Navigating the waters of private sales, whether you’re buying or selling a used car, a boat, or even a piece of equipment, can sometimes feel a bit murky. It’s not just about agreeing on a price and shaking hands; there are often legalities and formal requirements that need to be met to ensure a smooth, protected transaction for both parties. Without proper documentation, you might find yourself in a tricky situation down the road, facing disputes over ownership, condition, or even tax implications.

This is especially true in a state like Maryland, where specific procedures are in place for transferring ownership of various types of property. A well-drafted bill of sale isn’t just a suggestion; it’s often a legal necessity that provides a clear, undeniable record of the transaction. It acts as your proof of purchase or sale, detailing exactly what was exchanged, for how much, and between whom. Having this document on hand can save you a lot of headaches, from registering a vehicle at the MVA to settling any potential misunderstandings.

Why You Need a Maryland Bill of Sale

When you’re involved in the sale or purchase of personal property in Maryland, a bill of sale isn’t just a nice-to-have; it’s a foundational document that provides essential legal protection for both the buyer and the seller. Imagine trying to prove you bought a boat without a paper trail, or worse, imagine someone claiming you owe them money for something you already paid for. A properly executed bill of sale serves as irrefutable evidence of the transaction, detailing the terms and conditions agreed upon by both parties, thus preventing future disputes or misunderstandings. It clearly states the transfer of ownership, alleviating any ambiguity.

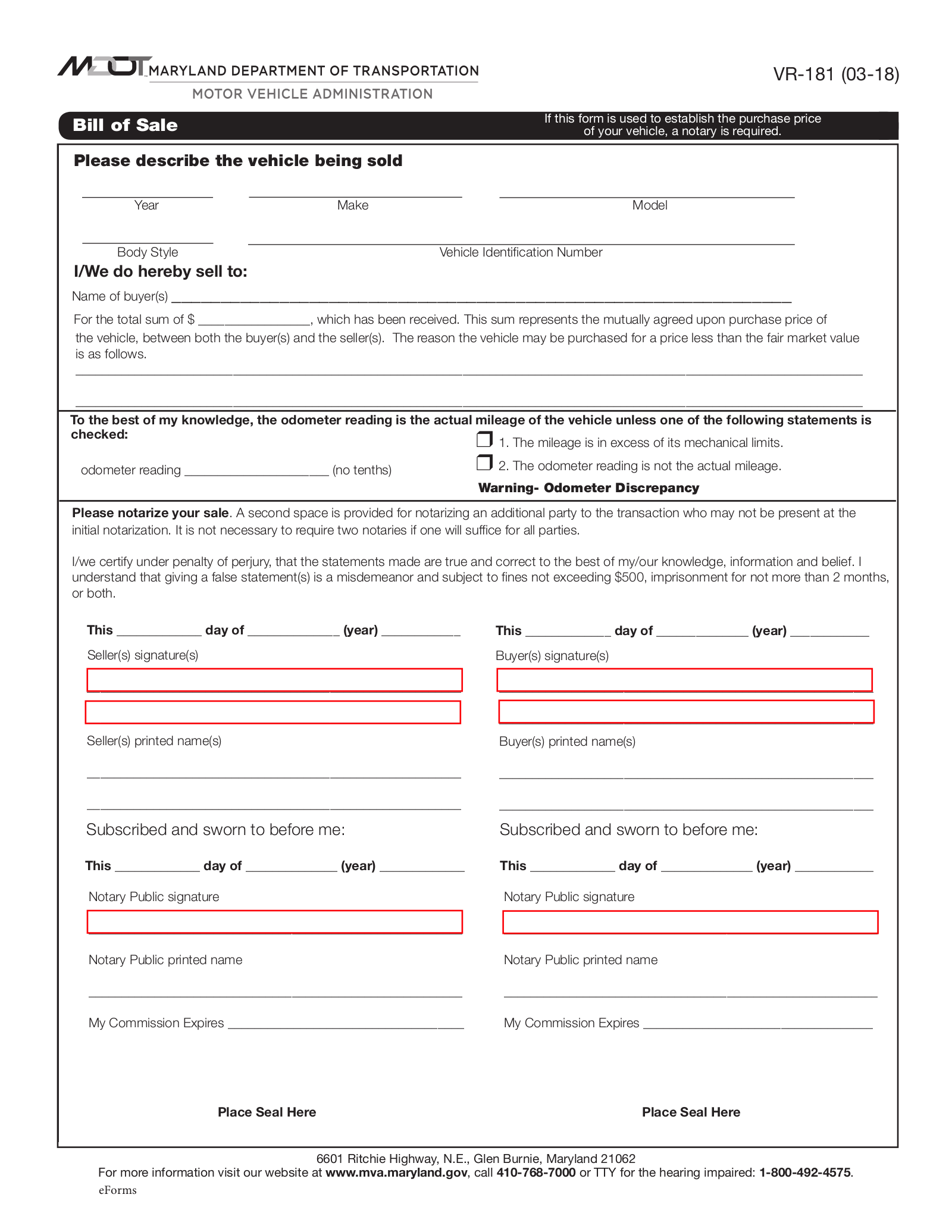

Beyond just personal protection, a bill of sale is frequently a mandatory requirement for official purposes. For instance, if you’re purchasing a vehicle in Maryland, the state’s Motor Vehicle Administration (MVA) will typically require a bill of sale as part of the registration and titling process. This document helps the MVA verify the sale price, which in turn affects the sales tax calculations and ensures the vehicle’s ownership is correctly transferred into the new owner’s name. Without it, you could face significant delays or even be unable to legally register your new acquisition, leaving it unusable on Maryland roads.

A comprehensive bill of sale should contain specific pieces of information to make it legally sound and effective. It’s more than just a receipt; it’s a formal record of agreement. The clarity and detail provided in this document are crucial for avoiding future legal complications or disputes regarding the property’s condition or the terms of the sale. Using a reliable maryland bill of sale template ensures that all necessary fields are included, guiding you through the process of documenting the sale accurately and completely.

Key Information to Include

Ensuring all these details are accurately filled out and legible is paramount. Any missing or incorrect information could potentially invalidate the document or weaken its legal standing should a dispute arise. Taking the time to double-check every field before signing can save a lot of grief down the line. It transforms a simple agreement into a verifiable and legally defensible record.

Tips for Using Your Maryland Bill of Sale Template Effectively

Once you have a reliable Maryland bill of sale template, the next step is to use it effectively to ensure your transaction is as smooth and legally sound as possible. While a template provides the structure, it’s up to you to fill in the specifics carefully and accurately. Whether you’re selling a car, a boat, an RV, or even something less conventional like specialized farm equipment, customizing the template to fit the exact nature of your sale is crucial. Don’t just hastily fill in the blanks; think about any unique aspects of your item or sale that might need to be explicitly stated. For instance, if you’re including specific accessories with a vehicle, list them.

Before signing, both the buyer and seller should thoroughly review the entire document. This means reading every line, checking every name, address, and particularly the description of the item and the agreed-upon price. It’s an opportunity to catch any typos or miscommunications before they become legally binding. Once signed, the terms are generally considered final, so make sure everything aligns with what you both discussed and agreed upon. A quick review can prevent significant headaches or costly legal battles later on.

Consider whether notarization is necessary or advisable for your particular transaction. While a bill of sale doesn’t always require a notary in Maryland, having one present adds an extra layer of authenticity and legal weight to the document. A notary public verifies the identities of the signers and witnesses their signatures, which can be invaluable proof if questions about the document’s legitimacy ever arise. For high-value items or complex transactions, seeking notarization can provide added peace of mind for both parties involved.

Finally, always make multiple copies of the signed bill of sale. Both the buyer and the seller should retain an original signed copy for their records. The buyer will likely need their copy for registration purposes, especially for vehicles, while the seller should keep a copy for tax purposes and as proof they are no longer the owner of the property. Storing these copies in a safe, accessible place is essential. Consider digital backups in addition to physical copies to ensure you always have access to this vital document.

Taking the time to properly document your private sales in Maryland using a well-prepared bill of sale is an investment in your peace of mind. It acts as a clear, undeniable record of your transaction, safeguarding your interests and ensuring a straightforward path through official state requirements. Having this document ready significantly simplifies the process of transferring ownership, whether you’re selling a long-loved family vehicle or acquiring a new piece of property. It solidifies your agreement and protects both parties involved.