When you experience a significant event that leads to a total loss of your property, whether it is due to a natural disaster like a fire or flood, or even a major theft, the aftermath can be overwhelming. Beyond the immediate shock and safety concerns, you are faced with the daunting task of figuring out what was lost and how to begin the recovery process. This is where the practical side of things, like dealing with insurance, comes into sharp focus.

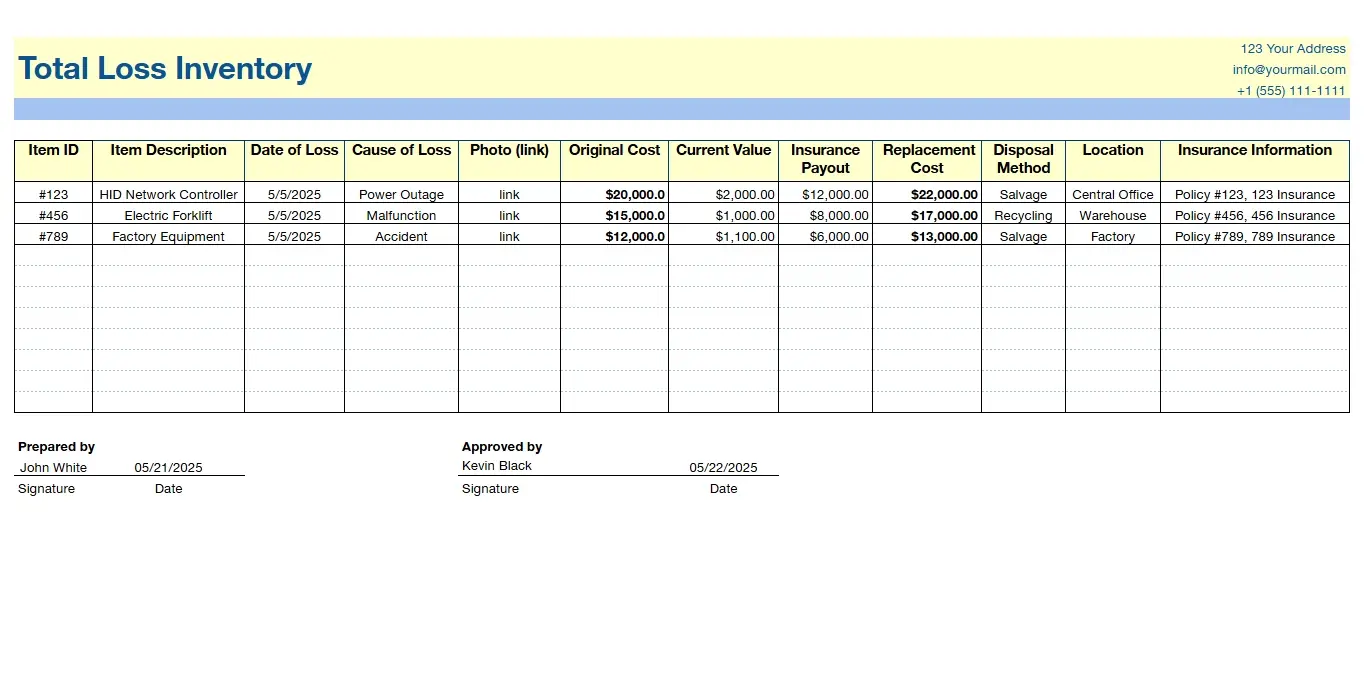

One of the most crucial steps in filing an insurance claim for a total loss is creating a detailed inventory of everything that was damaged or destroyed. This is not just a suggestion from your insurance company; it is a vital tool that directly impacts the compensation you receive. Using a well-structured total loss inventory list template can significantly reduce stress and ensure you do not overlook any valuable items during an already difficult time.

Having an organized method to document your possessions makes the entire claims process smoother and helps you secure a fair settlement. It transforms a chaotic situation into a manageable project, providing a clear pathway forward when you might feel lost.

Why a Detailed Inventory is Crucial for Your Claim

Facing a total loss is emotionally draining, and in the midst of it all, recalling every single item you owned can feel impossible. However, your insurance provider needs a clear, itemized list to properly assess your claim and determine the payout. Without a detailed inventory, you risk forgetting items, underestimating their value, and ultimately receiving less compensation than you deserve. Insurance companies operate on facts and documentation, and a comprehensive inventory provides just that.

Think of it as building a case for your lost belongings. Each item on your list contributes to the overall picture of your loss. Simply stating “I lost everything in the living room” is far less effective than listing “one 65-inch smart TV, purchased 2022, estimated value 1500 dollars” along with supporting details. The more specific you are, the less room there is for estimation or dispute during the claims adjustment process.

Moreover, the process of creating this list, though difficult, can actually be quite therapeutic. It forces you to mentally walk through your home and recall items, some of which you might not have thought about in years. This mental exercise, guided by a template, helps ensure nothing is overlooked, from major appliances to smaller, sentimental items that still hold monetary value.

Key Elements to Include in Your Inventory

- Item Description: Be specific. Instead of “chair,” write “upholstered armchair with floral pattern.”

- Purchase Date: Approximate date if you do not have the exact one.

- Original Cost: What you paid for it. Include tax if possible.

- Estimated Current Value: What it would cost to replace it today, or its depreciated value depending on your policy.

- Proof of Ownership: Receipts, photos, credit card statements, user manuals.

- Notes: Any additional information, like special features, condition, or sentimental value.

Gathering proof of ownership is just as important as the list itself. Photographs of your home before the loss, receipts for major purchases, and even credit card statements can serve as invaluable evidence. The more documentation you can provide to back up your inventory list, the stronger your claim will be, minimizing potential disagreements with your insurance adjuster.

Ultimately, a detailed inventory serves as your advocate during the claims process. It ensures that every single item, no matter how small, is accounted for. This meticulous approach can significantly impact the speed and fairness of your settlement, allowing you to focus on rebuilding your life with the resources you need.

Making the Most of Your Inventory Template

Once you have a suitable total loss inventory list template, the key to its effectiveness lies in how thoroughly and strategically you fill it out. Do not rush the process. Take your time, even if it means breaking it down into several sessions. The goal is accuracy and completeness, not speed. Consider tackling one room at a time, moving systematically through your home (or what remains of it) to ensure every area is covered.

Starting room by room helps you compartmentalize the task and reduces the feeling of being overwhelmed. Imagine walking into your living room and listing everything you see, then moving to the kitchen, and so on. This methodical approach helps jog your memory and prevents you from skipping areas or entire categories of items. Remember to open drawers, closets, and cabinets as well; these often contain a surprising number of valuable items.

Do not forget to consider items outside the main living areas, such as those in a garage, shed, attic, or basement. Tools, sporting equipment, seasonal decorations, and stored heirlooms can represent significant value. Keeping all this information organized within your template, perhaps with separate sections for different areas, will make it incredibly easy for your insurance adjuster to review.

Preparing a detailed inventory when faced with a total loss is more than just a procedural step; it is an act of self-advocacy. By systematically documenting every item and its value, you empower yourself to navigate the insurance claims process with confidence and clarity.

This thorough preparation means you are not relying on memory alone during a stressful period, but rather on a well-organized record that stands as a testament to what you have lost. It is a vital component in securing the financial resources necessary to begin restoring your life and property.