Navigating the waters of commercial real estate transactions can often feel like orchestrating a symphony with countless moving parts. From initial negotiations to the final handshake, each step demands meticulous attention and a deep understanding of legal, financial, and practical considerations. The sheer volume of documents, deadlines, and parties involved means that even the most seasoned professionals can find themselves needing a clear, systematic approach to ensure nothing falls through the cracks. This complexity underscores why preparation is not just important, but absolutely essential for a successful outcome.

This is precisely where the value of a well-structured commercial real estate closing checklist template becomes immeasurable. It serves as your comprehensive roadmap, guiding you through the intricate journey of a commercial property acquisition or sale. By providing a clear framework, it helps to demystify the process, ensuring that every detail, no matter how small, is accounted for. Such a tool transforms potential chaos into a manageable sequence of tasks, allowing all parties to proceed with confidence and clarity, ultimately leading to a smooth and timely closing.

Navigating the Pre-Closing Phase with Precision

The period leading up to the actual closing day for a commercial property is arguably the most critical stage of the entire transaction. This is where the bulk of due diligence, legal reviews, and financial arrangements are solidified. A proactive and organized approach during this phase can prevent costly delays, unexpected issues, and even the collapse of a deal. Understanding and meticulously executing each step here lays the groundwork for a successful and seamless transition of ownership. It is an intensive period requiring collaboration among various professionals, from attorneys and lenders to environmental consultants and surveyors, all working towards a common goal.

Due diligence is the cornerstone of this pre-closing activity, representing the buyer’s rigorous investigation into all aspects of the property and the transaction. This involves scrutinizing financial records, lease agreements, environmental reports, and structural assessments to uncover any potential liabilities or hidden costs. Its purpose is to allow the buyer to make an informed decision and to ensure that the property meets their investment objectives, free from undesirable surprises. A thorough due diligence process empowers the buyer with comprehensive knowledge, enabling them to negotiate any necessary adjustments to the purchase agreement or, if warranted, to withdraw from the deal before incurring further expense.

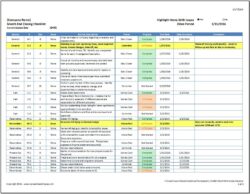

Key Due Diligence Items to Review:

When you’re sifting through the details, here’s a concise list of documents and reports that are typically part of a robust due diligence process:

- Review of Leases and Rent Rolls

- Environmental Site Assessment (Phase I & II)

- Property Surveys and Zoning Reports

- Title Commitment and Underlying Documents

- Financial Statements and Operating Expenses

- Service Contracts and Maintenance Records

- Building Inspections and Engineering Reports

Beyond the extensive due diligence, securing financing and engaging legal counsel are paramount. Lenders will conduct their own appraisals and underwriting processes, requiring a substantial amount of financial documentation from the buyer. Simultaneously, your attorney will review the purchase agreement, title commitment, and all other legal documents to protect your interests, ensuring that the terms are fair and legally sound. This includes identifying and resolving any title defects, lien issues, or other encumbrances that could cloud the property’s ownership.

Moreover, during this pre-closing stage, all contingencies outlined in the purchase agreement must be satisfied. This might include obtaining specific permits, completing necessary repairs, or securing tenant estoppels. Each of these conditions serves as a crucial hurdle that needs to be cleared before the transaction can progress to closing. Effective communication and proactive management of these contingencies are vital to keep the deal on track, requiring regular updates and coordination among all parties involved to avoid any last-minute snags.

Finally, preparation for closing involves the careful review of the closing statement, often known as a HUD-1 or Closing Disclosure, which itemizes all credits and debits for both the buyer and seller. This document must be meticulously checked for accuracy before funds are transferred. Simultaneously, all necessary insurance policies must be secured and activated by the closing date, providing protection against unforeseen events immediately upon taking ownership. This comprehensive pre-closing strategy is what ultimately leads to confidence and control on the day of closing.

Executing the Closing and Post-Closing Essentials

The closing day itself marks the culmination of all the intensive efforts undertaken during the pre-closing phase. It is the moment when ownership officially transfers from the seller to the buyer, facilitated by the signing of numerous legal documents and the exchange of funds. While much of the heavy lifting has already been done, closing day still requires attention to detail and a clear understanding of the final steps. This pivotal day confirms that all agreements have been met, all conditions satisfied, and all financial obligations accounted for, bringing the complex transaction to its much-anticipated conclusion.

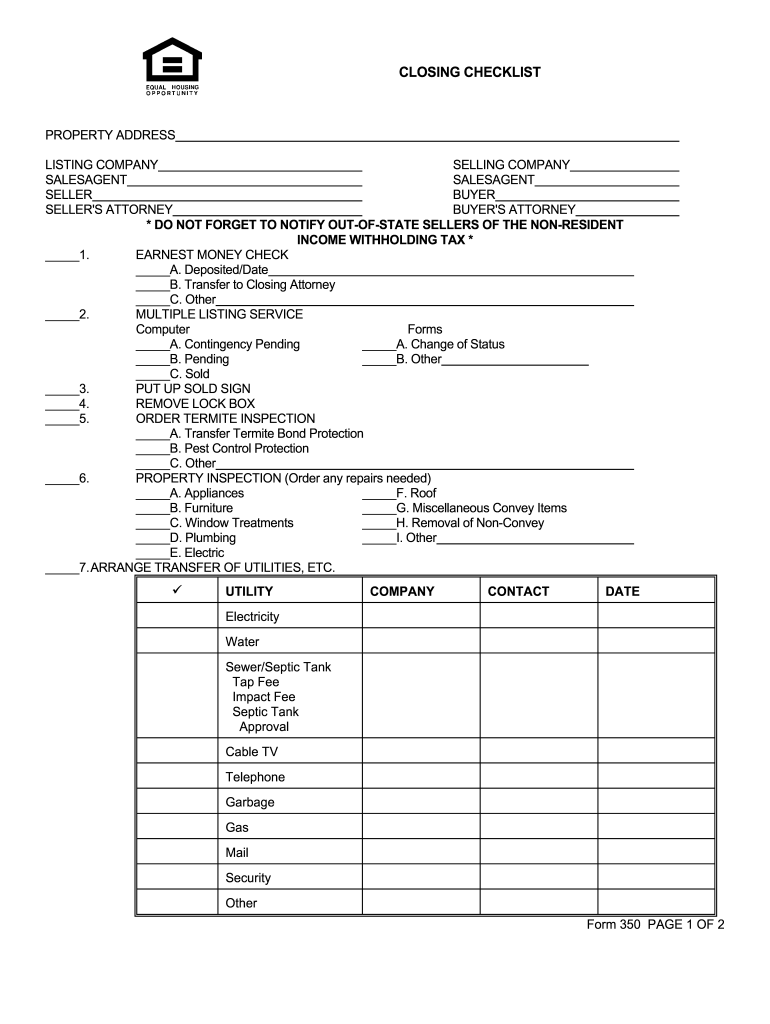

At the closing table, you will be reviewing and signing a multitude of critical documents. These typically include the deed, which legally transfers ownership of the property; the promissory note and deed of trust or mortgage, if financing is involved, which formalize the loan terms; and the final closing statement, detailing all financial aspects of the transaction. The closing agent or attorney plays a crucial role here, explaining each document and ensuring that all signatures are properly executed and witnessed. It is a moment of significant legal formality, ensuring that the transfer of property is conducted according to all applicable laws and regulations.

On the big day, you’ll be signing a lot of papers, but here are some of the most critical documents and actions:

- Finalizing the Deed of Trust or Mortgage

- Signing the Promissory Note

- Reviewing and Approving the Closing Disclosure (CD) or HUD-1

- Transferring Funds and Recording Documents

- Receiving Keys and Access Codes

However, the successful completion of a commercial real estate transaction doesn’t truly end with the signing of documents and the transfer of keys. The post-closing phase is equally important for a seamless transition and effective property management. This includes ensuring that the deed and mortgage documents are promptly recorded with the appropriate government authorities, formally updating public records to reflect the new ownership. Overlooking these administrative steps can lead to future complications and invalidate the legal transfer. It’s about securing your investment beyond the immediate transaction.

Furthermore, post-closing responsibilities extend to practical aspects of property management. This involves notifying existing tenants of the change in ownership, setting up new utility accounts, transferring service contracts, and establishing new property management agreements if applicable. A well-organized transition plan ensures minimal disruption to ongoing operations and maintains positive relationships with tenants and service providers. Taking these post-closing steps seriously helps to protect your investment and ensures that the commercial property begins generating revenue and operating smoothly under its new stewardship from day one.

Completing a commercial real estate transaction is a significant undertaking, requiring unwavering attention to detail and a systematic approach. The journey from initial interest to final ownership is paved with complex legal documents, intricate financial arrangements, and critical due diligence processes. By meticulously addressing each stage, from thoroughly vetting the property to carefully executing the closing documents, you transform a potentially daunting challenge into a manageable and successful endeavor. This disciplined process not only mitigates risks but also maximizes the potential return on your investment.

Ultimately, the key to navigating these sophisticated deals lies in preparation, organization, and the judicious use of tools designed to streamline the process. A robust commercial real estate closing checklist template becomes an indispensable asset, serving as your reliable guide to ensure no critical step is overlooked. With such a comprehensive framework in place, you can approach each transaction with confidence, securing your commercial real estate investments with precision and efficiency, and setting the stage for future growth and profitability.