Buying or selling a vehicle can be an exciting, yet often complex, endeavor. While many transactions involve a one-time cash payment, it’s not uncommon for buyers and sellers to agree upon a payment plan. This approach offers flexibility, making vehicle ownership more accessible for some, and allowing sellers to move their vehicles even when immediate full payment isn’t an option for the buyer. However, entering into such an agreement without proper documentation is like navigating a maze blindfolded – it’s fraught with potential misunderstandings and disputes.

That’s where a well-crafted document comes into play, providing a clear roadmap for everyone involved. It’s more than just a piece of paper; it’s a legally binding agreement that protects both parties, outlining the terms of the sale, the payment schedule, and what happens if things don’t go as planned. A robust vehicle bill of sale with payments template ensures that every detail, from the vehicle identification number to the final payment date, is meticulously recorded, leaving no room for ambiguity.

Why You Absolutely Need a Vehicle Bill of Sale with Payment Terms

Imagine you’ve just sold your trusty old car to a friend, and they’re paying you in installments. Sounds simple, right? But what if they miss a payment, or a dispute arises about the car’s condition after the sale? Without a clear, written agreement, you’re relying on verbal promises and good faith, which can quickly unravel. A vehicle bill of sale with payments template acts as your legal safety net, protecting your interests and providing a clear record for all parties involved.

For the seller, this document solidifies the buyer’s commitment to the payment plan. It outlines the specific amounts, due dates, and any late payment penalties, ensuring you have a legal recourse if payments aren’t made as agreed. It clearly states the terms of ownership transfer, whether it happens immediately or upon final payment, which is crucial for liability purposes. This clarity helps prevent awkward conversations and potential legal battles down the line.

On the flip side, buyers benefit immensely from this template as well. It provides a transparent record of their financial obligations, so there are no surprises about interest, hidden fees, or the total cost of the vehicle. It also serves as proof of their payments, protecting them from claims of non-payment. Furthermore, it details the condition of the vehicle at the time of sale, which can be invaluable if any issues arise that were not disclosed or agreed upon.

Ultimately, this document brings professional clarity to what can often be an informal transaction, especially between individuals. It transforms a handshake deal into a solid agreement, providing peace of mind and security for both the buyer and the seller throughout the entire payment period and beyond.

Essential Components of Your Payment Plan Bill of Sale

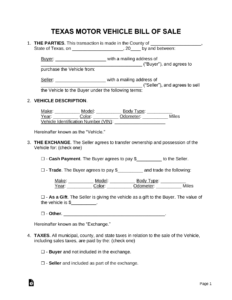

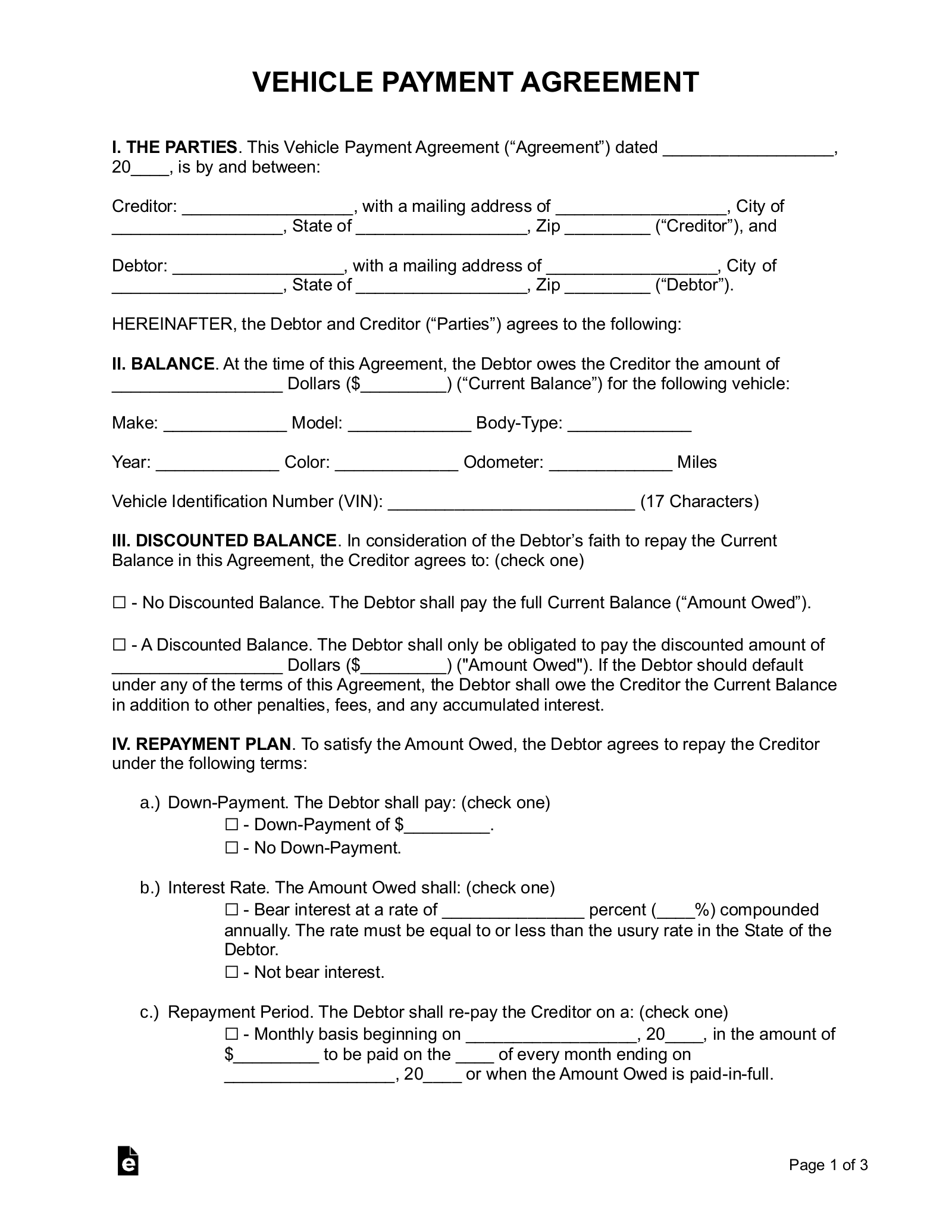

- Full legal names and addresses of both the buyer and seller.

- Detailed description of the vehicle, including make, model, year, VIN (Vehicle Identification Number), odometer reading, and license plate number.

- The agreed-upon purchase price of the vehicle.

- A clear breakdown of the payment plan, including down payment (if any), installment amounts, due dates, and the total number of payments.

- Information on any interest rates applied to the outstanding balance.

- Terms regarding late payments, default, and potential repossession procedures.

- Date of sale and signatures of both the buyer and seller.

- Space for notarization, if required by your state or desired for added legal weight.

Crafting Your Vehicle Bill of Sale with Payments Template: What to Consider

When you’re putting together your own vehicle bill of sale with payments template, precision is your best friend. Start with the basics: identifying information for both buyer and seller. Then, move to the heart of the matter – the vehicle itself. Include every detail: the year, make, model, color, and most importantly, the Vehicle Identification Number (VIN) and current odometer reading. These specifics eliminate any doubt about which vehicle is being sold and its condition at the time of transaction.

Next, dive deep into the payment structure. This is where the “payments” part of your vehicle bill of sale with payments template really shines. Clearly state the total purchase price, the amount of any down payment, and the specific schedule for the remaining installments. Will payments be weekly, bi-weekly, or monthly? What day are they due? Is there a grace period for late payments? Will interest accrue on the outstanding balance, and if so, at what rate? Being overly specific here prevents future disagreements.

It’s also crucial to anticipate potential bumps in the road. What happens if a payment is missed? Outline the consequences of late payments, such as late fees. More importantly, define what constitutes a default on the agreement and the actions that can be taken, such as the seller’s right to repossess the vehicle. While no one hopes for such scenarios, having these clauses clearly written protects both parties and provides a framework for resolving serious breaches of the agreement.

Finally, don’t forget the formalities that make the document legally sound. Ensure there are designated spots for the buyer’s and seller’s signatures, along with the date of the agreement. Consider whether your state requires witness signatures or notarization for a vehicle bill of sale involving payments; if so, include space for those as well. Always make at least two copies of the signed document, one for each party, to ensure everyone has their own official record.

- Be explicit about who is responsible for insurance during the payment period.

- Clarify the exact date ownership transfers (e.g., upon signing, upon final payment).

- Include a “sold as-is” clause if applicable, or detail any warranties or guarantees provided.

- Specify the method of payment for installments (e.g., bank transfer, check).

- Include contact information for both parties for ongoing communication.

Having a meticulously prepared document for your vehicle transaction involving payments isn’t just a good idea; it’s an essential safeguard. It provides a crystal-clear understanding of the terms for both buyer and seller, minimizing the risk of miscommunication, disputes, or legal headaches down the line. By taking the time to outline every detail from the payment schedule to default clauses, you’re investing in peace of mind.

This comprehensive approach ensures that the transfer of ownership and the ongoing financial commitments are handled professionally and transparently. It empowers both parties with a tangible record of their agreement, fostering trust and security throughout the duration of the payment plan. Approach your next vehicle sale or purchase with confidence, knowing you have a solid, legally sound foundation.