Giving a gift should be a joyous occasion, filled with warmth and appreciation. Whether it’s a car, a piece of art, or a valuable antique, the act of gifting often comes from a place of generosity and love. While the sentiment is pure, sometimes even the simplest acts require a little bit of paperwork to ensure everything is clear and above board, especially when significant assets are involved.

You might wonder why you’d need a formal document for something given freely. The truth is, for items of considerable value, a simple verbal agreement isn’t always enough. A properly drafted gift bill of sale template can protect both the giver and the recipient, preventing misunderstandings and providing clear documentation for legal, tax, or insurance purposes down the line. It’s about ensuring peace of mind for everyone involved.

Why You Need a Gift Bill of Sale Template

At first glance, the idea of using a formal document for a gift might seem overly complicated or even a little impersonal. After all, isn’t a gift supposed to be given freely, without strings attached? While that’s absolutely true in spirit, the practicalities of modern life, especially when dealing with high-value items, often necessitate a formal record. Think of it less as a contract and more as a helpful, protective measure. It’s about making sure that your generous act doesn’t inadvertently lead to future headaches for anyone.

One of the primary reasons to utilize a gift bill of sale is for tax purposes. In many jurisdictions, gifts exceeding a certain value might be subject to gift tax, or they might need to be reported to the tax authorities. Having a clear, signed document stating the item was a gift, not a sale, helps to establish the nature of the transaction. This can be crucial evidence if the IRS or a similar body ever has questions, clearly distinguishing between a taxable sale and a non-taxable gift within certain thresholds.

Beyond taxes, a gift bill of sale also serves as excellent proof of ownership for the recipient. Imagine gifting a vehicle or a valuable piece of jewelry. Without a formal document, the recipient might struggle to register the vehicle, insure the jewelry, or even prove that they are the rightful owner if the item is ever lost or stolen. It provides an undeniable paper trail that validates their possession and rights to the gifted item, making future administrative tasks much smoother.

Furthermore, this document can protect the giver from future liabilities. For instance, if you gift an old car and it later breaks down or is involved in an accident, a gift bill of sale clearly transfers ownership and any associated responsibilities at the time of the gift. It creates a clear boundary, ensuring that your generosity doesn’t come back to haunt you in unforeseen ways. It’s all about clear documentation and setting expectations for all parties involved.

Specific Scenarios Where It’s Invaluable

There are particular situations where having a documented gift transfer becomes exceptionally important. Consider these examples:

- Vehicles: To transfer title, registration, and prove no financial transaction occurred.

- Real Estate (minor parcels): For transferring small plots or specific rights without monetary exchange.

- High-Value Personal Property: Art, antiques, boats, or even significant collections that might require insurance or be part of an estate plan.

- Family Transfers: When passing down assets within a family to avoid probate issues or clarify intent among heirs.

What to Include in Your Gift Bill of Sale Template

Once you understand why a gift bill of sale is so beneficial, the next logical step is to know what essential information it should contain. While a basic form might suffice for some, a comprehensive document provides the most robust protection and clarity. Think of it as creating a complete narrative of the gift, ensuring no detail is left to interpretation. The goal is to make it as unambiguous as possible for anyone who might review it in the future.

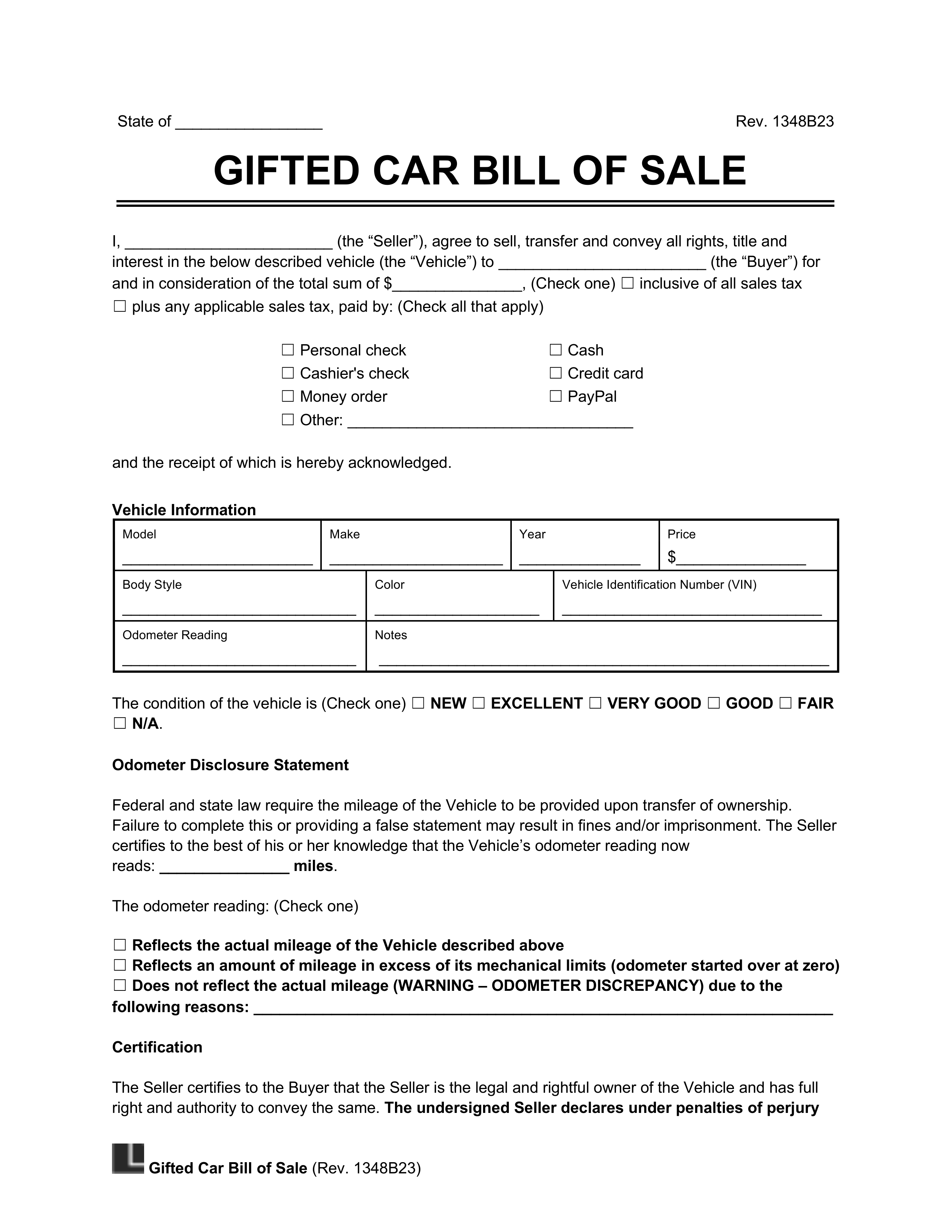

At its core, any gift bill of sale template should clearly identify the parties involved: the giver (donor) and the recipient (donee). This means including their full legal names and current addresses. It’s also crucial to state the date the gift was made. This establishes the timeline for ownership transfer and is vital for tax reporting or insurance activation. Without this fundamental information, the document loses much of its legal standing and practical utility.

The most critical part is a detailed description of the gifted item. Vague descriptions can lead to confusion. For a vehicle, include the make, model, year, VIN (Vehicle Identification Number), and odometer reading. For art, specify the artist, title, dimensions, and any unique identifying marks. The more specific you are, the less likely there will be disputes over exactly what was gifted. This level of detail ensures there’s no ambiguity about the asset being transferred.

Crucially, the document must explicitly state that the item is being given as a gift, without any monetary exchange or consideration. This distinguishes it from a sale and is paramount for tax and legal purposes. It should clearly declare that the transfer is free and clear of any liens, encumbrances, or debts, and that the giver is the rightful owner with the authority to gift the item. Both the giver and recipient should sign and date the document, and ideally, have their signatures witnessed or notarized for added legal weight, depending on the item’s value and local laws.

- Identification of Parties: Full names and addresses of both the giver and recipient.

- Date of Gift: The exact date the transfer of ownership occurred.

- Detailed Description of Item: Make, model, serial number, unique identifiers, condition, etc.

- Declaration of Gift: Explicit statement that the item is a gift, with no money or consideration exchanged.

- Statement of Ownership: Giver confirms they own the item and have the right to gift it.

- “As-Is” Clause (Optional but Recommended): States the item is accepted in its current condition, limiting future claims.

- Signatures: Signatures of both the giver and recipient.

- Witnesses/Notarization: Space for witnesses and/or a notary public to sign and seal (highly recommended for high-value items).

Preparing a gift bill of sale isn’t about diminishing the heartfelt nature of giving; it’s about adding a layer of practical security and clarity to a generous act. It ensures that the transition of ownership is smooth, transparent, and legally sound for both parties. Taking this small extra step can prevent potential legal or financial complications down the road, allowing everyone involved to focus on the joy of the gift itself, rather than worrying about paperwork.

Ultimately, this simple document provides peace of mind. It’s a testament to responsible giving and receiving, demonstrating foresight and care. By clearly documenting the transfer of significant assets, you’re not only protecting yourself but also providing invaluable proof of ownership and intent for the recipient. It’s a smart move that benefits everyone, ensuring that the act of giving remains what it should be: a positive and memorable experience.