When you’re buying or selling a vehicle in the Land of Lincoln, one document stands above the rest in terms of importance for a smooth, legally sound transaction: the bill of sale. It’s not just a receipt; it’s a critical legal record that protects both the buyer and the seller from potential disputes down the road. Without it, you could face unexpected headaches, from proving ownership to dealing with liability issues.

This document acts as undeniable proof of the transfer of ownership, detailing the terms of the sale and crucial information about the vehicle and the parties involved. For Illinois residents, having a reliable auto bill of sale template Illinois at your fingertips can save you a lot of time, confusion, and potential legal woes, ensuring that your vehicle transaction is as straightforward and secure as possible.

Why You Absolutely Need an Auto Bill of Sale in Illinois

Imagine you’ve just sold your car, and a few weeks later, you receive a parking ticket or even a notice about an accident involving the vehicle. Without a clear bill of sale, proving that you no longer own the car could be an uphill battle, potentially leaving you liable for incidents that occurred post-sale. This document provides clear, dated evidence of the ownership transfer, effectively cutting off your liability from the moment the transaction is complete. It’s your legal shield, protecting you from unforeseen circumstances.

For buyers, the bill of sale is equally vital. It serves as proof of purchase, which is essential for registering the vehicle with the Illinois Secretary of State (SOS) and obtaining a new title in your name. Without it, you might find yourself unable to legally register your new vehicle, leading to significant delays and frustration. It also confirms the agreed-upon price, mileage, and condition of the vehicle at the time of sale, preventing any disputes regarding the terms of the deal.

Furthermore, a properly executed bill of sale helps in calculating sales tax, which is mandatory in Illinois for vehicle purchases. The sale price stated on the bill of sale is typically what the state uses to determine the amount of sales tax due. An inaccurate or missing bill of sale could lead to incorrect tax calculations or, worse, accusations of tax evasion, even if unintentional. It brings transparency to the financial aspect of the transaction.

Beyond legal and tax implications, a comprehensive bill of sale offers peace of mind. Both parties know exactly what was agreed upon, reducing the likelihood of misunderstandings or future disagreements. It acts as a detailed contract, ensuring that both the buyer and seller fulfill their respective obligations and understand their rights regarding the vehicle sale.

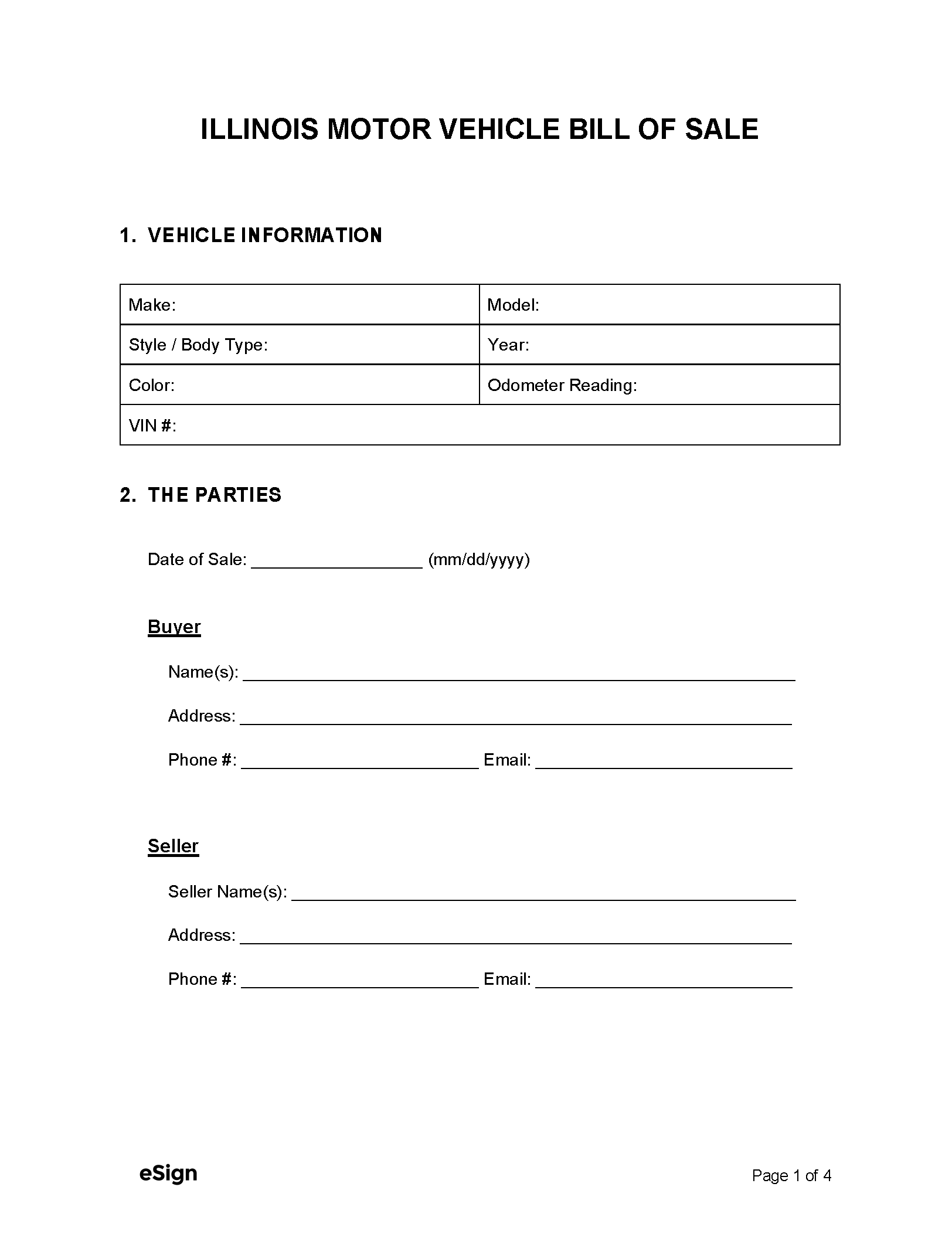

Key Information to Include in Your Illinois Bill of Sale

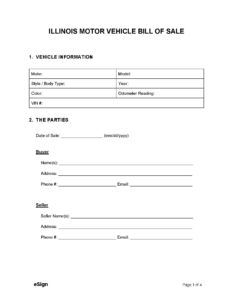

- Full names and addresses of both the seller and the buyer.

- The exact date of the transaction.

- Detailed vehicle information, including make, model, year, color, and Vehicle Identification Number (VIN).

- The current odometer reading at the time of sale.

- The agreed-upon purchase price of the vehicle.

- A statement indicating whether the vehicle is being sold “as-is” or with a warranty (though “as-is” is common for private sales).

- Signatures of both the seller and the buyer. While notarization is not always required by Illinois law for a bill of sale, it can add an extra layer of authenticity and is often recommended for high-value transactions.

How to Properly Use Your Auto Bill of Sale Template Illinois

Once you have your auto bill of sale template Illinois ready, the next crucial step is filling it out accurately and completely. Take your time to meticulously enter all the required information. Double-check everything from the spelling of names to the VIN to ensure there are no errors that could invalidate the document or cause issues later. Any discrepancies, no matter how minor, can lead to complications with the Secretary of State or in potential legal disputes. Precision here is paramount for a smooth transfer.

Before any signatures are made, both the buyer and the seller should thoroughly review the entire document. This ensures that all terms, conditions, and details about the vehicle and the transaction are mutually understood and agreed upon. It’s an opportunity for either party to ask questions or clarify any points before committing to the sale. Consider this a final check-in, where both parties confirm their understanding and consent to the outlined terms.

After all details are confirmed and both parties are satisfied, it’s time for the signatures. Ensure that both the buyer and seller sign the document clearly and legibly. It’s highly advisable that each party receives an original signed copy of the bill of sale for their records. The seller will need it to demonstrate they’ve relinquished ownership, while the buyer will need it for registration and title transfer purposes with the Illinois SOS. Keeping these records is vital for future reference or in case any issues arise.

To further ensure a seamless transaction, consider meeting in a public or safe location, such as a bank or a police station, especially if you are meeting someone you don’t know. Discuss payment methods beforehand to avoid any surprises; cash, cashier’s check, or electronic bank transfers are generally preferred for security. Before the sale is finalized, the buyer should ideally conduct a thorough inspection of the vehicle, perhaps even having a mechanic look it over. This ensures the buyer is fully aware of the vehicle’s condition before committing, minimizing disputes after the sale.

Important Considerations for Your Vehicle Sale

- Always verify the identity of the person you are transacting with by checking a valid photo ID.

- For payment, avoid personal checks that can bounce. Secure options like certified checks or a direct bank transfer are much safer.

- While not always legally required for a bill of sale in Illinois, having the document notarized can provide an extra layer of legal validity, especially for higher-value vehicles.

- As the seller, remember to remove your license plates from the vehicle. Illinois law requires that plates stay with the seller, not the vehicle.

- The seller should also notify the Illinois Secretary of State of the sale within 20 days using a Notice of Sale form, which helps prevent liability for the vehicle after it’s sold.

Using a properly prepared and completed bill of sale for your vehicle transaction in Illinois isn’t just a good idea; it’s a fundamental step toward protecting yourself legally and ensuring a trouble-free experience. This simple document can prevent future headaches, streamline the transfer of ownership, and provide clear evidence of the agreement between buyer and seller.

Taking the time to utilize a suitable template and fill it out correctly ensures that both parties are clear on the terms, reducing the likelihood of disputes. It’s an essential part of the process, guaranteeing that your vehicle transaction, whether buying or selling, is finalized with confidence and full compliance with Illinois state requirements.