Gifting a vehicle to a family member or a dear friend can be a wonderfully generous gesture, bringing joy and convenience to their lives. However, unlike simply handing over a wrapped present, transferring ownership of a car, truck, or motorcycle involves a bit more than just passing over the keys. There are crucial legal and administrative steps you need to follow to ensure the gift is properly documented and recognized by the authorities.

This is where a dedicated vehicle bill of sale gift template becomes an invaluable tool. It’s not merely a formality; it’s a legal document that protects both the giver and the recipient, ensuring a smooth transition of ownership without future complications, especially concerning taxes, liability, and registration. Let’s explore why this template is so important and how to use it effectively.

Why You Need a Vehicle Bill of Sale Gift Template

While the act of giving is often simple and heartfelt, the process of transferring vehicle ownership, even as a gift, needs to be handled with care. Many people mistakenly believe that if no money exchanges hands, no paperwork is necessary. This couldn’t be further from the truth. A properly executed bill of sale, specifically tailored for a gift, is fundamental for several reasons.

Firstly, it serves as indisputable proof of ownership transfer. Without it, the previous owner might remain liable for parking tickets, accidents, or other issues associated with the vehicle, even if they no longer possess it. For the recipient, this document is essential to prove they are the rightful new owner, which is a requirement for subsequent registration, titling, and insurance.

Secondly, a gift bill of sale addresses potential tax implications. In many jurisdictions, gifts of vehicles might be exempt from sales tax, but only if documented correctly. Without a clear statement that the vehicle was a gift with no monetary consideration, the state Department of Motor Vehicles (DMV) might assume it was a sale and attempt to collect sales tax based on the vehicle’s market value. A specialized vehicle bill of sale gift template explicitly states the nature of the transaction, helping to avoid such misunderstandings.

Lastly, it simplifies the registration process for the recipient. When they visit the DMV to register the vehicle in their name and obtain a new title, they will be required to present documentation proving how they acquired the vehicle. A completed and signed gift bill of sale fulfills this requirement, making the process much smoother and preventing delays or complications.

Key Elements of a Gift Bill of Sale

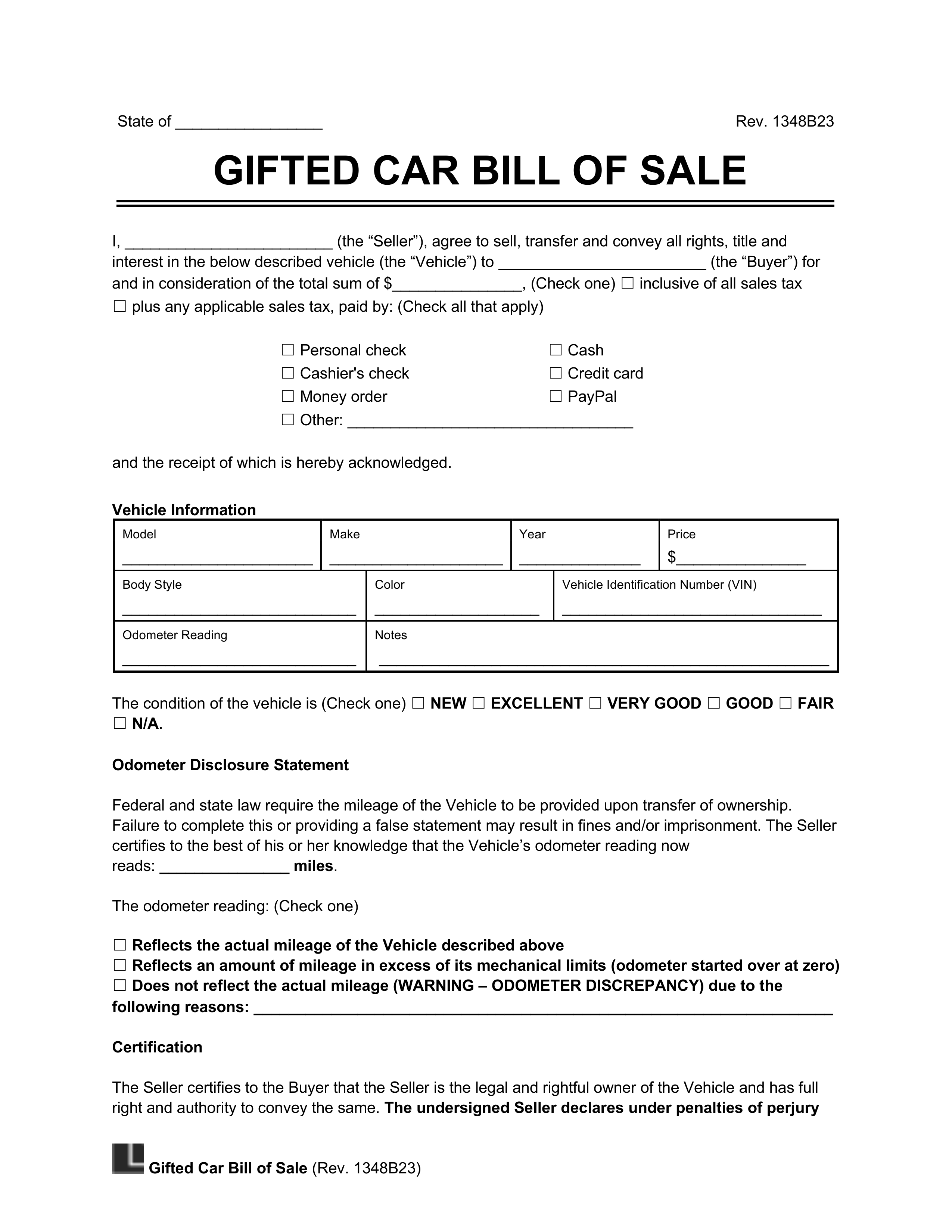

To be effective and legally sound, a vehicle bill of sale gift template must include specific information that clearly outlines the transaction. Missing any of these details could lead to issues down the road.

- Full legal names and addresses of both the giver (seller) and the recipient (buyer).

- Detailed description of the vehicle, including make, model, year, body style, and Vehicle Identification Number (VIN).

- The current odometer reading at the time of transfer.

- The exact date of the transfer.

- A clear statement indicating that the vehicle is being transferred as a gift, often stating “zero consideration” or “gift” as the purchase price.

- Signatures of both the giver and the recipient.

- Space for a notary public’s acknowledgment and seal, if required by your state’s regulations for vehicle transfers.

Steps to Using Your Vehicle Bill of Sale Gift Template Effectively

Once you have a suitable vehicle bill of sale gift template, the next crucial step is to fill it out accurately and ensure all necessary procedures are followed. This isn’t a document you want to rush through or treat lightly, as its precision directly impacts the legality and ease of the transfer.

Begin by gathering all the required information for both parties and the vehicle itself. Have the vehicle’s title, registration, and insurance information handy. Double-check all spellings, addresses, and especially the Vehicle Identification Number (VIN) to ensure there are no errors. An incorrect VIN can cause significant headaches at the DMV and invalidate the document’s purpose.

Carefully complete each section of the template. Make sure to clearly indicate that the vehicle is being transferred as a gift, signifying that no money or other consideration is being exchanged. This specific declaration is what differentiates a gift bill of sale from a standard sales agreement and is vital for tax purposes. Use clear, legible handwriting if filling it out manually, or type it for maximum clarity.

Once the template is filled out, both the giver and the recipient must sign the document. It’s highly recommended that this be done in front of a notary public, even if your state doesn’t explicitly require it. Notarization adds an extra layer of legal validity by verifying the identities of the signers and that the signatures are authentic. Check your local DMV’s website or contact them directly to confirm if notarization is a mandatory step in your state for gift vehicle transfers.

After the bill of sale is signed and, if necessary, notarized, both parties should keep a copy for their records. The recipient will need the original document to present to the DMV when registering the vehicle and applying for a new title. The giver should also notify their insurance company and the DMV that they have transferred ownership of the vehicle, often by submitting a release of liability form, to ensure they are no longer associated with the vehicle for any legal or financial purposes.

Gifting a vehicle can be a truly meaningful act, but ensuring all the legal ducks are in a row is paramount for both your peace of mind and the recipient’s convenience. A meticulously completed bill of sale for a gift clearly establishes the transfer of ownership, helps manage potential tax implications, and streamlines the process of registering the vehicle in its new owner’s name.

By taking the time to properly document the transfer using a reliable template and following the necessary steps, you can avoid future headaches and ensure that this generous gift brings nothing but joy and smooth sailing for everyone involved.