Buying or selling a used vehicle can feel like navigating a maze of paperwork, even when it’s a straightforward private sale. While the excitement of a new ride or the satisfaction of passing on an old one is great, it’s crucial not to overlook the necessary legal documentation. A bill of sale might seem like a minor detail, but it’s actually the bedrock of a smooth, legally sound vehicle transaction, providing essential protection for both the buyer and the seller. It acts as a clear, written record of the agreement made.

Understanding the specific requirements for your state is vital, and Massachusetts has its own set of nuances that make a generic template less than ideal. That’s why having access to a reliable vehicle bill of sale template Massachusetts residents can use is incredibly helpful. It ensures you’re covering all your bases and providing the necessary information that the Commonwealth’s Registry of Motor Vehicles (RMV) will expect to see, helping you avoid potential headaches down the road.

Why a Massachusetts Vehicle Bill of Sale is Absolutely Essential

When you’re exchanging keys and cash for a vehicle in Massachusetts, a simple handshake just won’t cut it, nor will a basic receipt. A proper bill of sale serves as irrefutable proof of the transaction. For the seller, it clearly marks the date and time they relinquished ownership and liability for the vehicle, protecting them from any incidents that might occur after the sale. Imagine getting a parking ticket or even being held responsible for an accident involving a car you no longer own – a signed bill of sale is your shield against such scenarios.

On the flip side, for the buyer, this document is your initial proof of ownership. It’s absolutely required when you head to the Massachusetts RMV to register the vehicle in your name and apply for a new title. Without it, you simply won’t be able to complete the registration process, leaving you with a new car you can’t legally drive. Beyond the immediate legal necessities, it solidifies the terms of the sale, detailing the agreed-upon price and confirming the vehicle’s condition at the time of purchase, which can be invaluable in case any disputes arise later.

Furthermore, the Massachusetts Department of Revenue uses the bill of sale to calculate the sales tax you’ll owe on your vehicle purchase. The document clearly states the purchase price, ensuring an accurate assessment. It removes any ambiguity about what was paid, making the tax calculation process transparent and straightforward. This clarity benefits both parties by providing a concrete record for financial and legal purposes.

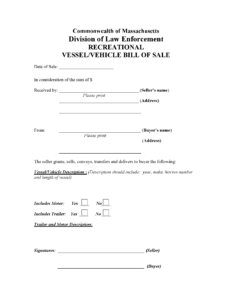

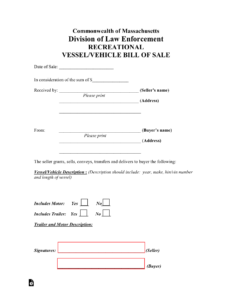

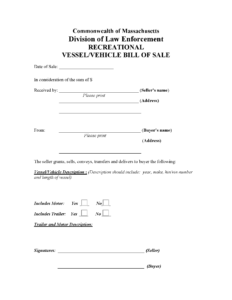

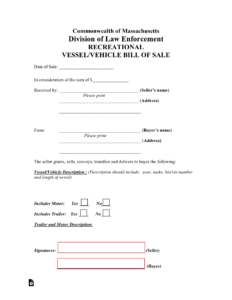

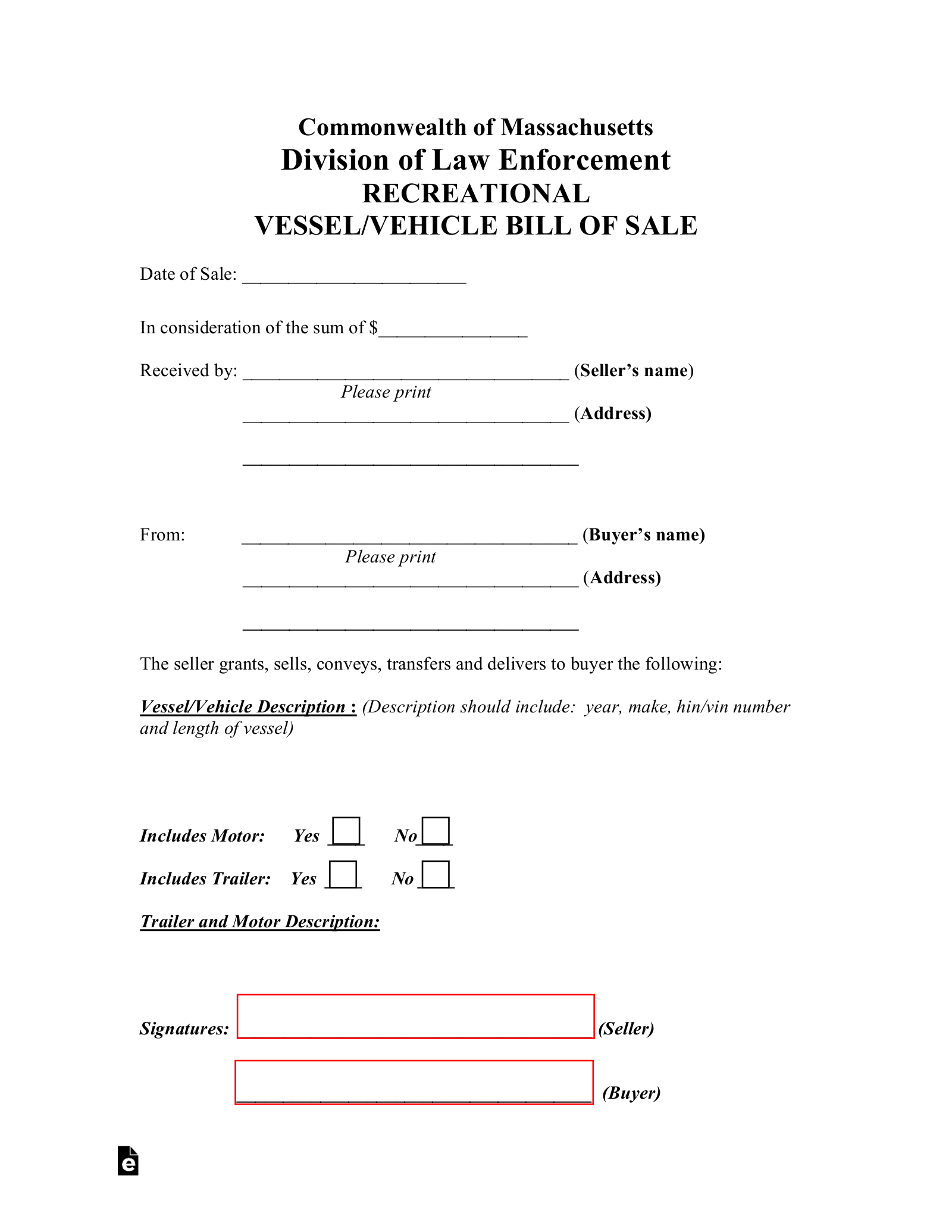

Key Information to Include in Your Massachusetts Bill of Sale

To ensure your vehicle bill of sale template Massachusetts version is complete and legally binding, it must contain several critical pieces of information. Missing any of these details could lead to delays at the RMV or even future legal complications. Always double-check that every field is accurately filled out before signing.

- Buyer’s Full Legal Name and Address: This identifies who is taking ownership.

- Seller’s Full Legal Name and Address: This identifies who is transferring ownership.

- Vehicle Identification Number (VIN): This unique 17-character code identifies the specific vehicle.

- Vehicle Details: Include the make, model, year, and odometer reading at the time of sale. The odometer reading is especially important for Massachusetts vehicle sales.

- Purchase Price: The exact amount agreed upon for the sale.

- Date of Sale: The precise date the transaction took place.

- Signatures of Both Buyer and Seller: These signatures legalize the document. It is often recommended to have these notarized, though not strictly required for every private sale in Massachusetts, it adds an extra layer of authenticity.

- Any Specific Conditions or Disclosures: Such as “as-is” clauses or specific agreements about repairs.

Ensuring all these details are accurately recorded on your bill of sale will significantly streamline your visit to the RMV and provide peace of mind for both parties involved in the transaction. Take your time, review everything, and don’t hesitate to ask questions if something isn’t clear.

Finding and Utilizing Your Vehicle Bill of Sale Template in Massachusetts

Finding a suitable vehicle bill of sale template for Massachusetts can be simpler than you might think. Many online legal form providers offer state-specific templates designed to meet the Commonwealth’s requirements. You might also find resources directly on the Massachusetts Registry of Motor Vehicles website or through reputable automotive associations. The key is to ensure the template you choose is specifically tailored for Massachusetts to account for any unique state-level stipulations, such as specific odometer disclosure requirements or details regarding sales tax collection.

Once you have your template, the process of filling it out is straightforward but requires careful attention to detail. Gather all the necessary information about the vehicle, the buyer, and the seller beforehand. This includes the Vehicle Identification Number (VIN), current odometer reading, make, model, year, and the agreed-upon sale price. Double-check all spellings, addresses, and numerical figures to avoid any errors that could cause issues later, especially when you head to the RMV for registration.

Both the buyer and the seller should sign the document, and it’s a good practice for both to retain a copy for their records. The buyer will need the original signed bill of sale when registering the vehicle, so make sure they walk away with it. Consider making multiple copies: one for the seller, one for the buyer, and potentially an extra for the RMV if they require it. Some individuals also choose to have the signatures notarized, which, while not always legally required for a private sale in Massachusetts, adds an extra layer of legal validity and peace of mind for both parties.

After the bill of sale is complete and signed, the buyer can proceed with registering the vehicle and obtaining a new title at the RMV. For the seller, it’s important to remove your license plates from the vehicle immediately after the sale. You’ll need to either transfer them to another vehicle you own or cancel them with the RMV to avoid further liabilities, such as excise taxes or insurance requirements on a vehicle you no longer possess. The bill of sale is crucial proof that the transfer of ownership has occurred.

A properly executed bill of sale is more than just a piece of paper; it’s a vital legal safeguard. It protects both parties in a private vehicle transaction, ensuring clarity, preventing disputes, and facilitating the necessary steps for vehicle registration and title transfer within the Commonwealth. Taking the time to prepare this document meticulously will ensure a smooth, worry-free process for everyone involved, offering invaluable peace of mind.