Diving into the world of buying or selling a business can be incredibly exciting, but it often comes with a heap of paperwork and legal considerations. It’s a big step, whether you’re passing on your legacy or taking over a new venture, and ensuring everything is properly documented is paramount. Just like buying a car, a business transaction needs clear, undeniable proof of ownership transfer to protect everyone involved.

That’s where a reliable business bill of sale template comes into play. It’s more than just a receipt; it’s a legally binding document that formally records the transfer of ownership of a business and its assets from one party to another. Having a comprehensive template simplifies this complex process, ensuring that all crucial details are covered and that both the buyer and seller are protected from future disputes or misunderstandings.

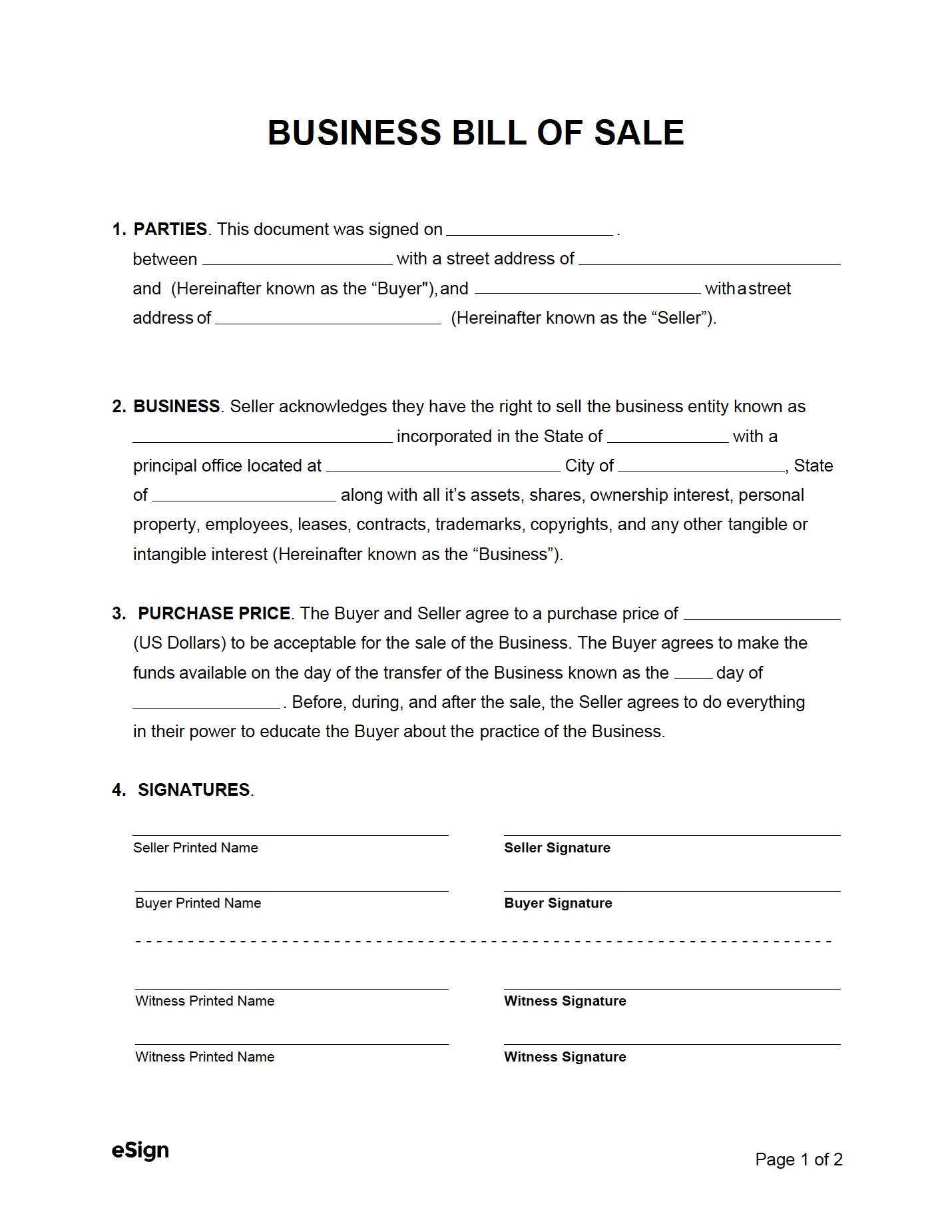

What Exactly is a Business Bill of Sale?

At its core, a business bill of sale is a legal document that serves as proof of purchase and sale for an entire business or a substantial part of its assets. Think of it as the final handshake in writing, confirming that the ownership has officially changed hands. It’s not just about the monetary transaction; it’s about formalizing the transfer of everything from intellectual property to physical equipment and even customer lists.

This document is incredibly important because it provides a clear, verifiable record of the transaction. Without it, you might find yourself in a sticky situation, lacking proof of ownership or facing disagreements about what was or wasn’t included in the sale. It solidifies the terms and conditions agreed upon by both parties, providing a reference point should any questions arise down the line.

While the exact contents can vary depending on the nature and size of the business, a good business bill of sale template typically covers several key components. It identifies the buyer and seller, describes the business and its assets being sold, specifies the purchase price and payment terms, and includes any warranties or representations made by the seller. It’s designed to leave no room for ambiguity about the transaction.

Customizing a general template to fit the specific nuances of your business sale is always a smart move. Every business is unique, with its own set of assets, liabilities, and operational intricacies. A generic form might miss critical details pertinent to your specific situation, which could lead to complications later on. Therefore, a comprehensive template should be seen as a starting point, to be tailored with precision.

Key Elements to Look For in Your Business Bill of Sale Template

- Identification of Parties: Full legal names and addresses of both the buyer and seller.

- Description of Business and Assets: A detailed list of everything being transferred, including business name, inventory, equipment, furniture, trade names, goodwill, customer lists, websites, social media accounts, and any intellectual property.

- Purchase Price and Payment Terms: The agreed-upon sale price and how it will be paid (e.g., lump sum, installments, financing details).

- Date of Sale: The official date the ownership transfer takes effect.

- Warranties and Representations: Any promises or guarantees made by the seller about the condition of the business or its assets.

- Governing Law: The state or jurisdiction whose laws will govern the agreement.

- Signatures: Legally binding signatures of all parties involved, often with witness signatures or notarization.

Why You Can’t Afford to Skip This Important Document

Ignoring the necessity of a proper bill of sale when acquiring or divesting a business can lead to significant headaches and financial losses down the road. This document serves as a crucial layer of protection for both the buyer and the seller, ensuring that the transaction is clear, legally sound, and dispute-free. It’s not just about meeting legal requirements; it’s about securing peace of mind.

For the buyer, having a detailed business bill of sale template means clear proof of ownership for all acquired assets. This is vital for tax purposes, insurance claims, and demonstrating legal ownership to third parties. Without it, verifying what you own, or that you even own it, could become a complicated and time-consuming ordeal. It protects your investment and provides a solid foundation for your new venture.

On the seller’s side, this document offers definitive proof that the business and its associated liabilities have been transferred. It helps in separating yourself from the business’s future operations and financial responsibilities, preventing any lingering claims or obligations. It’s your official record that you’ve completed the sale, releasing you from future responsibilities related to the sold entity.

Moreover, a well-drafted business bill of sale minimizes the potential for future disputes. By clearly outlining what is included in the sale, the conditions of the sale, and any warranties, it leaves little room for misinterpretation. This clarity can save both parties from expensive legal battles and prolonged disagreements, allowing everyone to move forward with confidence and a clear understanding of the transaction.

Securing a comprehensive bill of sale is a non-negotiable step in any business transfer. It solidifies the terms of the agreement, protects both parties legally, and provides a clear audit trail for financial and tax purposes. Without it, you are essentially engaging in a major transaction without a safety net, leaving yourself vulnerable to unforeseen complications.

Ultimately, whether you’re a seasoned entrepreneur or taking your first plunge into business ownership, understanding and utilizing a robust business bill of sale is essential. It’s the final, formal step that encapsulates the entire agreement, offering clarity and protection. Don’t view it as mere bureaucracy, but rather as an invaluable safeguard for one of the most significant transactions you’ll undertake.

Taking the time to ensure this document is accurate, thorough, and tailored to your specific situation will undoubtedly save you time, money, and potential frustration in the long run. It’s an investment in peace of mind, allowing both buyer and seller to confidently embark on their next chapter, knowing that their business transaction is legally sound and fully documented.