Navigating the world of business transactions can sometimes feel like a maze, especially when it involves the intricate details of asset transfers within a limited liability company, or LLC. Whether you are buying or selling equipment, intellectual property, or even an entire segment of a business that operates under an LLC structure, having the right legal documentation in place is paramount. It’s not just about the exchange of goods or services; it’s about establishing a clear, legally binding record of the transaction that protects all parties involved.

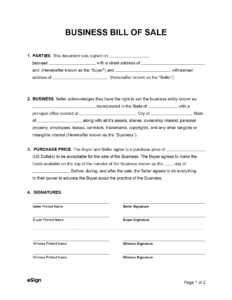

This is where a well-crafted bill of sale comes into play. While many people are familiar with a basic bill of sale for personal items, an LLC requires a more specific approach that acknowledges its unique legal standing as a separate entity. Understanding the nuances and knowing how to properly document these transactions can save a lot of headaches down the line, ensuring smooth operations and compliance. We’ll delve into why an LLC bill of sale is crucial and how you can effectively utilize a reliable llc bill of sale template to manage your company’s asset transfers with confidence.

Understanding The Importance Of An LLC Bill Of Sale

When an LLC engages in the sale or purchase of an asset, whether it’s a vehicle, machinery, intellectual property, or even a client list, a standard bill of sale might not fully capture the complexities involved. An LLC bill of sale specifically acknowledges that the transaction is occurring between the LLC as a distinct legal entity and another party, rather than between individuals. This distinction is vital for maintaining the liability protection that an LLC offers its members. Without proper documentation, the lines between personal and business assets can become blurred, potentially exposing personal assets to business liabilities.

Think of it as the formal handshake, but in written legal form, that clearly states what is being transferred, who is transferring it, and who is receiving it, all under the umbrella of the LLC. This document serves as undeniable proof of ownership transfer, which is critical for various reasons. For instance, when it comes to tax reporting, an accurate record of asset acquisition or disposition is essential for calculating depreciation, capital gains, or losses. It also provides a clear audit trail for financial scrutiny.

Key Elements To Include In Your Bill Of Sale

- Full legal names and addresses of both the seller (the LLC) and the buyer.

- A detailed description of the asset being sold, including serial numbers, model numbers, or any unique identifiers.

- The purchase price and payment terms, specifying if it’s a lump sum, installments, or other arrangements.

- The date of the transaction and the effective date of transfer.

- A statement confirming the seller’s ownership and their right to sell the asset.

- Any warranties or disclaimers regarding the asset’s condition.

- Signatures of authorized representatives from both the LLC (seller) and the buyer.

Furthermore, having this document prevents future disputes. Imagine selling a piece of machinery without a clear record. Years down the line, if a dispute arises over ownership or responsibilities related to that asset, a properly executed LLC bill of sale provides undeniable evidence to resolve the matter quickly and efficiently. It’s an investment in peace of mind and legal security for your business.

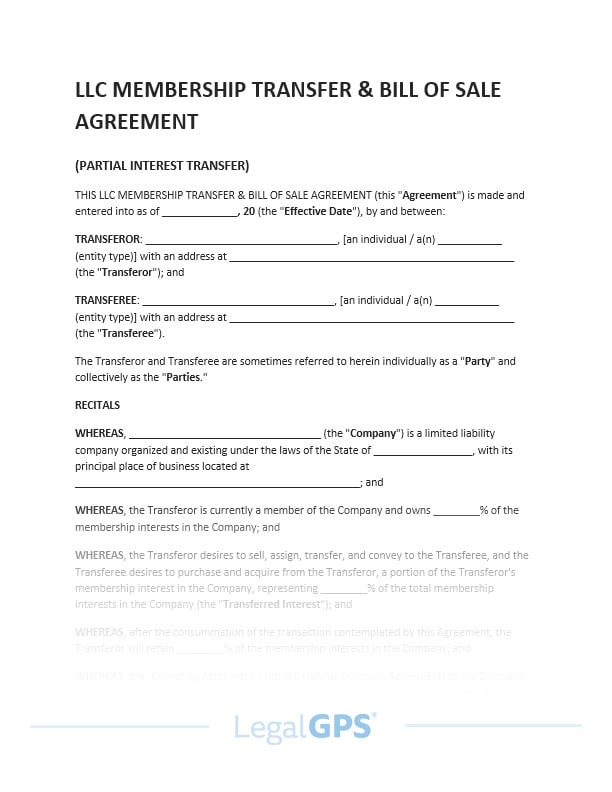

Creating And Customizing Your LLC Bill Of Sale Template

While the prospect of drafting legal documents might seem daunting, utilizing an existing llc bill of sale template simplifies the process considerably. These templates are designed to cover the fundamental legal requirements, providing a solid foundation that you can then tailor to your specific transaction. The key is to find a reputable template from a reliable source and then understand how to adapt it to fit the unique circumstances of your sale or purchase.

Start by populating the template with the core information: the full legal name of your LLC as the seller, its registered address, and similar details for the buyer. Be meticulous in describing the asset. Generic descriptions can lead to ambiguity, so include all relevant identifying details to ensure there’s no confusion about what is being transferred. For example, if it’s a vehicle, include the VIN, make, model, and year. If it’s intellectual property, specify the type, registration numbers, and any associated rights.

Payment details are another critical section. Clearly state the agreed-upon purchase price and how the payment will be made. Will it be a single payment, or are there payment terms involved? Will there be any deposits or contingencies? Clarity here helps prevent financial misunderstandings later. Also, consider the “as-is” clause. Many asset sales occur on an “as-is” basis, meaning the buyer accepts the item in its current condition with no further warranties from the seller. If this applies, ensure it’s explicitly stated in your bill of sale.

Finally, and perhaps most importantly, ensure that the bill of sale is signed by the appropriate authorized representatives of both parties. For an LLC, this typically means a manager or an authorized member, depending on the LLC’s operating agreement. Proper execution, often including witnessing or notarization depending on the asset and jurisdiction, solidifies the document’s legal standing. Once signed, always keep original copies for your business records and provide a copy to the buyer. This diligent record-keeping is vital for future reference, accounting, and potential legal needs.

Having a clear, legally sound document for every asset transaction is a cornerstone of responsible business management. It safeguards your LLC’s integrity and provides a clear audit trail for all significant transfers. By taking the time to properly complete and file your bill of sale, you are actively protecting your company’s assets and its future.

This attention to detail in your documentation practices not only fosters transparency but also reinforces your LLC’s status as a professional and compliant entity in the eyes of tax authorities, potential investors, and other business partners. It’s an essential step in maintaining the clear separation between your business and personal liabilities, ensuring your operations run smoothly and securely.