Managing your household finances can sometimes feel like juggling too many balls at once. Between various due dates, different payment methods, and the sheer volume of bills that arrive each month, it is easy to feel overwhelmed or even miss an important payment. Many of us have experienced that sudden jolt of panic when realizing a bill was due yesterday, or the frustration of trying to track down a payment confirmation.

Imagine a world where all your financial obligations are neatly organized, clearly visible, and easily managed. This is where a fantastic tool, like a home finance bill organizer template, comes into play. It is designed to bring clarity and control back to your financial life, transforming a chaotic pile of papers or a jumbled digital inbox into a streamlined system that actually works for you.

Why You Need a Home Finance Bill Organizer Template in Your Life

In our busy lives, financial management often takes a backseat until a crisis hits. Without a clear system, you might find yourself constantly stressed about upcoming payments, unsure of your true financial standing, or even incurring late fees that could have been easily avoided. These small financial missteps can add up, impacting your budget and even your credit score over time. A good home finance bill organizer template acts as your personal financial assistant, ensuring nothing falls through the cracks.

Think of it as your financial command center. Instead of rummaging through emails or physical mail, everything is laid out in an easy-to-understand format. This proactive approach not only saves you money by preventing late fees but also significantly reduces your stress levels, allowing you to focus on other important aspects of your life. It provides a comprehensive snapshot of your income versus your outgoing expenses, making budgeting a breeze.

Say Goodbye to Stress

One of the most immediate benefits you will experience is a profound reduction in financial anxiety. Knowing exactly what is due, when it is due, and how much is required gives you peace of mind. No more last-minute scrambles or the unsettling feeling that you have forgotten something important. This organized approach builds confidence in your financial decision-making.

Avoid Late Fees and Penalties

Late fees are essentially money wasted. They chip away at your hard-earned income and can accumulate quickly. A home finance bill organizer template helps you stay ahead of every due date, providing timely reminders and a clear record of when each bill needs to be paid. This simple preventative measure can save you a substantial amount of money over the course of a year, money that can be put towards savings or other financial goals.

* Clear overview of all bills

* Improved budgeting capabilities

* Reduced financial anxiety

* Enhanced credit score

* Better long-term financial planning

Empower Your Financial Future

Beyond just paying bills on time, this organizational tool empowers you to make smarter financial choices. When you have a clear picture of your cash flow, you can identify areas where you might be overspending, find opportunities to save, and even plan for larger financial goals like a down payment on a home or a well-deserved vacation. It transforms bill paying from a chore into a strategic step towards a more secure financial future.

How to Choose and Use Your Perfect Home Finance Bill Organizer Template

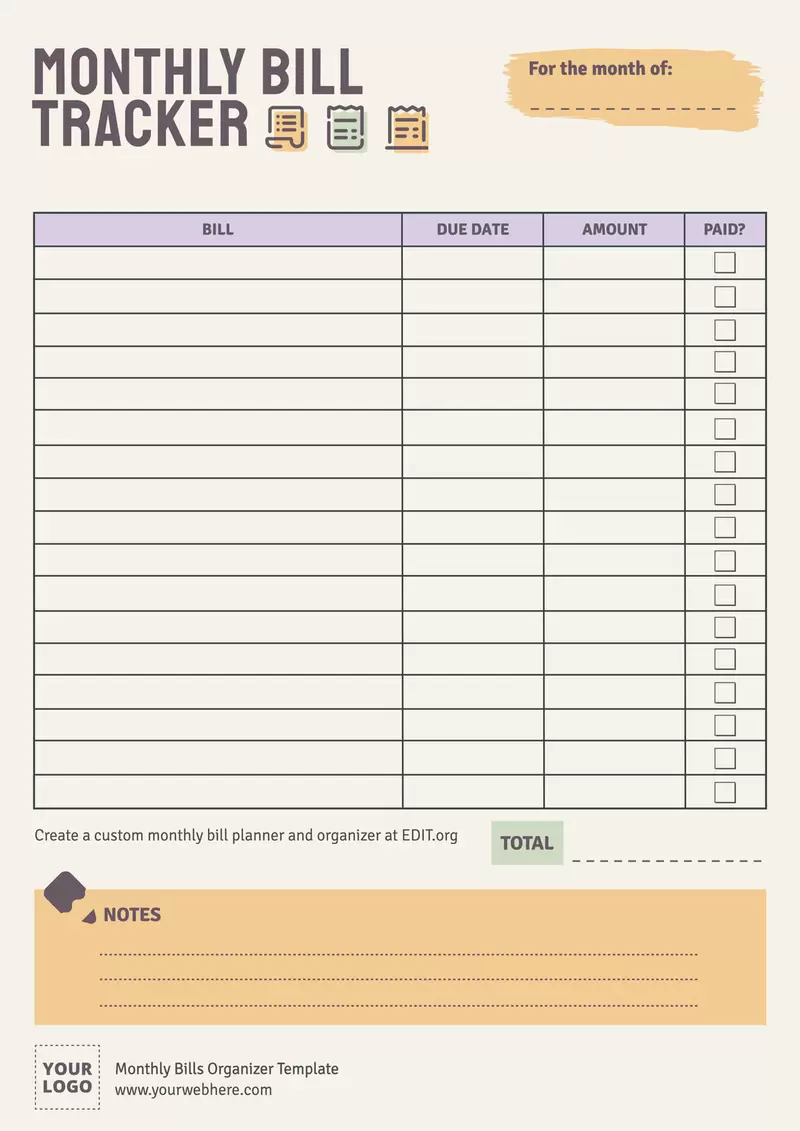

When it comes to selecting the ideal home finance bill organizer template, you have a few options, each with its own advantages. You might prefer a digital spreadsheet that automatically calculates totals, a printable PDF that you can fill out by hand, or even a dedicated app designed specifically for bill tracking. The best template is one that aligns with your personal preferences and technological comfort level, ensuring you will actually use it consistently.

Look for a template that is intuitive and easy to navigate. Key sections to consider include columns for the bill name, due date, amount due, payment status, confirmation number, and any notes you might need to add. Some templates also offer categories for different types of bills, like utilities, subscriptions, or credit cards, which can further enhance your organization. Customization options are a bonus, allowing you to tailor it exactly to your unique financial landscape.

Once you have chosen your template, the next step is to populate it with your financial information. Gather all your current bills, whether they are physical statements or online invoices. Input the recurring bills first, as these are typically the backbone of your monthly expenses. Make sure to include the due dates accurately. This initial setup might take a little time, but it is an investment that will pay dividends in peace of mind.

The real power of any organizer lies in its consistent use. Make it a habit to update your template regularly, perhaps weekly or bi-weekly, after you have paid a bill. Mark it as paid, add the confirmation number, and note the date paid. This ritual keeps your template current and your financial picture accurate, allowing you to quickly see what is outstanding and what has been taken care of.

* Gather all your bills and financial statements.

* Choose a home finance bill organizer template that suits your style.

* Input recurring bills and their due dates first.

* Update the template regularly after each payment.

* Review your template weekly or bi-weekly to stay on track.

Consistency is truly the key to unlocking the full potential of your bill organizer. By integrating it into your routine, you will transform the way you interact with your money, moving from reactive responses to proactive management.

Embracing a systematic approach to your finances, such as utilizing a dedicated bill organizer, simplifies what can often feel like an overwhelming task. It grants you not just clarity on your current financial obligations but also empowers you with the knowledge needed to make informed decisions for your future. This proactive stance on managing your money can truly be a game changer, allowing you to spend less time worrying and more time enjoying life.

Taking control of your bills and understanding your financial flow is a significant step towards achieving overall financial wellness. By implementing an effective organizational tool, you are not just paying bills; you are building a foundation for a more secure and stress-free financial journey ahead. It is time to transform your relationship with money from one of dread to one of confident control.