Navigating the complex landscape of regulatory compliance can feel like a daunting task for any business. One area that stands out as critically important is Know Your Customer (KYC). Having a robust know your customer checklist template isn’t just about meeting legal obligations; it’s about safeguarding your business from financial crime, fraud, and reputational damage. It provides a structured approach to understanding who your customers truly are, ensuring you’re not inadvertently facilitating illicit activities.

The core principle behind KYC is straightforward: verify the identity of your clients and assess their potential risks. This process helps prevent money laundering, terrorist financing, and other illegal financial activities. Without a clear, documented system, businesses risk significant fines, legal penalties, and severe harm to their brand’s trustworthiness, which can be incredibly difficult to rebuild.

This article will delve into the essential components that make up an effective KYC checklist, exploring how you can tailor it to your specific industry needs. We’ll also cover best practices for implementation, ensuring your business not only meets its compliance duties but also fosters a secure and transparent environment for all stakeholders.

What Goes Into a Comprehensive KYC Checklist?

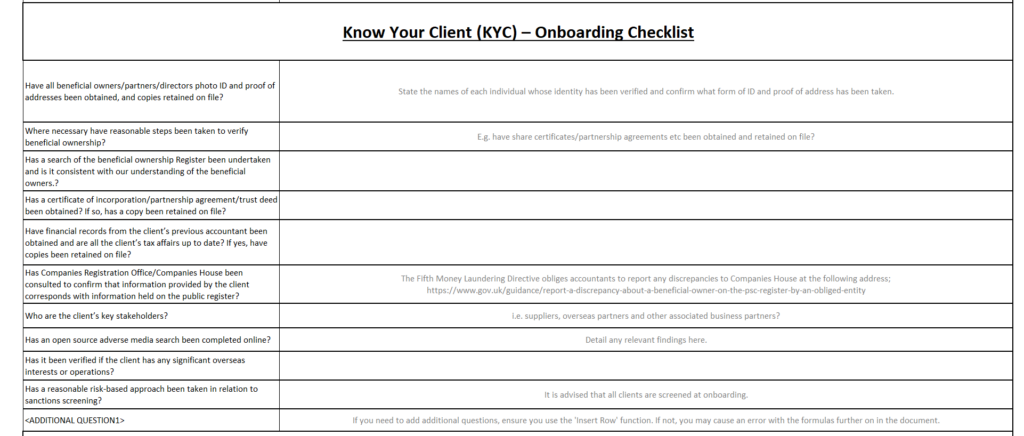

Building a truly effective KYC checklist requires more than just ticking boxes; it demands a deep understanding of various risk factors and regulatory requirements. At its heart, a comprehensive checklist begins with robust identity verification. This is the bedrock upon which all other KYC processes are built, ensuring that the individual or entity you’re dealing with is who they claim to be. It typically involves collecting specific personal or corporate data and then cross-referencing it with reliable, independent sources.

Customer Identification Program (CIP)

The initial phase often falls under the Customer Identification Program (CIP). This section of your know your customer checklist template should detail the exact information required from each new customer. For individuals, this typically includes their full legal name, date of birth, residential address, and a unique identification number like a national ID card, passport number, or social security number. For corporate clients, you’ll need the legal entity name, business address, tax identification number, and details of beneficial owners, including their names and ownership percentages.

Beyond collecting data, the CIP also dictates the methods for verifying this information. This might involve checking government-issued IDs against official databases, reviewing utility bills to confirm addresses, or cross-referencing company registration details with public registries. The goal is to establish a reasonable belief that you know the true identity of your customer.

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

Once identity is verified, the next crucial step is Customer Due Diligence (CDD). This involves understanding the nature and purpose of the business relationship. Your checklist should guide you in assessing the customer’s risk profile, considering factors such as their occupation, source of funds, expected transaction volume, and geographic location. High-risk jurisdictions or industries, for instance, naturally warrant closer scrutiny. This helps categorize customers into different risk tiers, influencing the level of ongoing monitoring required.

For customers identified as high-risk, an Enhanced Due Diligence (EDD) process becomes necessary. This goes deeper than standard CDD, requiring more extensive information gathering and verification. It might involve conducting adverse media searches, scrutinizing complex ownership structures, or delving into the backgrounds of politically exposed persons (PEPs) and their associates. The checklist for EDD should outline specific additional steps and approvals needed to onboard and maintain relationships with these higher-risk entities.

Ongoing Monitoring and Record Keeping

A static KYC process is insufficient in today’s dynamic environment. Your template must include provisions for ongoing monitoring. This involves continuously reviewing customer activity for suspicious patterns or changes in risk profile, as well as periodically updating customer information. Regular reviews ensure that the risk assessment remains accurate and that any red flags are promptly identified and investigated. Finally, a robust record-keeping section is vital, detailing how and for how long all KYC documentation and analysis will be stored, complying with regulatory retention periods.

Implementing Your KYC Checklist Template Effectively

Having a well-designed know your customer checklist template is only half the battle; its effective implementation is what truly makes a difference. This involves integrating the checklist seamlessly into your operational workflows and ensuring that all relevant staff are thoroughly trained. A successful implementation strategy focuses on clarity, consistency, and continuous improvement, making compliance a routine part of doing business rather than an occasional burden.

Staff training is paramount. Every employee who interacts with customers or processes their information needs to understand their role in the KYC process. This includes recognizing red flags, knowing when to escalate an issue, and being proficient in using the tools and systems that support your KYC efforts. Regular training sessions and clear procedural guides can significantly reduce errors and improve overall compliance rates.

Leveraging technology can also streamline your KYC processes considerably. Automated solutions for identity verification, sanctions screening, and transaction monitoring can enhance accuracy, reduce manual workload, and speed up customer onboarding. Integrating these tools with your checklist ensures a more efficient and reliable compliance framework. Remember, technology should augment human oversight, not replace it entirely.

- Regularly review and update your KYC checklist to reflect changes in regulations, business practices, and emerging risks.

- Ensure clear lines of responsibility for different aspects of the KYC process.

- Foster a culture of compliance within your organization, emphasizing its importance beyond just avoiding penalties.

- Document every step of your KYC procedures and decisions, creating an audit trail for regulatory scrutiny.

By meticulously applying your KYC framework, businesses can significantly reduce their exposure to financial crime and maintain a pristine reputation. It’s an investment in long-term security and integrity, building trust with customers and regulators alike. A proactive approach not only keeps you compliant but positions your business as a responsible and reliable entity in the marketplace.

Ultimately, a diligent and adaptive KYC program ensures that your operations remain resilient against evolving threats. It empowers you to build stronger, more transparent relationships with your clients, fostering an environment of trust and secure transactions that benefits everyone involved.