When you’re involved in buying or selling a business, even just a portion of its assets, it’s a big deal. There are so many moving parts, from valuation to negotiations, and countless details to manage. Amidst all this complexity, one document often gets overlooked until the very last minute, yet it’s absolutely crucial for ensuring a smooth, legal, and clear transfer of ownership: the bill of sale.

This seemingly simple piece of paper serves as the official record of the transaction, providing protection for both the buyer and the seller. It’s more than just a receipt; it’s a formal acknowledgment of what assets are being transferred, who they’re being transferred from, and who they’re being transferred to, alongside the agreed-upon terms. Getting this right prevents misunderstandings and potential legal headaches down the line.

What Exactly is a Bill of Sale for Business Assets?

At its core, a bill of sale for business assets is a legal document that records the transfer of ownership of specific items from one party to another. Unlike selling an entire company, which might involve stock transfers or complex merger agreements, a business asset bill of sale specifically deals with individual or groups of tangible and intangible assets. Think of it as the formal handshake that puts the details of your agreement down on paper, making it legally binding.

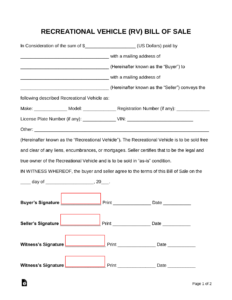

The primary purpose of this document is to clearly identify the assets being sold and to confirm that the seller has the right to sell them, and that the buyer is receiving them free and clear of any encumbrances. For the seller, it serves as proof that they no longer own the assets and are absolved of future responsibilities related to them. For the buyer, it establishes clear title and ownership, allowing them to fully utilize their newly acquired property without dispute.

Without a properly executed bill of sale, establishing proof of ownership can become incredibly difficult. Imagine acquiring a fleet of vehicles or a valuable patent without clear documentation; you could run into issues with registration, insurance, or even future resale. This document is your shield against such complications, providing a clear legal trail for all parties involved and for any future auditors or authorities.

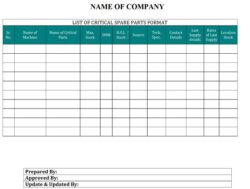

It typically covers a wide range of assets, from physical inventory, machinery, and equipment to intellectual property like trademarks, copyrights, and customer lists. Even goodwill can be included if it’s considered part of the asset sale. The more detailed and specific the description of these assets, the better, as it leaves no room for ambiguity about what exactly is being transferred in the transaction.

Key Elements to Include

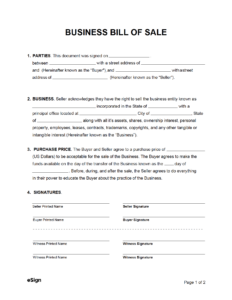

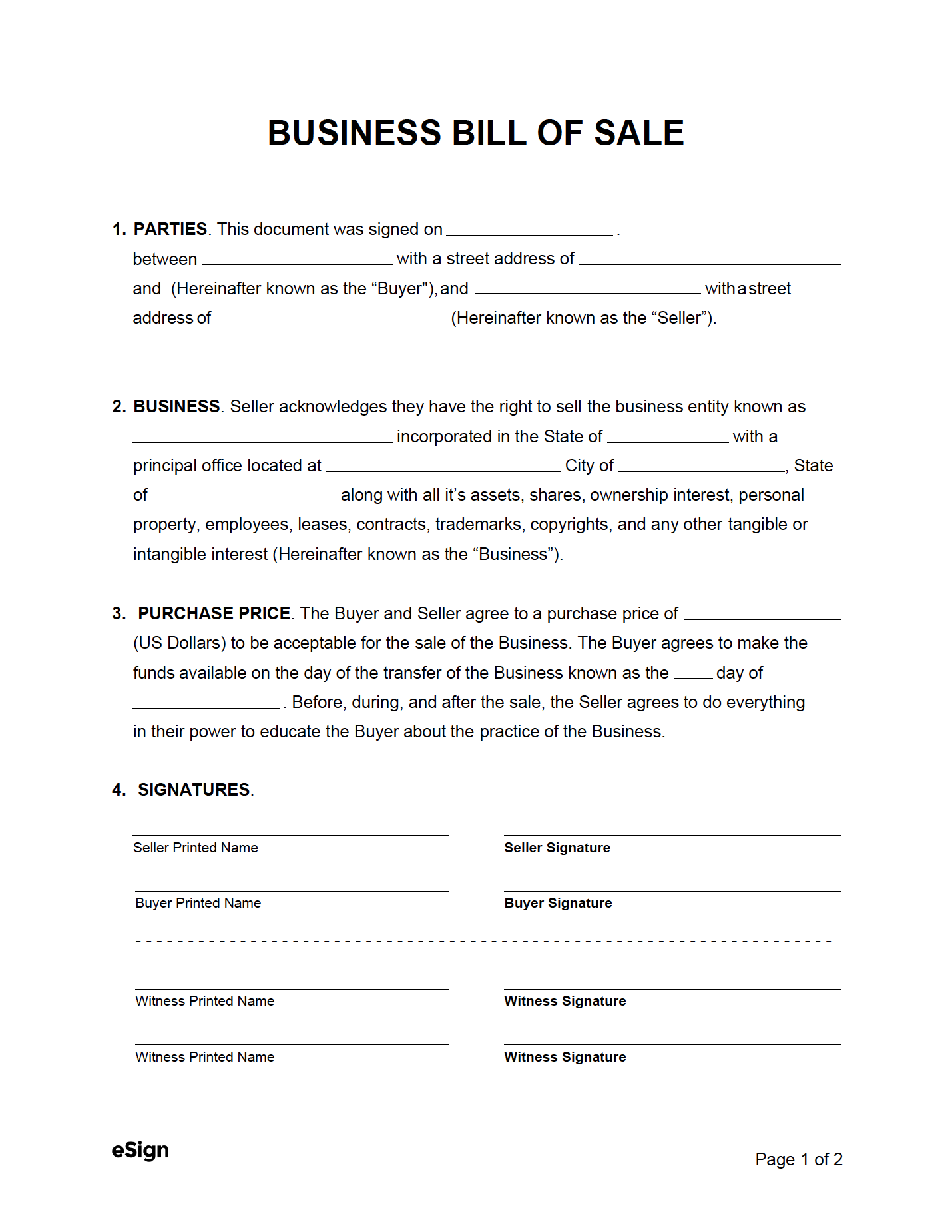

To be effective and legally sound, a bill of sale for business assets must contain several critical pieces of information. Omitting even one could jeopardize its validity or lead to future disputes. It’s about ensuring clarity, transparency, and completeness in every aspect of the transfer.

The essentials generally include:

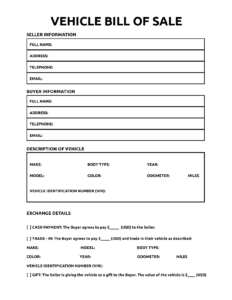

- Full legal names and addresses of both the buyer and the seller.

- A precise and detailed description of each asset being transferred. This might involve serial numbers, model numbers, intellectual property registration numbers, or even comprehensive lists of inventory.

- The agreed-upon purchase price and the terms of payment, including any deposits, installments, or payment schedules.

- The date of the transaction and the effective date of transfer.

- A statement confirming that the seller owns the assets and has the legal right to sell them, free of any liens or encumbrances.

- Signatures of both the buyer and the seller, and often, the signature of a witness or a notary public to further validate the document.

- Any specific warranties or disclaimers related to the assets, such as “as-is” clauses.

Why You Need a Robust Bill of Sale Business Assets Template

Using a professionally prepared bill of sale business assets template isn’t just a suggestion; it’s a strategic move that saves time, reduces risk, and ensures compliance. Trying to draft such a complex legal document from scratch can be overwhelming, especially if you’re not familiar with legal jargon or the specific requirements for asset transfers in your jurisdiction. A template provides a solid foundation, ensuring you don’t miss any critical clauses or necessary information.

Templates are designed with best practices in mind, incorporating standard legal language that has been vetted over time. This means you’re starting with a document that already addresses common scenarios and protects the interests of both parties. It helps streamline the closing process significantly, as you simply need to fill in the blanks with your specific transaction details rather than spending hours researching and drafting.

Furthermore, a good template acts as a comprehensive checklist. It prompts you to include all the essential elements, from detailed asset descriptions to payment terms and disclaimers. This structured approach minimizes the chances of oversight, which could otherwise lead to costly legal battles or complications down the road. Both buyer and seller benefit from the clarity and certainty that a well-crafted document provides.

For the buyer, a robust template ensures they receive clear title and that all necessary disclosures are made by the seller. For the seller, it provides definitive proof that ownership has been transferred and limits their future liability regarding the assets. It’s a foundational document for record-keeping and tax purposes, and it can be invaluable if any disputes arise after the sale is complete.

Ultimately, opting for a comprehensive bill of sale business assets template gives you peace of mind. It transforms a potentially stressful and complicated legal formality into a manageable task. By leveraging a reliable template, you ensure that your asset transfer is conducted professionally, legally, and without unnecessary hassle, safeguarding your interests and setting the stage for a successful transaction.