When you’re buying or selling something valuable, whether it’s a vehicle, a boat, or even significant personal property, having proper documentation is absolutely essential. It’s not just about shaking hands and exchanging money; it’s about creating a clear, legal record that protects both the buyer and the seller. This is where a bill of sale comes into play, acting as a crucial piece of paper that formalizes the transfer of ownership.

In the Lone Star State, understanding the specifics of these transactions can save you a lot of hassle down the road. A well-prepared bill of sale ensures that all parties are on the same page regarding the terms of the sale, the condition of the item, and the final price. For anyone dealing with property transfers in Texas, finding a reliable tx bill of sale template is often the first step towards a smooth and legally sound transaction.

Why You Absolutely Need a Texas Bill of Sale (and Where a Template Comes In Handy)

A bill of sale serves as a legally binding document that proves the transfer of ownership from one party to another. For the seller, it provides evidence that they no longer own the item, potentially shielding them from liability after the sale. For the buyer, it’s proof of purchase and ownership, which is vital for registration, insurance, or in case of any future disputes. Without it, verifying who owns what can become a tangled mess, especially if the item is involved in an accident or a legal claim arises.

Think about selling an old car or even a valuable antique. If you don’t have a record showing you sold it, you could theoretically still be considered responsible for it. Similarly, if you buy something and don’t have proof of purchase, proving it belongs to you later could be incredibly difficult. This document eliminates guesswork and provides a clear audit trail for the transaction, making it invaluable for peace of mind.

Key Elements to Look For in Your tx bill of sale template

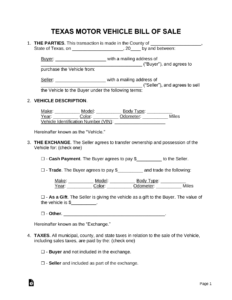

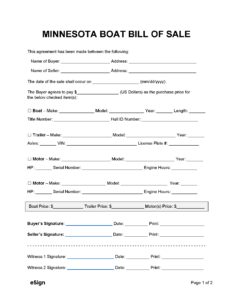

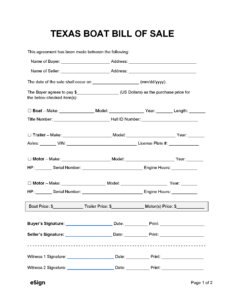

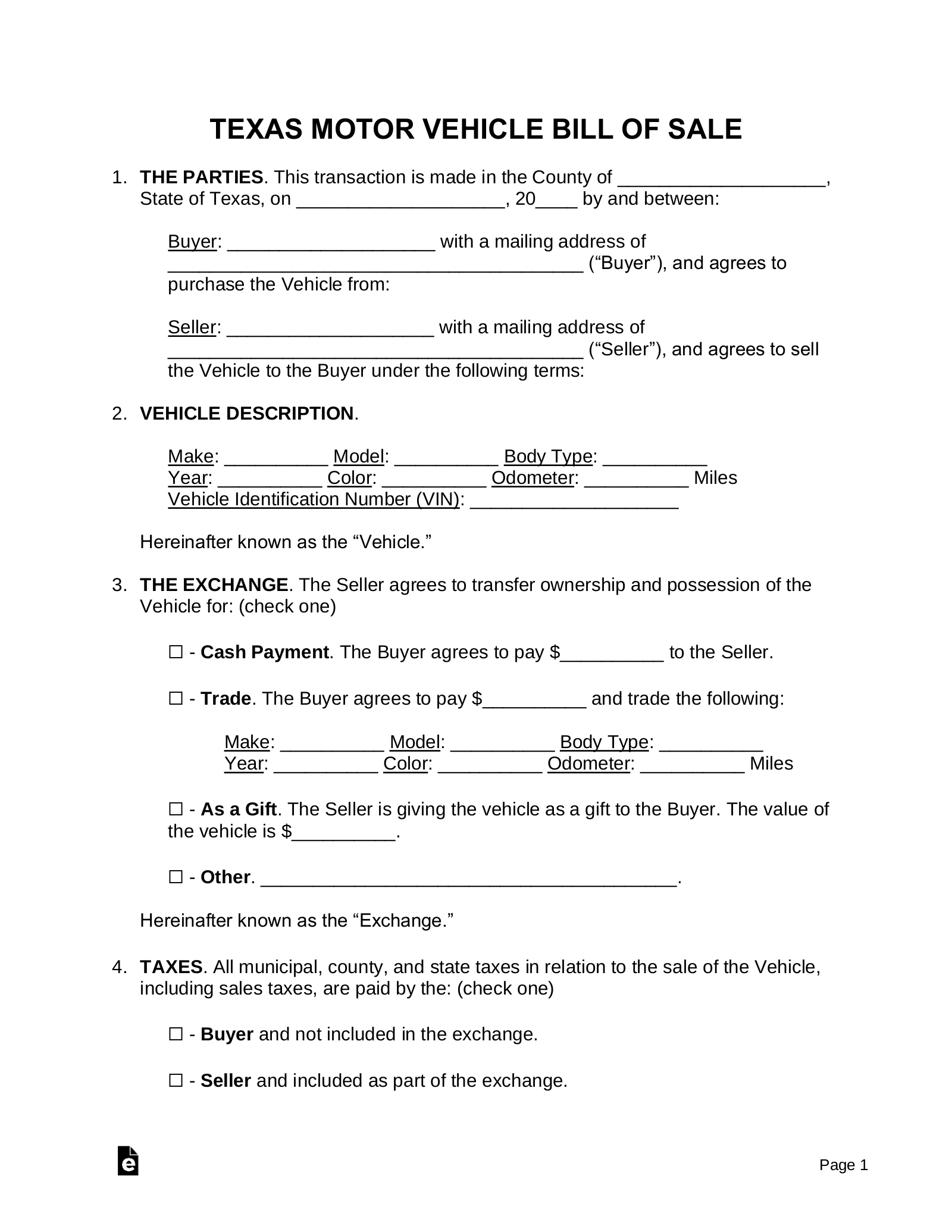

A good tx bill of sale template will guide you through all the necessary fields, ensuring no critical information is missed. It’s more than just a receipt; it’s a detailed account of the transaction. Taking the time to fill out each section completely and accurately is paramount for its legal strength.

- Seller and Buyer Information: Full legal names, addresses, and contact details for both parties. This clearly identifies who is selling and who is buying.

- Item Description: A detailed description of the property being sold. For vehicles, this includes make, model, year, Vehicle Identification Number (VIN), odometer reading, and license plate number. For other items, specific identifiers like serial numbers or unique characteristics are important.

- Purchase Price and Payment Method: The agreed-upon sale price and how the payment was made (e.g., cash, check, money order).

- Date of Sale: The exact date the ownership transfer occurred.

- Signatures of Both Parties: The signatures of the seller(s) and buyer(s), indicating their agreement to the terms.

- Warranty Disclaimer: Often, a "sold as-is" clause is included, meaning the buyer accepts the item in its current condition with no implied warranties from the seller. This is very common for private sales and protects the seller from future claims about the item’s condition.

Using a pre-designed tx bill of sale template not only saves you time but also helps ensure that all these essential details are captured. It acts as a comprehensive checklist, reducing the chance of overlooking a critical piece of information that could complicate things later.

Navigating the Process: Tips for Using Your Bill of Sale Effectively

Once you have your bill of sale template, the next step is to fill it out and execute it properly. Accuracy is key here. Double-check all names, addresses, item descriptions, and numerical figures. Any discrepancies could weaken the document’s legal standing. It’s a good idea to complete the form in a clear, legible manner, preferably by typing or printing neatly.

After all the information is entered, both the buyer and the seller should sign the document. It’s highly recommended that each party receive an original signed copy for their records. Keeping a copy means you always have proof of the transaction readily available, which can be crucial for tax purposes, vehicle registration, or in the event of any disputes that might arise. Don’t rely on just one copy; make sure everyone walks away with their own.

While not always legally required for a simple bill of sale in Texas, having the document notarized can add an extra layer of authenticity and legal weight, especially for high-value items or complex transactions. A notary public verifies the identity of the signers, ensuring that the signatures are genuine. This step can provide additional peace of mind for both parties involved.

- Double-check all information before signing: Ensure accuracy in names, addresses, item details, and the agreed price.

- Make multiple copies for all parties involved: Each person should walk away with a signed original for their records.

- Consider a witness or notarization for high-value items: This adds an extra layer of verification and legal strength.

- Understand "as-is" clauses: Ensure both parties clearly understand if the item is being sold without a warranty.

Ultimately, a properly completed and executed bill of sale is more than just paperwork; it’s a cornerstone of a transparent and secure transaction. It protects the rights and interests of both the buyer and the seller, documenting the transfer of ownership clearly and concisely.

Taking the time to utilize a proper bill of sale for your personal property transactions is a smart move that offers significant benefits. It provides clarity, legal protection, and peace of mind for both the person selling and the person buying. This simple document can prevent future misunderstandings and ensure that the transfer of ownership is undisputed.

Whether you’re selling a car, a piece of equipment, or any other valuable item, having a detailed record of the sale makes the process smoother and more secure. It’s a foundational step that underscores professionalism and helps avoid any potential headaches down the road, ensuring all parties are well-protected and the transaction is legally sound.