When you buy or sell a car, especially in a state like Massachusetts, there’s more to it than just handing over keys and cash. A crucial document that often gets overlooked, yet provides immense protection and clarity for both parties, is the bill of sale. It’s not just a receipt; it’s a legal record of the transaction that can save you a lot of headaches down the road.

Understanding the components and proper execution of this document is vital for a smooth and legally sound vehicle transfer. Whether you’re a first-time seller or a seasoned car buyer, knowing how to correctly utilize a bill of sale ensures that all aspects of the sale are transparent and officially recorded.

Why You Absolutely Need a Bill of Sale in Massachusetts

When it comes to buying or selling a vehicle in the Bay State, the importance of a properly executed bill of sale cannot be overstated. This document serves as a legally binding contract that details the terms of the transaction between the buyer and the seller. It’s not merely a formality; it’s a vital piece of evidence that can protect both parties from future disputes or misunderstandings. Without it, proving ownership transfer, the sale price, or even the date of the transaction can become incredibly difficult.

A comprehensive bill of sale offers significant legal protection. For the seller, it clearly indicates that ownership of the vehicle has been transferred, thereby absolving them of responsibility for the car once it leaves their possession. This is critical for avoiding liability for any accidents, parking tickets, or other incidents that might occur after the sale. For the buyer, it serves as undeniable proof of purchase and a clear record of the vehicle’s condition at the time of sale, protecting them from claims of non-payment or disputes over the agreed-upon price. It is also a necessary document for vehicle registration and title transfer with the Massachusetts Registry of Motor Vehicles (RMV).

Beyond proving ownership and protecting against liability, a bill of sale is essential for tax purposes. In Massachusetts, sales tax is typically assessed on the purchase price of the vehicle, and the bill of sale provides the official record of that price for the RMV and tax authorities. An accurate and detailed document ensures you pay the correct amount of sales tax and avoids potential audits or discrepancies later on. It truly streamlines the administrative side of a vehicle transaction, making the process much smoother for everyone involved.

Moreover, a well-drafted bill of sale includes specific details that are crucial for a clear and undisputed transaction. It’s more than just a simple receipt; it’s a comprehensive record. Utilizing a robust bill of sale for car Massachusetts template ensures you cover all your bases, providing peace of mind and legal compliance.

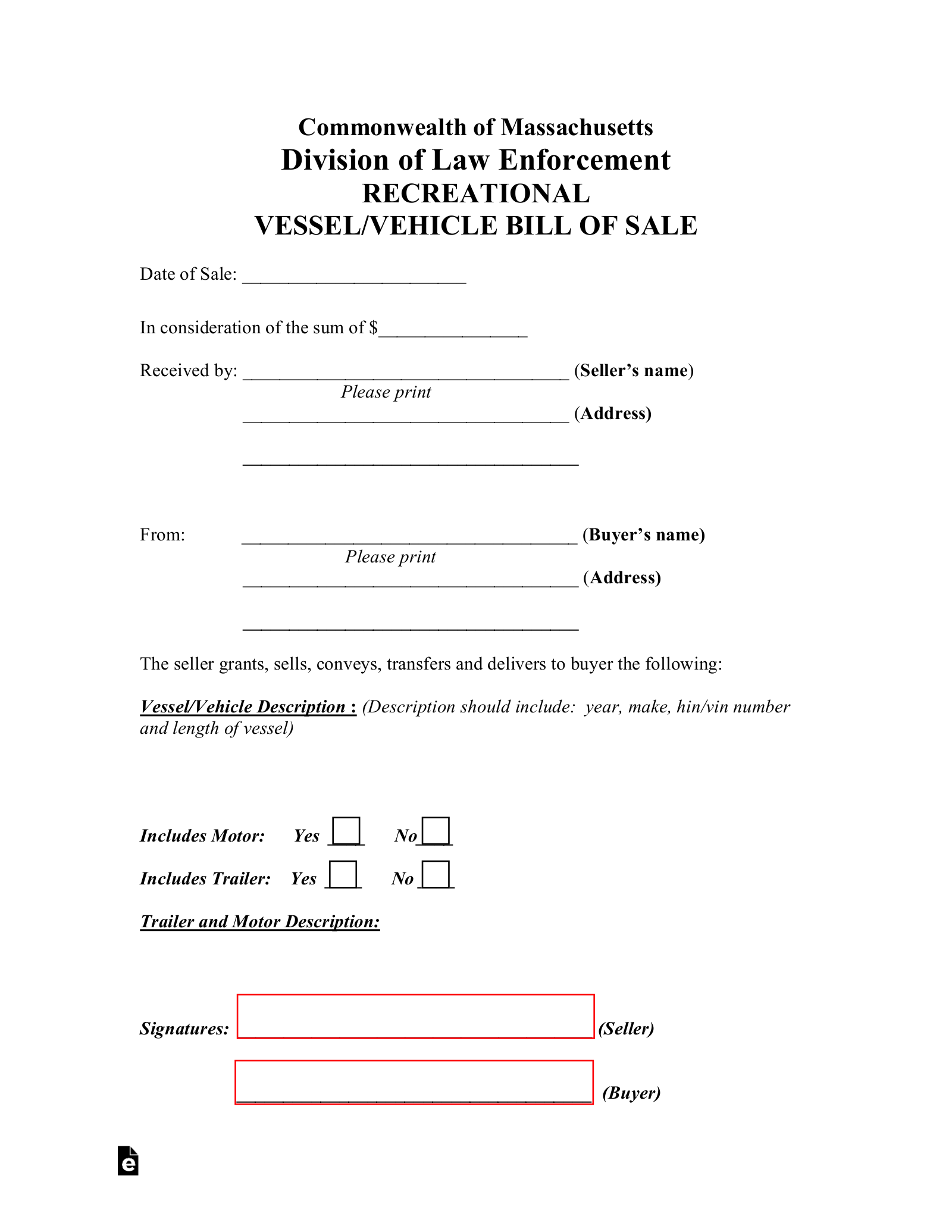

Key Information to Include in Your Massachusetts Bill of Sale

- Full names and addresses of both the buyer and the seller.

- Date of the sale.

- Vehicle Information: Year, make, model, VIN (Vehicle Identification Number), odometer reading.

- Sale price (in words and numbers).

- Disclosure of any known defects or “as-is” clauses.

- Signatures of both the buyer and the seller.

- Witness signatures (recommended, but not always required).

Navigating the Bill of Sale Process for Your Massachusetts Car Sale

Successfully completing a vehicle transaction in Massachusetts involves more than just agreeing on a price; it requires careful attention to documentation. Using a reliable bill of sale for car Massachusetts template is the cornerstone of this process, providing a structured approach to what could otherwise be a confusing exchange. Before you even meet the other party, gather all necessary information about the vehicle, including its make, model, year, and crucially, the Vehicle Identification Number (VIN) and current odometer reading. Having this data readily available will make filling out the template much more efficient and reduce the chances of errors.

Once you have your chosen template, begin by accurately inputting all the required information. This includes the full legal names and current addresses of both the buyer and the seller, the precise date of the sale, and a clear, unambiguous statement of the agreed-upon purchase price, written both numerically and in words to prevent any discrepancies. The vehicle’s details, particularly the VIN, must be exact, as this is the primary identifier for the car and essential for official registration purposes with the Massachusetts RMV. An incorrect VIN can lead to significant delays and complications.

It is also wise to include a statement regarding the vehicle’s condition. Most private car sales are done “as-is,” meaning the buyer accepts the vehicle in its current state, without any warranties from the seller. Clearly stating this in the bill of sale can protect the seller from future claims regarding the vehicle’s mechanical condition. Transparency at this stage builds trust and prevents misunderstandings down the line. Remember, every piece of information recorded contributes to the document’s legal strength and clarity.

After all details have been filled out, both the buyer and the seller must sign and date the bill of sale. It’s highly recommended, though not always legally mandated, to have the document witnessed and potentially notarized, especially for higher-value transactions, as this adds an extra layer of authenticity. Once signed, each party should retain an original copy of the bill of sale for their records. The buyer will need their copy for registering the vehicle and transferring the title at the RMV, while the seller needs their copy as proof of sale to release liability. This simple step provides invaluable protection and peace of mind for everyone involved.

Taking the time to accurately complete this essential document ensures a legally sound and hassle-free vehicle transfer. It’s a small effort that yields significant benefits, protecting your interests and streamlining the path to new ownership.