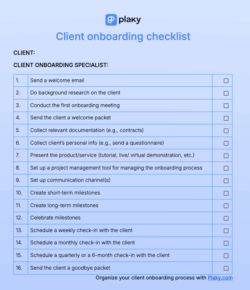

The first step in any effective onboarding is often the initial communication and discovery. This is where you learn about the client’s business, their specific needs, and what challenges they hope to solve by hiring you. It’s a two-way street, allowing the client to learn about your services and how you operate. Be prepared with a set of questions that help you understand their industry, existing financial systems, and pain points. This initial fact-finding mission is crucial for tailoring your services appropriately.

Following the discovery phase, it’s time to formalize the agreement. This involves presenting a clear proposal and then drafting an engagement letter. This document is more than just a formality; it legally binds the agreement and outlines the scope of work, pricing structure, payment terms, and responsibilities of both parties. Clarity at this stage prevents disputes and ensures everyone is on the same page regarding expectations.

Once the agreement is signed, the practical setup begins. This is where you gather all necessary financial information, gain access to relevant accounts, and integrate your preferred bookkeeping software. This often involves securely requesting bank statements, credit card statements, payroll reports, previous tax returns, and access to existing accounting platforms. Establishing secure methods for information exchange is paramount during this stage to protect sensitive data.

Finally, client education and ongoing communication are vital. Don’t just set up the systems and disappear. Walk your client through how you’ll communicate, what reports they can expect, and how to provide information to you going forward. A successful bookkeeping client onboarding checklist template doesn’t just end when the accounts are set up; it encourages continued engagement and clarity.

Initial Contact and Discovery Call

- Understand client’s business structure and industry.

- Identify their specific bookkeeping pain points and goals.

- Discuss desired service level and expected outcomes.

- Clarify your service offerings and how they align with their needs.

Engagement Letter and Agreement

- Detail the scope of services to be provided.

- Outline fee structure, payment terms, and billing cycle.

- Define responsibilities of both the client and your firm.

- Include clauses for confidentiality and data security.

System Setup and Data Access

- Request secure access to bank accounts, credit cards, and loan statements.

- Gather historical financial data (previous year’s financials, tax returns).

- Set up client within your preferred cloud accounting software (e.g., QuickBooks Online, Xero).

- Integrate necessary third-party apps (e.g., payroll, expense management).

Customizing Your Bookkeeping Client Onboarding Checklist Template for Success

While a general bookkeeping client onboarding checklist template provides a fantastic starting point, true efficiency and client satisfaction come from tailoring it to your specific practice and the unique needs of each client. No two businesses are exactly alike, and neither should be their onboarding experience entirely. Thinking about your typical client demographic, the industries you specialize in, and the specific services you offer will help you refine your process considerably.

Consider, for instance, a client who operates an e-commerce business versus one who runs a local service-based company. Their needs for sales tax reconciliation, inventory management, or perhaps tracking specific project costs will differ significantly. Your customized checklist should reflect these nuances, ensuring that you’re asking the right questions and collecting the precise data relevant to their operations. This proactive approach not only streamlines your work but also demonstrates your expertise and attention to detail to the client.

Furthermore, your firm’s unique service offerings play a big role. Do you offer payroll services, tax preparation, or advanced financial advisory in addition to core bookkeeping? Each of these additional services will require specific onboarding steps, such as gathering employee information for payroll or previous tax filings for tax prep. Integrating these distinct modules into your main template, perhaps as optional sections, ensures you cover all bases without overwhelming simpler clients.

Don’t forget to incorporate your branding and communication style into the template. While the core items remain, the language you use, the order in which you present information, and even the tools you use for communication (e.g., a secure client portal vs. email) can be customized. A personalized touch makes the client feel valued and reinforces your firm’s identity. This adaptability makes your onboarding process scalable and robust, ready to handle diverse client requirements efficiently.

By investing the time to customize your onboarding process, you’re not just creating a more efficient internal workflow; you’re actively building a stronger, more professional client relationship from day one. It means less back-and-forth, fewer missed steps, and ultimately, a more positive experience that leads to long-term client retention and referrals. Think of your refined template as a dynamic tool that evolves with your practice and your clients.

The process of bringing on new bookkeeping clients can be one of the most exciting yet challenging aspects of growing your practice. By embracing a structured approach guided by a comprehensive template, you empower your team, impress your clients, and lay the groundwork for a prosperous partnership. It’s about more than just checking boxes; it’s about building trust and demonstrating your commitment to their financial success.

Ultimately, a streamlined and professional onboarding process not only saves you time and reduces stress but also enhances your firm’s reputation. Clients appreciate efficiency and clarity, and by providing a seamless experience from the very beginning, you position yourself as a reliable and organized partner. Implement these strategies, refine your template, and watch your client relationships flourish and your practice thrive.