Navigating the complexities of medical bills can often feel like an overwhelming journey. One moment you’re recovering from an illness or injury, and the next, a stack of confusing invoices arrives, potentially leading to financial stress. Many people find themselves in a situation where the cost of care seems insurmountable, unsure of how to challenge or reduce these significant expenses. However, you don’t have to face this burden alone or accept the first bill you receive.

Taking a proactive approach can make a significant difference in managing healthcare costs. This often involves negotiating with healthcare providers or collection agencies to reach a more manageable payment arrangement. A powerful tool in this process is a well-crafted settlement letter. Understanding how to use a medical bill settlement letter template empowers you to advocate for yourself effectively, communicate your financial situation clearly, and potentially reduce your overall medical debt.

Why You Need a Medical Bill Settlement Letter

When faced with a large or unexpected medical bill, your first instinct might be to call the provider. While phone calls can be useful for initial inquiries, a formal, written letter carries significant weight. It demonstrates professionalism, provides a clear record of communication, and ensures all parties are on the same page regarding the terms of a potential settlement. This written documentation can be crucial if any disputes arise later.

There are many scenarios where such a letter becomes indispensable. Perhaps you’ve received care that wasn’t covered as expected by your insurance, or an emergency visit left you with a massive out-of-pocket expense. Maybe you’ve identified errors in the billing, or your financial circumstances have drastically changed since the service was rendered. In these situations, simply ignoring the bill can lead to negative consequences like collection efforts, damaged credit, or even legal action.

From the provider’s perspective, receiving some payment is often preferable to receiving no payment at all, especially if the alternative is sending the account to collections, which can be a lengthy and expensive process for them. They understand that patients sometimes face genuine financial hardship. A well-reasoned settlement offer, presented formally, shows you’re serious about resolving the debt and are willing to pay what you can reasonably afford.

Ultimately, this letter serves as a vital tool for patient advocacy. It’s your opportunity to clearly state your case, explain your financial limitations, and propose a fair resolution. It allows you to present a structured offer rather than just making a vague request, increasing your chances of a positive outcome. Remember, persistence and clear communication are key when dealing with medical billing issues.

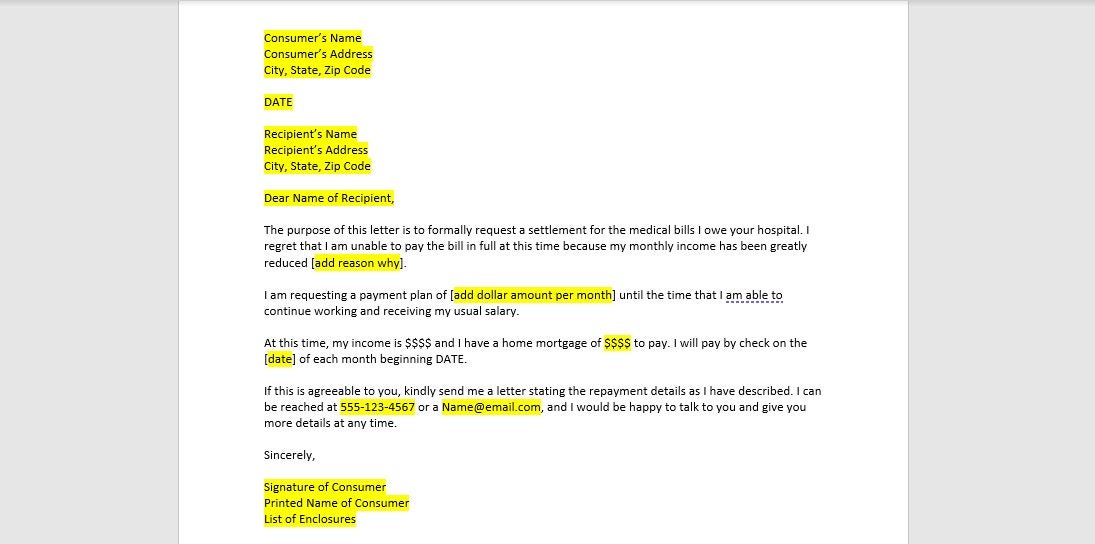

Key Components of an Effective Letter

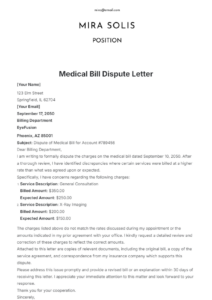

* Your contact information and the date

* The healthcare provider or collection agency’s name and address

* Your patient account number and any relevant bill numbers

* The date(s) of service and the original bill amount

* A clear statement of your proposed settlement offer

* A concise explanation for your offer (e.g., financial hardship, billing error, no insurance)

* Your proposed payment method and timeline (e.g., lump sum)

* A request for a written confirmation of any agreement

* A polite closing and your signature

Before You Send That Letter

Before you even start drafting your letter, it’s crucial to do your homework. Gather all relevant documents, including the original bill, Explanation of Benefits (EOB) from your insurance, and any correspondence. Research typical costs for the services you received to see if the charges seem excessive. Most importantly, honestly assess your financial situation to determine a realistic amount you can offer to pay.

Crafting Your Medical Bill Settlement Offer

When you’re ready to write your settlement letter, remember that tone matters significantly. While you’re advocating for yourself, maintaining a respectful and professional tone throughout the letter is crucial. Avoid accusatory language or emotional appeals; instead, focus on clear facts and your proposed solution. The goal is to open a dialogue, not to create animosity.

Determining a reasonable settlement offer is often the trickiest part. While there’s no hard and fast rule, many providers might consider offers ranging from 20% to 50% of the original bill amount, especially if you’re offering a lump sum payment. Your specific circumstances, such as your income, other outstanding medical debts, or issues with insurance coverage, will influence what you can realistically offer and what a provider might accept. Be prepared to justify your offer with evidence of financial hardship if necessary.

The “why” behind your offer is just as important as the offer itself. Clearly explain your reasons for seeking a reduction. This could be due to a sudden job loss, unexpected medical emergencies that depleted your savings, a significant increase in other living expenses, or a genuine belief that the bill is incorrect or inflated. Providing a concise, factual explanation helps the provider understand your position and empathize with your situation.

It’s also beneficial to offer a lump-sum payment if possible, as this is often more attractive to providers who prefer to close out accounts quickly. Clearly state your payment terms in the letter, including the amount you’re willing to pay and when you can pay it. You might also include a reasonable deadline for their response, usually around 10-14 business days, to encourage a timely resolution.

Once you’ve sent your letter, be prepared for a response, which might be an acceptance, a counter-offer, or a denial. If they counter, consider if their offer is within your means. Always insist on getting any agreed-upon settlement in writing before making a payment to ensure there are no misunderstandings later. This written agreement should clearly state the settled amount, that it is a full and final settlement, and that your account will be marked as paid in full.

* Gather all relevant documentation to support your claim.

* Clearly state your proposed settlement amount and payment terms.

* Explain your reasons concisely and factually.

* Request a written agreement for any accepted offer.

* Be prepared for negotiation and follow up promptly.

Taking control of your medical bills by preparing a thoughtful and well-articulated settlement letter is a powerful step towards financial peace of mind. It demonstrates your commitment to resolving the debt while ensuring the proposed solution aligns with your financial capabilities. Remember that advocacy is a process, and persistence often yields positive results.

Don’t let the fear of high medical costs prevent you from seeking a fair resolution. With the right approach and a clear understanding of your options, you can effectively communicate your needs and work towards a manageable outcome. Your proactive efforts can lead to significant relief and help you navigate the often-complex world of healthcare billing with greater confidence.