Embarking on a commercial real estate transaction can feel like navigating a complex maze, filled with exciting opportunities but also potential pitfalls. Whether you’re a seasoned investor or new to the commercial property landscape, the stakes are incredibly high. A successful acquisition hinges not just on finding the right property at the right price, but more crucially, on a meticulous investigation into every facet of the deal before you sign on the dotted line. This investigative process is known as due diligence, and it’s your best defense against unexpected liabilities and costly surprises down the road.

This is precisely where a comprehensive commercial real estate due diligence checklist template becomes an indispensable tool. It transforms what could be an overwhelming and haphazard process into a structured, manageable workflow. By providing a clear roadmap of all the critical areas to examine, from financial records to environmental reports and tenant agreements, a well-crafted checklist ensures no stone is left unturned. It empowers you to make informed decisions, negotiate effectively, and ultimately, protect your investment.

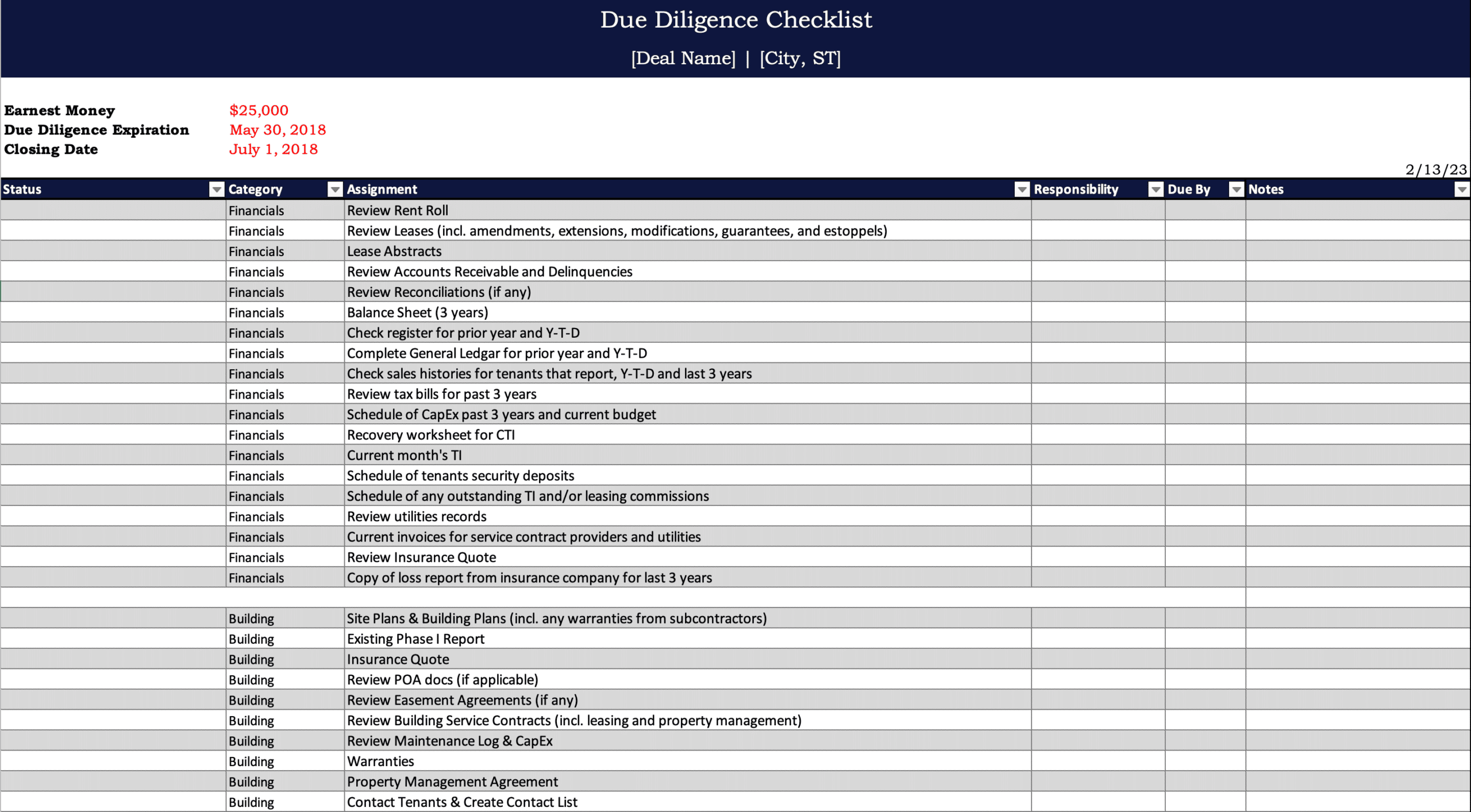

The Anatomy of a Robust Due Diligence Checklist

A truly effective commercial real estate due diligence checklist template isn’t just a simple list of items; it’s a living document that guides you through a multi-faceted investigation. It should cover every conceivable angle of the property and transaction, ensuring you have a complete picture of what you’re acquiring. Thinking of it as several interconnected layers of inquiry can help demystify the process and ensure thoroughness. This systematic approach is crucial because overlooking even a minor detail can have significant financial repercussions down the line.

The scope of your due diligence will naturally vary based on the property type, its location, and the specifics of the transaction. For instance, an industrial warehouse will require a different emphasis than a multi-tenant retail plaza or an office building. However, certain core categories remain universally critical, forming the backbone of any reliable checklist. These categories are designed to unearth potential issues, confirm representations made by the seller, and assess the property’s overall viability and future potential.

Financial Scrutiny: Understanding the Numbers

One of the most critical aspects involves a deep dive into the property’s financial health. This isn’t just about reviewing current income and expenses; it’s about projecting future performance and identifying any hidden costs or unsustainable revenue streams. You’ll want to verify all financial claims and ensure they align with the property’s historical performance and market realities.

- Rent rolls and tenant lease agreements: Verify current rents, lease terms, expiry dates, renewal options, and any clauses that might impact future income.

- Operating expenses: Review historical utility bills, property taxes, insurance premiums, maintenance costs, and management fees.

- Income and expense statements: Analyze profit and loss statements for at least the past three to five years.

- Capital expenditure history: Understand past significant repairs or upgrades and anticipate future capital needs.

- Existing loans and financing documents: If assuming a loan, scrutinize all terms and conditions.

Legal and Regulatory Compliance: Protecting Your Rights

Beyond the financial aspects, the legal standing of the property is paramount. This involves ensuring the property adheres to all relevant laws and regulations, and that there are no unresolved legal disputes or encumbrances that could jeopardize your ownership or operational plans. This section helps you understand any restrictions or obligations tied to the property.

- Title report and survey: Identify any liens, easements, encroachments, or zoning restrictions.

- Property deeds and legal descriptions: Confirm ownership and property boundaries.

- Certificates of occupancy and permits: Ensure the property is legally permitted for its current use.

- Environmental reports (Phase I and Phase II ESA): Assess potential environmental contamination or hazards.

- ADA compliance and other building codes: Verify adherence to accessibility standards and local construction codes.

- Litigation history: Check for any past or pending lawsuits related to the property or seller.

Beyond the Checklist: Practical Application for Success

Having a meticulously detailed commercial real estate due diligence checklist template is a fantastic start, but its true value comes from its effective application. It’s not just about ticking boxes; it’s about understanding the implications of each item and knowing when to dig deeper. The process requires a dedicated approach, a skilled team, and often, the expertise of various professionals to truly uncover all potential risks and opportunities. Think of the checklist as a foundation, upon which you build a comprehensive understanding of your prospective asset.

One crucial aspect of successful due diligence is establishing clear timelines and responsibilities. Assign specific sections of the checklist to individuals or teams with the relevant expertise, whether that’s your in-house finance team, legal counsel, or external consultants like environmental engineers and property inspectors. Regular communication and progress reviews are essential to keep the process on track and address any emerging issues promptly. Remember, time is often of the essence in commercial real estate transactions, so efficiency without sacrificing thoroughness is key.

Furthermore, don’t hesitate to leverage the expertise of external professionals. Engaging a reputable commercial real estate attorney, an experienced property inspector, and environmental consultants can provide invaluable insights and uncover issues that might not be apparent to the untrained eye. Their specialized knowledge can protect you from significant liabilities and help you interpret complex reports and legal documents. These experts become an extension of your due diligence team, adding layers of scrutiny that are difficult to achieve otherwise.

Finally, be prepared for negotiation. The findings from your due diligence are powerful tools that can be used to renegotiate purchase price, terms, or even walk away from a deal if the risks are too high. Uncovering issues like significant deferred maintenance, environmental concerns, or unfavorable lease terms gives you leverage to request concessions from the seller. A thorough investigation ensures you enter negotiations from a position of strength, armed with verifiable facts rather than assumptions.

The path to a successful commercial real estate acquisition is paved with thoroughness and careful investigation. By systematically working through a robust checklist, you equip yourself with the knowledge needed to make sound decisions and safeguard your investment. This proactive approach not only mitigates risks but also enhances your confidence in the viability and potential of your new property.