Tax season can often feel like a looming cloud for small business owners, bringing with it a whirlwind of receipts, spreadsheets, and deadlines. It is a period that tests patience and organizational skills, but it doesn’t have to be a source of overwhelming stress. Imagine having a clear, step-by-step guide to follow, ensuring you don’t miss a single detail or potential deduction. This is precisely what a well-crafted small business tax checklist template offers: a beacon of clarity in the often-murky waters of tax preparation.

Staying organized throughout the year is undoubtedly beneficial, but having a dedicated roadmap specifically for tax filing can transform a daunting task into a manageable process. It helps you gather all the necessary documents, track your income and expenses systematically, and ultimately, face the tax authorities with confidence. No more last-minute scrambling or wondering if you’ve forgotten something important.

This article will guide you through the essential elements of an effective tax checklist, helping you understand what to look for, how to use it, and how it can empower you to not only meet your tax obligations but also optimize your financial position. Let’s demystify tax season together and turn potential headaches into proactive planning.

Navigating the Tax Maze: Key Components of Your Checklist

Preparing your small business taxes involves much more than just tallying up numbers. It requires a systematic approach to ensure accuracy, compliance, and the maximization of any eligible deductions. A comprehensive tax checklist acts as your personal project manager, guiding you through each stage of the preparation process. It breaks down the monumental task into smaller, actionable steps, making the entire journey less intimidating and more efficient. Think of it as your personalized assistant, reminding you of what needs to be done and when, reducing the chances of costly errors or missed opportunities.

Gathering Your Financial Records

The foundation of any accurate tax filing is a complete set of financial records. Your checklist should begin by prompting you to collect all bank statements and credit card statements related to your business activities. These documents provide a clear overview of your cash flow and are crucial for verifying income and expense transactions. Ensure you have statements covering the entire tax year, from January 1st to December 31st.

Beyond bank and credit card statements, you’ll need to round up all invoices issued to clients, as these prove your business income. Equally important are all receipts for business purchases, whether they are for office supplies, client lunches, or professional development. If you have employees, payroll records including wage statements and tax withholding forms are indispensable.

Understanding Your Income and Expenses

Once your records are gathered, the next step involves categorizing your income and expenses. Your checklist will guide you to determine your gross income from all business operations. This includes sales of products, services rendered, and any other revenue streams. A clear understanding of your income is paramount for calculating your tax liability.

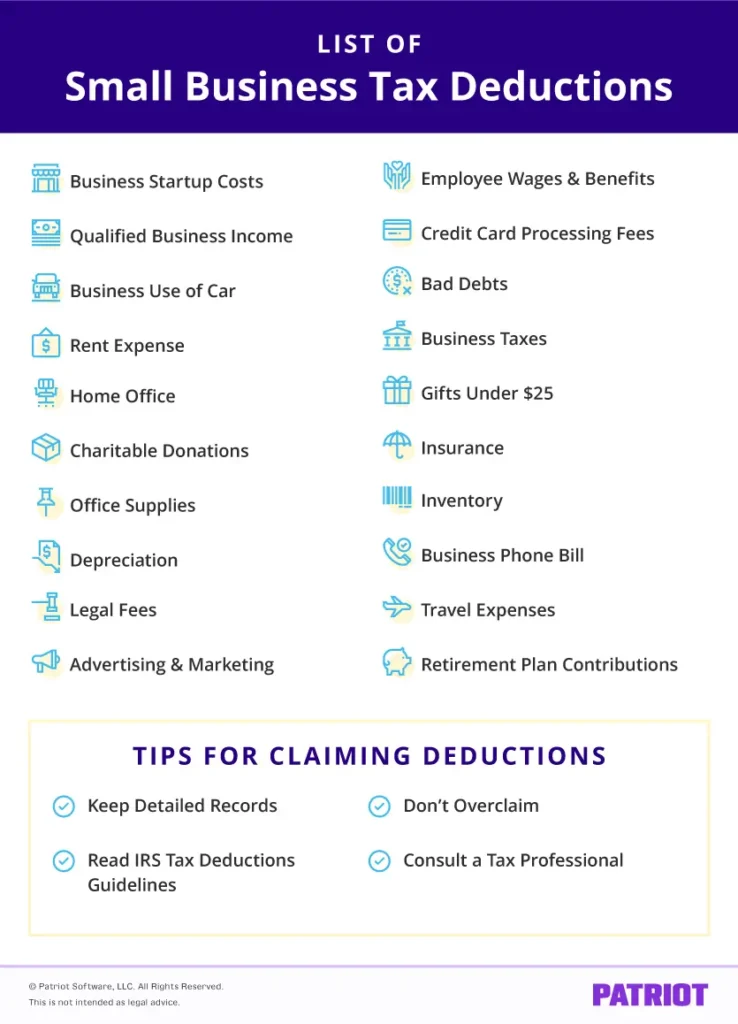

Equally vital is identifying and documenting all eligible business deductions. These are the expenses that reduce your taxable income. Common deductions include rent or mortgage interest for business premises, utility bills, internet services, and advertising costs. Don’t forget professional fees paid to accountants or lawyers, insurance premiums, and travel expenses incurred for business purposes.

Specific deductions often overlooked include home office expenses if you work from home, which can involve a portion of your utilities, rent, or depreciation on your home. Vehicle expenses, whether actual costs or the standard mileage rate, also represent significant potential savings. Keep detailed logs for all business-related mileage.

Employee and Contractor Documentation

If your small business employs staff or engages independent contractors, your checklist must include specific items related to these individuals. For employees, you’ll need all W-2 forms that you issued, along with records of payroll taxes paid and filed throughout the year (such as Form 941). For independent contractors, you’ll be responsible for issuing 1099-NEC forms if you paid them over a certain threshold, typically 600, and ensuring you have their W-9 forms on file.

Finally, consider state and local tax obligations. Depending on your business structure and location, you might have sales tax, property tax, or other specific local business taxes to account for. These often have different filing deadlines and requirements than federal taxes, so your checklist should prompt you to confirm all relevant state and local obligations.

Beyond the Basics: Leveraging Your Checklist for Success

A small business tax checklist template is not just a tool for the frantic weeks leading up to the tax deadline. It’s an invaluable asset that, when utilized proactively throughout the year, can significantly improve your financial management and reduce year-end stress. By integrating the checklist into your regular accounting practices, you transform it from a reactive task list into a powerful, ongoing organizational strategy. This continuous engagement ensures that financial records are always up-to-date and easily accessible, making tax preparation a seamless part of your business operations rather than a standalone, dreaded event.

Embracing this proactive approach offers numerous benefits beyond just easier tax filing. It cultivates an environment of financial clarity, allowing you to better understand your business’s true profitability and identify areas for potential growth or cost-cutting. By regularly reviewing the checklist items, you can spot discrepancies early, ensure compliance with changing tax laws, and even discover new deductions you might have previously overlooked. The peace of mind that comes from knowing your financial house is in order is truly invaluable.

- Improved Organization: Keeps all financial documents in one place, easily retrievable.

- Reduced Stress: Eliminates last-minute panic and ensures a smoother filing process.

- Maximized Deductions: Helps identify all eligible expenses, potentially saving you money.

- Better Financial Insight: Provides a clearer picture of your business’s financial health.

- Compliance Assurance: Helps ensure you meet all federal, state, and local tax requirements.

Think of your small business tax checklist template as a living document. It should be reviewed and updated periodically, perhaps quarterly, to reflect any changes in your business operations, tax laws, or personal financial situation. Customizing it to fit the unique nuances of your industry and business structure will make it even more effective. This iterative process not only simplifies tax time but also strengthens your overall financial discipline, paving the way for more informed decision-making throughout the year.

Embracing a systematic approach to tax preparation is one of the smartest moves any small business owner can make. By diligently using a comprehensive checklist, you empower yourself with control and clarity over your financial responsibilities, transforming what often feels like an insurmountable burden into a straightforward, manageable process. It’s about more than just avoiding penalties; it’s about strategic financial stewardship.

Ultimately, having your financial ducks in a row well before tax season allows you to focus on what you do best: running and growing your business. The proactive effort you put into organizing your tax documents and understanding your obligations will pay dividends in reduced stress, potential savings, and the invaluable peace of mind that comes from knowing you’re fully prepared.