Embarking on a business acquisition, investment, or significant strategic partnership is an exciting venture, often filled with immense potential. However, beneath the surface of promising prospects lies a critical need for rigorous examination: financial due diligence. This crucial process is akin to a thorough health check-up for a company, ensuring that the financial narratives presented truly align with reality. It’s about verifying every number, scrutinizing every claim, and uncovering any hidden issues that could impact the value or viability of the deal.

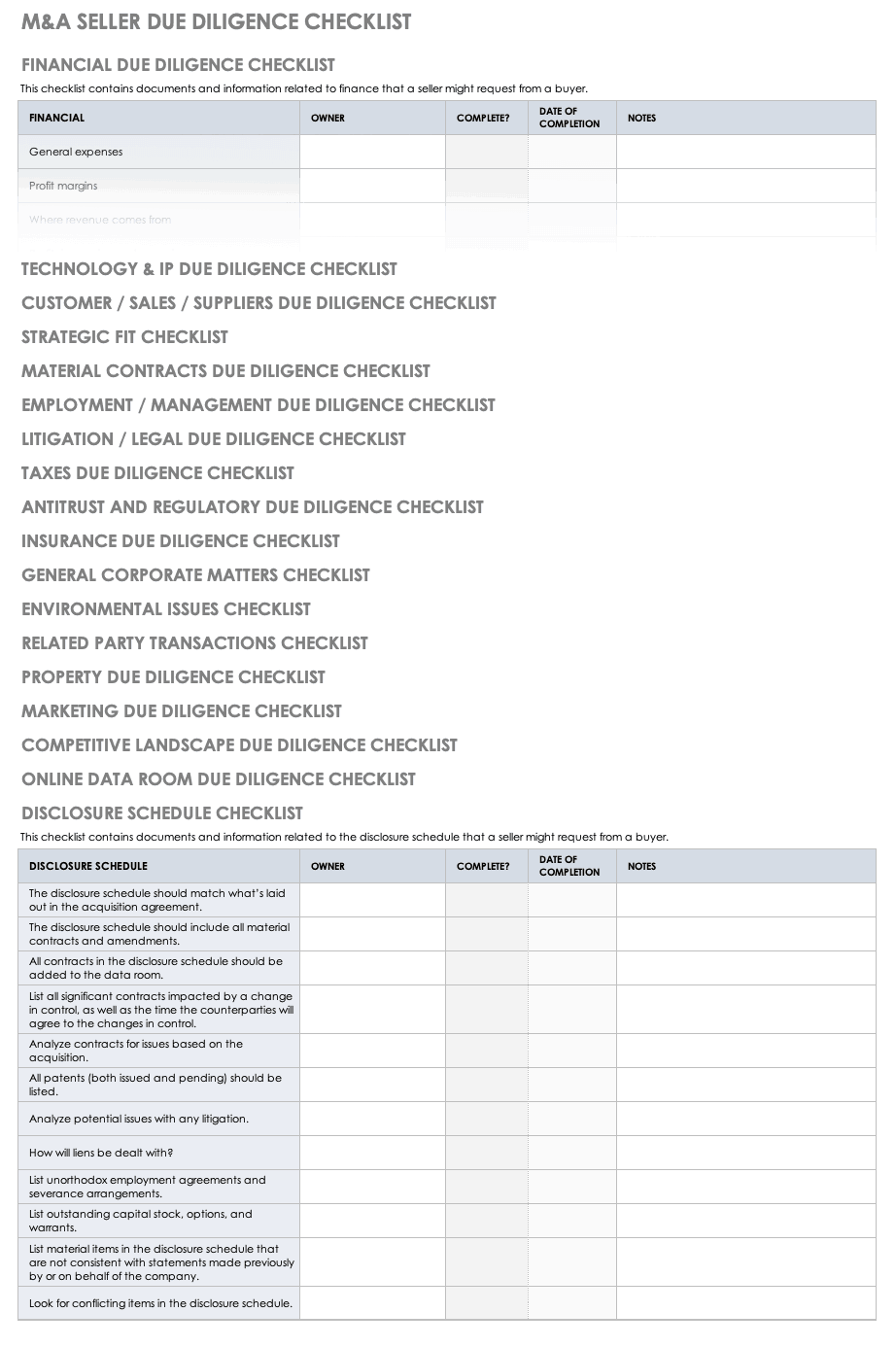

Without a systematic approach, the sheer volume of financial data can be overwhelming, making it easy for critical details to be overlooked. This is precisely why a structured framework is not just helpful but essential. It transforms a daunting task into a manageable process, guiding you through the intricate layers of financial information with precision and clarity.

Understanding the Core of Financial Due Diligence

When you embark on financial due diligence, you’re essentially putting a magnifying glass over a company’s financial story. It’s not just about looking at the final numbers; it’s about understanding how those numbers came to be and what they truly represent. This deep dive is critical for anyone considering an acquisition, a significant investment, or even a strategic partnership. The goal is to get an accurate picture of the target’s financial health, performance, and prospects, far beyond what initial reports might suggest.

Imagine buying a house without an inspection. You’d never do it, right? Financial due diligence is precisely that inspection for a business. It aims to confirm the accuracy of financial information provided, identify any hidden liabilities or red flags, assess the sustainability of earnings, and evaluate working capital needs. Without a systematic approach, it’s easy for crucial details to slip through the cracks, leading to costly surprises down the road.

This is where a structured framework, like a financial due diligence checklist template, becomes indispensable. It acts as your roadmap, ensuring that every significant financial aspect is scrutinized methodically. Trying to navigate this complex process without such a tool can lead to inefficiencies, oversights, and ultimately, poor decision-making. A well-designed template provides a consistent framework, guiding your team through the intricate layers of financial data and ensuring nothing is left to chance.

Core Pillars of a Comprehensive Financial Review

A truly effective financial due diligence checklist template will break down the vast landscape of financial data into manageable, actionable categories. It ensures you’re not just scanning surface-level reports but digging deep into the underlying operations that drive those numbers. Think of it as peeling back the layers of an onion to understand its true core. We’re talking about everything from how revenue is recognized to the efficiency of accounts payable.

Key areas typically covered include a meticulous review of historical financial statements—income statements, balance sheets, and cash flow statements—for at least the past three to five years. This historical perspective helps in identifying trends, seasonality, and any one-off events that might distort performance. Furthermore, analysts will scrutinize revenue recognition policies, customer contracts, and sales pipelines to understand the quality and sustainability of earnings. On the expense side, a deep dive into cost structures, vendor agreements, and operating efficiencies is paramount. Understanding how the company manages its working capital, including accounts receivable, accounts payable, and inventory, provides crucial insights into its operational liquidity and efficiency.

Furthermore, attention is often given to tax compliance, identifying any potential tax exposures or unrecognized tax assets. Employee compensation, benefits, and any contingent liabilities related to staff are also critical. Legal and regulatory compliance, while often a separate diligence stream, frequently has significant financial implications that need to be cross-referenced. Ultimately, the goal is to build a complete financial mosaic, allowing for an informed valuation and risk assessment.

Implementing Your Financial Due Diligence Checklist Template

Once you have a robust financial due diligence checklist template in hand, the next step is its effective implementation. This isn’t a passive exercise; it requires active engagement, strategic planning, and meticulous execution. The very first action should be to customize the template to fit the specific nuances of the target company and the objectives of your transaction. No two businesses are exactly alike, and a one-size-fits-all approach can overlook critical details unique to an industry or business model. Tailor the checklist to reflect specific risk areas or growth drivers relevant to the deal.

As you begin collecting data, establish clear channels of communication with the target company’s management team. Transparency and cooperation are key to a smooth process. Designate a primary point of contact on both sides to facilitate information requests and follow-ups. Ensure that all requested documents, from general ledgers to specific customer contracts, are provided in an organized and timely manner. This organized approach minimizes delays and allows your team to focus on analysis rather than chasing down scattered information.

The real value of an organized due diligence process lies in the analysis of the collected information. It’s not enough to just tick boxes; the findings must be thoroughly scrutinized for anomalies, trends, and potential red flags. This often involves performing financial modeling, sensitivity analysis, and scenario planning based on the verified data. Your team will assess the quality of earnings, the sustainability of cash flow, and the accuracy of asset valuations, ultimately forming a comprehensive view of the target’s financial landscape. This analytical phase culminates in a detailed report summarizing key findings, risks, opportunities, and recommendations for the decision-makers.

Even after the financial due diligence is complete and a transaction proceeds, the insights gained from the process remain valuable. These insights can inform post-acquisition integration strategies, help in setting realistic performance targets, and guide ongoing financial monitoring. It’s a foundational piece of intelligence that continues to serve the acquiring entity well into the future, ensuring that the initial investment decision was not only well-informed but also built on a solid understanding of the target’s financial reality.

Navigating the complexities of business acquisitions or significant investments demands a level of scrutiny that goes beyond surface-level appearances. The financial health of a target company is the bedrock upon which any successful transaction is built, and understanding it thoroughly is paramount to safeguarding your investment.

By adopting a systematic and comprehensive approach, guided by a well-structured financial review, you equip yourself with the insights needed to make informed decisions, mitigate potential risks, and unlock true value. This diligent process ultimately provides the confidence required to move forward, ensuring that your strategic moves are backed by a clear and accurate financial picture.