Navigating the world of property assessments can often feel like deciphering a complex code, leaving many homeowners and property managers scratching their heads. You might wonder if your property’s assessed value truly reflects its current market standing, or perhaps you just want to ensure you’re not paying more than your fair share in property taxes. This is precisely where a well-structured property assessment improvement checklist template becomes an invaluable asset, guiding you through the often-overlooked steps to better understand and potentially challenge your property’s valuation.

Understanding your property assessment isn’t just about taxes; it’s about being informed. An accurate assessment is foundational to your overall financial planning as a property owner. It impacts everything from your mortgage considerations to the eventual sale price of your home. When you have a clear picture of how your property is valued and the factors contributing to that figure, you are in a much stronger position to make informed decisions.

This article aims to demystify the assessment process, providing you with a clear, conversational roadmap to not only understand your current assessment but also to proactively identify areas for potential improvement or correction. Think of it as your friendly guide to becoming a more empowered and knowledgeable property owner, ready to tackle those assessment notices with confidence.

Demystifying Your Property Assessment: The Foundation of Fairness

Before diving into improvements, it’s crucial to truly grasp what a property assessment is and why it exists. In essence, a property assessment is the official valuation of your real estate, determined by a local government assessor for the purpose of levying property taxes. This valuation isn’t necessarily what your home would sell for on the open market today, though it often attempts to approximate that figure, but rather a uniform method to distribute the tax burden equitably among property owners to fund local services like schools, roads, and emergency services.

Assessors typically use mass appraisal techniques, which involve evaluating many properties at once using standardized methods and data. They consider various factors such such as the property’s size, age, construction quality, number of bedrooms and bathrooms, lot size, and any unique features or improvements. They also analyze sales data of comparable properties in your neighborhood to ensure their valuations are consistent with market trends in your area.

The challenge for homeowners often lies in the sheer volume of properties an assessor must evaluate. While they strive for accuracy, individual nuances of a property might sometimes be overlooked, or data might become outdated between assessment cycles. For instance, a property might have suffered damage that wasn’t properly recorded, or perhaps a recent renovation hasn’t been fully accounted for in a way that truly reflects its value addition versus its cost.

Moreover, economic shifts and local market dynamics play a significant role. A booming housing market could see assessments rise rapidly, while a downturn might lag in its reflection on official valuations. Understanding these underlying mechanisms helps you appreciate that the assessment is a snapshot in time based on specific criteria, and it’s not immune to errors or oversight.

The ultimate goal of an assessment is fairness. However, "fairness" in the context of mass appraisal sometimes means ensuring everyone is assessed by the same rules, not necessarily that every single property’s valuation is perfectly precise down to the last dollar. This distinction is vital because it creates an opportunity for property owners to review their specific assessment details and advocate for adjustments if they uncover discrepancies.

Being an active participant in understanding your assessment empowers you to question details that seem off and to ensure your property’s unique characteristics are accurately represented. It’s about ensuring the data used to calculate your taxes is as correct as possible, which is the cornerstone of a fair and equitable system.

Your Actionable Property Assessment Improvement Checklist: Steps to Success

Now that we understand the intricate world of property assessments, let’s translate that knowledge into actionable steps. Creating your own property assessment improvement checklist template can transform a potentially intimidating process into a manageable project. This isn’t just about finding errors; it’s about systematically ensuring your property is assessed fairly and that you have all the information you need.

Start by obtaining a copy of your most recent assessment record. This document is the foundation of your review. It typically lists the assessor’s description of your property, including lot size, square footage of the building, number of rooms, construction type, and any other features they’ve recorded. Compare every single detail against your own records and a physical inspection of your property. Are the number of bathrooms correct? Is the lot size accurate? Has an old shed been removed but is still listed? These small details can collectively impact your valuation.

Next, research comparable properties in your immediate area. Look for homes that have recently sold (within the last 6-12 months) that are similar in size, age, condition, and features to yours. Online real estate platforms, local assessor’s websites, and even speaking with local real estate agents can provide valuable data. If you find several comparable homes selling for significantly less than your assessed value, or if your assessment is higher than similar properties, this could be a strong point of contention.

When you’re comparing properties, remember to adjust for differences. A brand-new kitchen in one home versus an original kitchen in another will affect value. Similarly, a house on a busy road might be worth less than an identical house on a quiet cul-de-sac. Being thorough in your comparison is key to building a strong case.

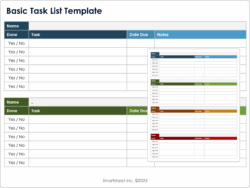

- Review Your Assessment Notice Thoroughly: Don’t just glance at the total. Check every detail listed for your property.

- Inspect Your Property for Discrepancies: Walk around your home and property with your assessment notice in hand. Note any errors in measurements or features.

- Gather Comparable Sales Data: Research recently sold properties in your neighborhood that are similar to yours.

- Document Any Damages or Issues: Take photos of any structural problems, significant wear and tear, or other issues that might negatively impact value.

- Understand the Appeal Process: Familiarize yourself with your local assessor’s appeal deadlines and required documentation.

- Consider Professional Help: For complex cases, a real estate appraiser or tax consultant can provide expert guidance and reports.

By systematically working through this property assessment improvement checklist template, you empower yourself with the knowledge and evidence needed to confidently engage with your assessor. You’ll not only identify potential areas for adjustment but also gain a deeper understanding of your property’s true value.

Taking an active role in scrutinizing your property assessment is more than just a financial exercise; it’s about advocating for yourself as a property owner. By using a structured approach and being well-informed, you can ensure that your property’s valuation is fair, accurate, and reflects its true standing. This proactive stance helps maintain balance and fairness within the system for everyone involved.