Facing a stack of medical bills can feel incredibly overwhelming. The sheer volume of paperwork, the confusing codes, and the often-exorbitant figures are enough to make anyone’s head spin. Many people find themselves in this exact position, wondering how they’ll ever manage to pay off what they owe without completely derailing their financial stability. The good news is that you don’t have to tackle these challenges alone, and there are structured ways to bring order to the chaos.

One of the most effective strategies for managing healthcare debt is to set up a payment plan directly with your provider or the billing department. Instead of feeling cornered, a well-defined payment agreement can give you back a sense of control. This is where having a clear, actionable guide becomes invaluable, and understanding the components of a solid medical bill payment plan template can transform your approach from reactive stress to proactive management.

Why a Medical Bill Payment Plan Template is Your Best Friend in Healthcare Finance

Navigating medical debt can be a confusing and stressful journey, but having a structured approach like a medical bill payment plan template can make all the difference. Think of it as your personal financial compass, guiding you through the often-turbulent waters of healthcare costs. This template isn’t just a piece of paper; it’s a tool for clear communication, a promise between you and the healthcare provider, and a roadmap to financial peace of mind. Without a clear plan, misunderstandings can arise, leading to late fees, collection calls, and unnecessary stress.

A well-crafted template ensures that both parties are on the same page regarding the terms of repayment. It formalizes the agreement, laying out every crucial detail so there’s no ambiguity about what’s expected. This clarity helps prevent missed payments, protects your credit score, and shows the provider that you are serious about fulfilling your obligations, even if you need a little flexibility. It’s about building trust and demonstrating a commitment to resolving your medical expenses responsibly.

Furthermore, using a template can empower you during negotiations. When you present a clear proposal, even if it’s just filling in the blanks of a standard form, it demonstrates your readiness to engage constructively. It helps you articulate your financial situation and propose a realistic payment schedule that works for your budget, rather than simply accepting whatever terms are offered. This proactive stance can often lead to more favorable outcomes, such as reduced interest rates or extended repayment periods.

In essence, a medical bill payment plan template serves as your personal advocate, simplifying a complex situation into manageable steps. It’s a proactive measure that shields you from the potential pitfalls of unmanaged debt and provides a clear pathway toward resolving your medical bills systematically and without undue strain.

Key Components of an Effective Template

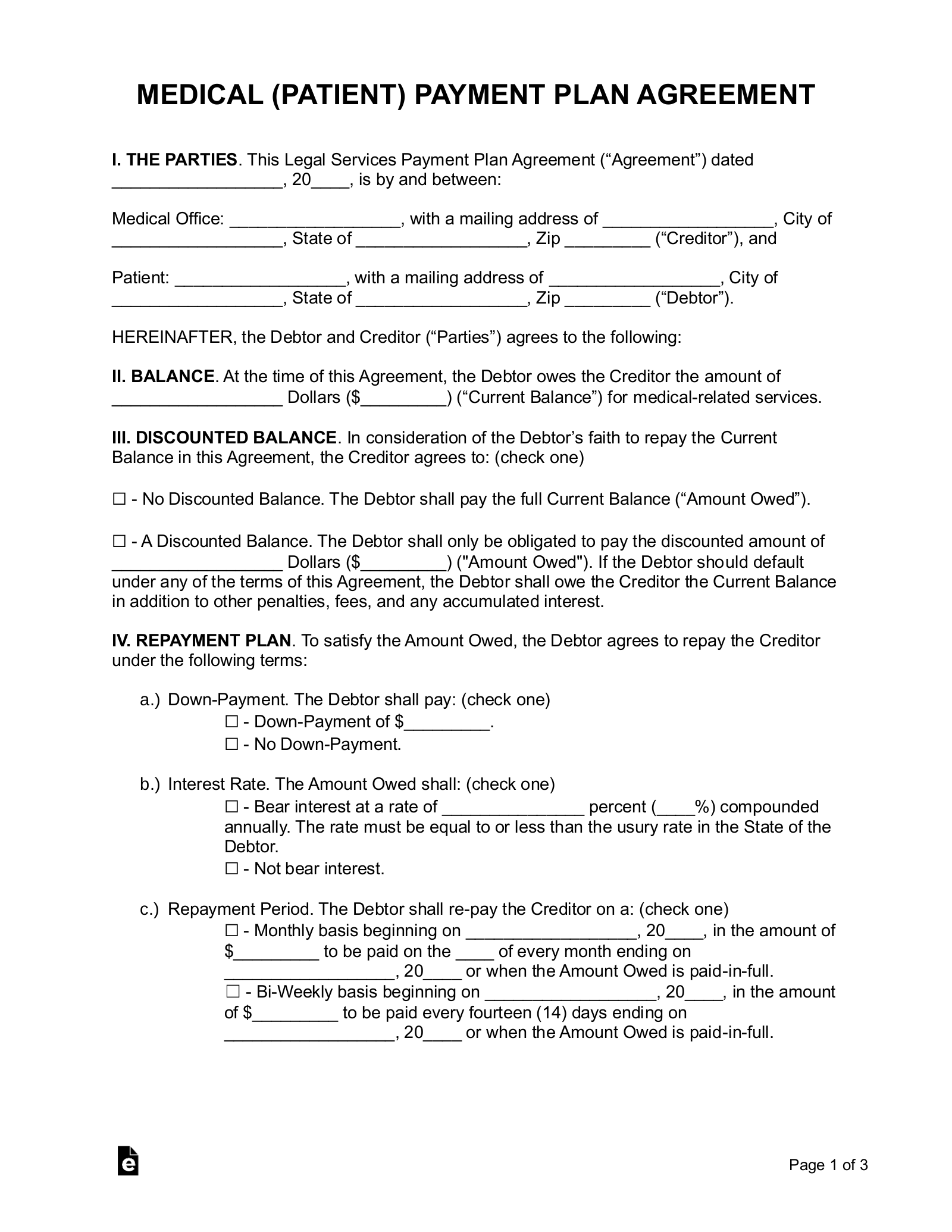

- Patient Information: Full name, address, contact details, and account number.

- Provider Information: Name of the hospital or clinic, department, and contact person for billing.

- Total Bill Amount: The exact outstanding balance owed for services.

- Agreed Payment Amount: The fixed sum to be paid per installment.

- Payment Frequency: How often payments will be made (e.g., weekly, bi-weekly, monthly).

- Due Date: The specific day of the month each payment is expected.

- Start and End Dates: The date the plan begins and when the final payment is due.

- Interest and Fees: Any applicable interest rates or late payment fees.

- Signature Lines: Spaces for both the patient and an authorized representative from the provider to sign and date, indicating agreement.

How to Use and Customize Your Medical Bill Payment Plan Template

Once you have a solid medical bill payment plan template, the next step is putting it to good use. The process begins with open communication with your healthcare provider’s billing department. Don’t be afraid to call them as soon as you receive a bill you can’t pay in full. Explain your situation calmly and inquire about their options for payment plans. Many hospitals and clinics are surprisingly flexible and willing to work with patients, as it’s often more beneficial for them to receive partial payments over time than no payment at all.

When discussing the terms, have your personal financial details ready. This includes your income, essential expenses, and what you realistically can afford to pay each month. Use your template as a guide during this conversation. You can propose specific monthly payment amounts and a timeline based on your budget. Remember, the template is a starting point; it’s designed to be adaptable. You might need to adjust the monthly payment amount or the duration of the plan based on what the provider is willing to accept and what you can comfortably manage without financial stress.

Customizing your template means ensuring that every field accurately reflects the agreement reached. For example, if you negotiate a lower total amount or a longer repayment period, make sure these changes are clearly documented on the template before you or the provider sign it. Pay close attention to any clauses regarding interest, penalties for missed payments, or options for early payoff. It’s crucial that you understand every aspect of the agreement to avoid surprises down the line.

After the agreement is finalized and signed by both parties, make sure you receive a copy for your records. Set up reminders for your payment due dates and try to automate payments if possible to avoid missing an installment. Regularly review your financial situation to ensure you can continue to meet your obligations. Should your circumstances change, do not hesitate to reach out to the provider again to renegotiate the terms. Proactive communication is key to successfully navigating any payment plan, ensuring you fulfill your commitment and keep your financial health on track.

Taking control of medical debt can feel like a monumental task, but it doesn’t have to be. By utilizing a structured approach and proactively communicating with healthcare providers, you can transform an overwhelming burden into a manageable financial commitment. Having a clear plan in place not only alleviates stress but also builds a pathway toward financial stability.

Embracing the use of a formal agreement ensures clarity and accountability for both you and the provider. It empowers you to navigate healthcare costs with confidence, knowing you have a well-defined strategy for repayment. Ultimately, managing your medical bills effectively is about taking charge of your financial well-being, one organized step at a time.