Embarking on the journey of selling a business is a monumental step, filled with anticipation and often a bit of apprehension. You have poured your heart and soul into building something valuable, and now it is time to pass the torch. While securing a buyer and agreeing on a price are significant hurdles, ensuring a smooth and legally sound transfer of ownership is equally, if not more, critical for both parties involved.

This is where proper documentation steps in as your guiding light. Among the myriad of papers exchanged during such a complex transaction, one document stands out as the ultimate record of the asset transfer: the bill of sale. It formalizes the change of hands for specific assets and provides essential protection.

Why a Bill of Sale is Absolutely Essential When Selling Your Business

When you are selling a business, you are not just selling a name; you are transferring a collection of assets, goodwill, and often liabilities. A robust bill of sale goes far beyond a simple receipt; it serves as a definitive legal document that formally transfers ownership of specific business assets from the seller to the buyer. This clarity is paramount, preventing future disputes and ensuring that both parties fully understand what is being exchanged and under what terms. Without it, you are essentially operating on a handshake agreement, which can lead to significant complications down the road.

This document brings a critical layer of formality and finality to the transaction. It solidifies the agreement reached between the buyer and seller, detailing the specific items included in the sale, the agreed-upon purchase price, and other pertinent conditions. Think of it as the ultimate proof that the buyer now legally owns the transferred assets and the seller has relinquished their claim. It protects the seller from future claims on assets already sold and assures the buyer of their new ownership.

Moreover, a well-drafted bill of sale acts as a foundational document for other post-sale necessities, such as transferring licenses, permits, and even utilities. It can be required by banks, creditors, and government agencies to acknowledge the change in ownership. Trying to navigate these requirements without a clear, comprehensive bill of sale would be like trying to sail without a compass – you might eventually get somewhere, but it will be a much more difficult and uncertain journey. That is why having a reliable bill of sale template for selling a business at your disposal is incredibly beneficial.

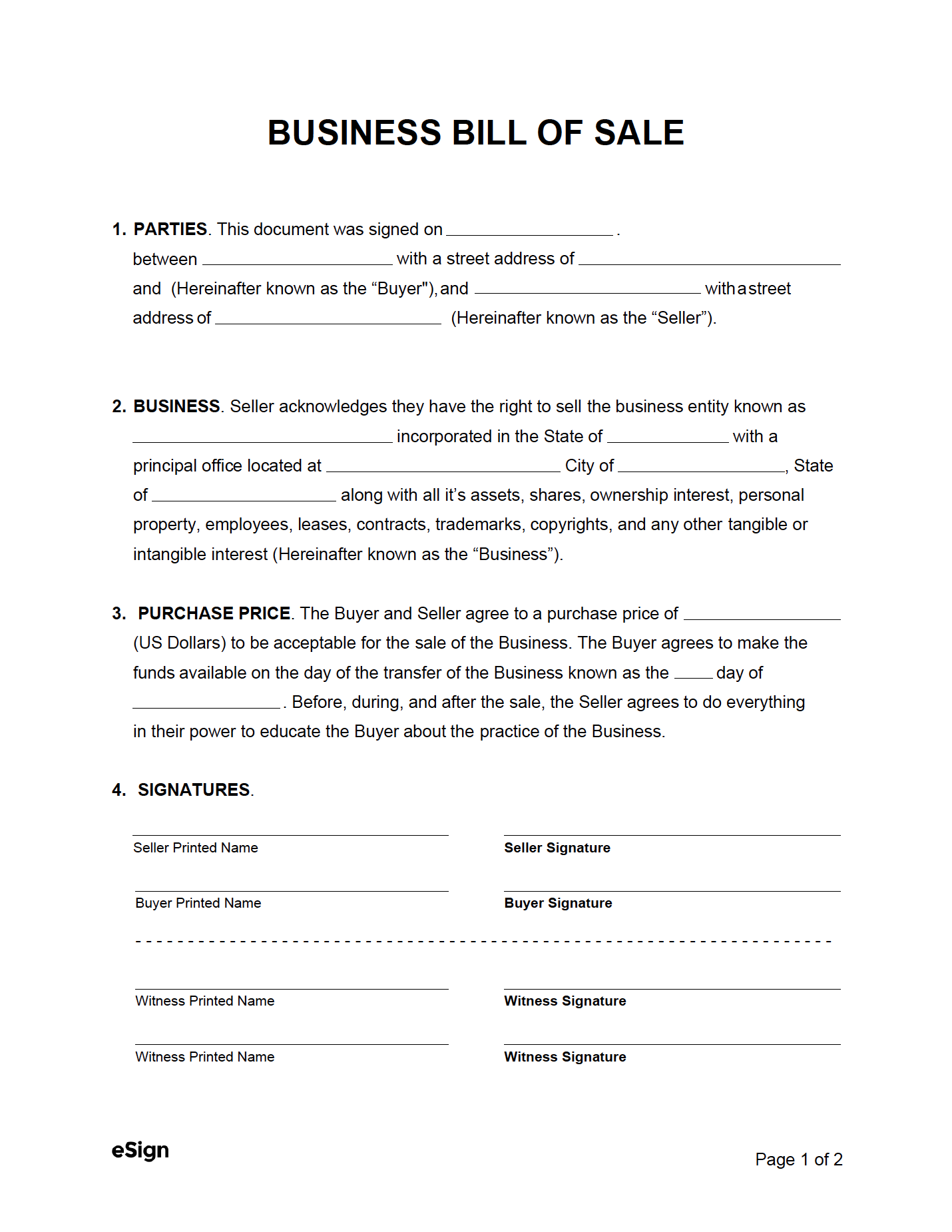

Key Components to Look for in a Comprehensive Business Bill of Sale

- Identification of Buyer and Seller: Full legal names, addresses, and contact information for all parties.

- Description of Assets Being Sold: A detailed and specific list of all tangible and intangible assets included in the sale. This could range from equipment, inventory, and real estate to intellectual property like trademarks and customer lists, and even the crucial goodwill of the business.

- Purchase Price and Payment Terms: Clearly stating the total purchase price, how it is allocated among the assets, and the agreed-upon payment schedule.

- Representations and Warranties: Statements from the seller guaranteeing certain facts about the business and its assets, and indemnification clauses outlining how parties will be protected from certain liabilities after the sale.

- Governing Law: Specifying which state’s laws will govern the interpretation and enforcement of the bill of sale.

- Signatures: Signatures of all involved parties, often requiring notarization or witnesses to ensure authenticity and legal validity.

Having these elements properly documented in your bill of sale is not just good practice; it is essential for a legally sound and smooth business transfer. A good bill of sale template for selling a business will guide you in including all these critical pieces of information.

Navigating the Business Sale Process with a Reliable Bill of Sale Template

Using a professionally designed bill of sale template can significantly streamline the entire business selling process. Instead of starting from scratch or relying on generic forms that might not be suitable for a complex business transaction, a well-crafted template provides a pre-structured framework. This means you have a clear outline of all the essential information that needs to be included, ensuring no critical details are overlooked in the rush and excitement of closing the deal.

Templates are incredibly efficient tools. They save valuable time and can potentially reduce legal costs, as they provide a solid starting point for your transaction documentation. You are not reinventing the wheel; you are merely customizing a proven structure to fit your specific circumstances. This allows you to focus more on the strategic aspects of the sale and less on the nitty-gritty of drafting legal prose from scratch. It builds confidence knowing you are working with a document that addresses common business sale requirements.

While a template offers a fantastic foundation, it is crucial to remember that every business sale is unique. Therefore, customization is key. You will need to carefully review each section of the template and tailor it to reflect the specific assets, liabilities, and terms of your particular deal. For instance, the way you describe inventory for a retail shop will differ greatly from how you detail intellectual property for a tech startup. Taking the time to accurately fill in all the blanks and adjust clauses as needed is vital for the document’s effectiveness.

Even with the most comprehensive template, professional legal advice remains indispensable. A template provides a strong framework, but a legal expert specializing in business transactions can review your specific bill of sale to ensure it fully complies with local laws, addresses any unique nuances of your business, and protects your interests effectively. They can spot potential pitfalls and suggest amendments that could save you from future legal headaches, making sure that your entire business sale is executed with precision and security.

The finalization of your business sale is a moment of both relief and new beginnings. With a meticulously prepared bill of sale, you ensure that the transfer of your hard-earned assets is legally sound, unambiguous, and protects all parties involved. It marks the clear end of your ownership and the definitive start of the buyer’s journey.

By taking the time to properly document this critical transition, you empower yourself to move forward with confidence, knowing that all the necessary formalities have been handled. This diligent approach lays the groundwork for a smooth transition for both you and the new owners, allowing everyone to focus on their next chapter without lingering concerns about past transactions.