Navigating the waters of private sales can sometimes feel like a delicate dance, especially when the full payment isn’t happening upfront. Whether you’re selling a vehicle, a piece of equipment, or even an expensive antique, there are situations where you need more than just a simple receipt to protect both parties. This is where a robust and clear document becomes not just helpful, but absolutely essential for a smooth and secure transaction.

Understanding the nuances of sales agreements can seem daunting, but thankfully, tools exist to simplify the process. A well-crafted document ensures that both the buyer and seller are fully aware of their rights and obligations throughout the payment period. It’s about setting clear expectations and providing a safety net should unforeseen circumstances arise, ensuring peace of mind for everyone involved.

Understanding the Basics of a Conditional Bill of Sale

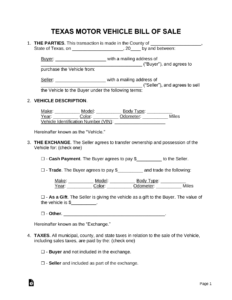

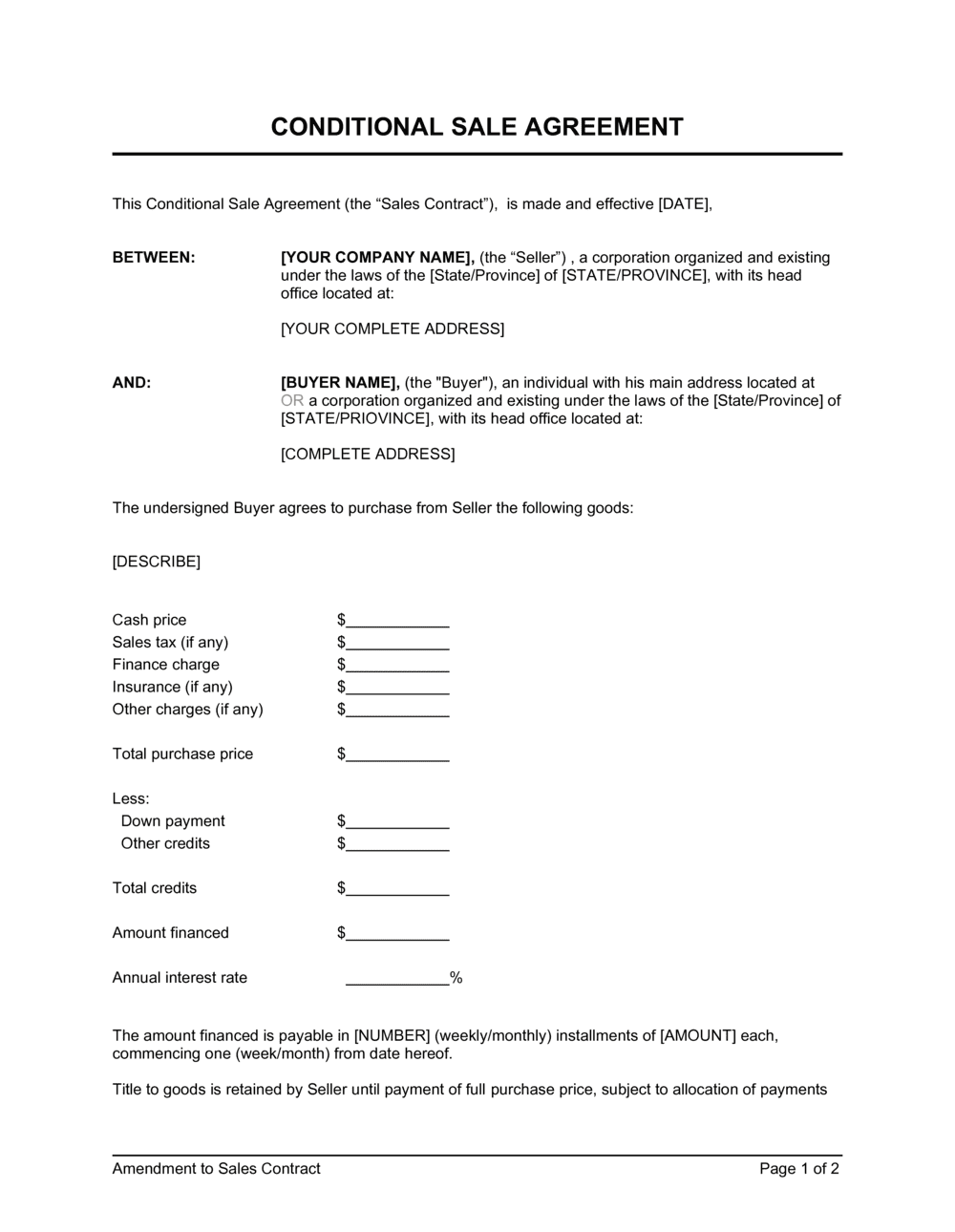

At its core, a conditional bill of sale is a legal document that outlines the terms of a sale where the transfer of ownership (title) of an asset is dependent upon certain conditions being met. Unlike a standard bill of sale where ownership typically transfers immediately upon signing and payment, with a conditional agreement, the seller retains legal ownership of the item until all specified conditions, usually the full payment of the purchase price, have been satisfied. This provides a crucial layer of security, especially in situations involving installment payments or seller financing.

Imagine you’re selling a valuable item on a payment plan. Without a conditional bill of sale, if the buyer stops making payments, you might find yourself in a difficult position trying to reclaim your property or seeking the outstanding balance. This type of agreement clearly states that while the buyer may take possession and use the item, they do not truly own it until every penny is paid or every condition is fulfilled. It’s a powerful tool for safeguarding your interests.

This document is particularly prevalent in scenarios where significant assets are involved, such as vehicles, heavy machinery, or even substantial collections. It acts as a protective shield for the seller, ensuring that they have a clear path to reclaim their property if the buyer defaults on their commitments. For the buyer, it provides a structured path to ownership, clearly outlining their responsibilities and the timeline for becoming the rightful owner.

The beauty of such an agreement lies in its ability to provide clarity and prevent future disputes. By clearly articulating the terms from the outset, both parties are on the same page, minimizing misunderstandings and providing a solid legal framework. It transforms a potentially risky transaction into a well-defined and manageable process for everyone involved.

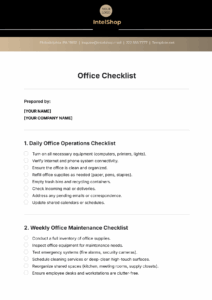

Essential Components of Your Template

- Full legal names and contact information of both the buyer and the seller.

- A detailed and accurate description of the asset being sold, including serial numbers, make, model, and any unique identifying features.

- The agreed-upon purchase price and the specific payment schedule, including the amount of each installment, due dates, and any interest rates.

- Explicit conditions for the transfer of title, making it clear when legal ownership will pass from the seller to the buyer.

- Default clauses, outlining what happens if the buyer fails to meet their obligations, including remedies available to the seller.

- Governing law, specifying which state or provincial laws will apply to the agreement.

- Spaces for the dated signatures of both the buyer and seller, and ideally, a witness or notary.

Why a Conditional Bill of Sale Template is Indispensable

Having access to a reliable conditional bill of sale template is not just about convenience; it’s about establishing a robust foundation for your transactions. Using a template ensures that all the crucial legal components are included, reducing the risk of overlooking essential clauses that could lead to complications down the line. It provides a standardized framework that can be easily adapted to various types of sales, saving you time and giving you confidence in the legitimacy of your agreement.

For sellers, the template is a powerful shield. It explicitly states that you retain legal ownership until the conditions are met, which means if the buyer defaults on payments, you have a clear legal right to repossess the item. This can be invaluable, especially when dealing with high-value goods where the financial risk of non-payment is significant. It ensures that your investment in the item is protected even after it leaves your immediate possession.

On the flip side, a well-defined template also offers considerable protection to the buyer. It clearly outlines the terms of payment, the conditions for ownership transfer, and what steps will be taken if issues arise. This transparency builds trust and ensures that the buyer understands exactly what is required of them to ultimately gain full ownership. It avoids ambiguity and provides a clear pathway to securing their purchase without any hidden surprises.

Ultimately, opting for a comprehensive conditional bill of sale template is a smart move for anyone involved in a transaction requiring deferred payment or specific conditions for ownership transfer. It simplifies a potentially complex legal process, provides clarity for both parties, and most importantly, offers significant legal protection. It transforms a handshake deal into a secure, legally binding agreement that stands up to scrutiny.

When engaging in transactions where the full value of an item isn’t paid upfront, having a clear and legally sound agreement is paramount. This specialized document acts as a safeguard, defining the terms of ownership transfer and protecting the interests of both the buyer and the seller. It provides a framework for secure transactions, offering peace of mind through every stage of the payment process.