Navigating the world of transactions, whether buying a vintage guitar or hiring a professional service, often involves more than just the agreed-upon price. There can be additional charges, administrative costs, or service fees that need to be clearly accounted for. While a standard bill of sale handles the transfer of ownership, what happens when those extra fees come into play, and how do you ensure everything is meticulously documented for both parties?

This is precisely where a specialized document comes in handy, ensuring absolute transparency and preventing future misunderstandings. It’s about more than just the core transaction; it’s about comprehensively detailing every financial aspect involved. Understanding and utilizing such a tool can save you from headaches down the line, providing a clear record for all involved.

What Exactly is a Fee Bill of Sale?

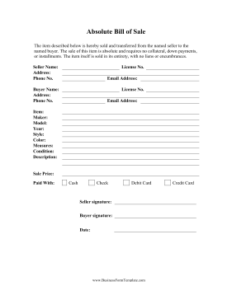

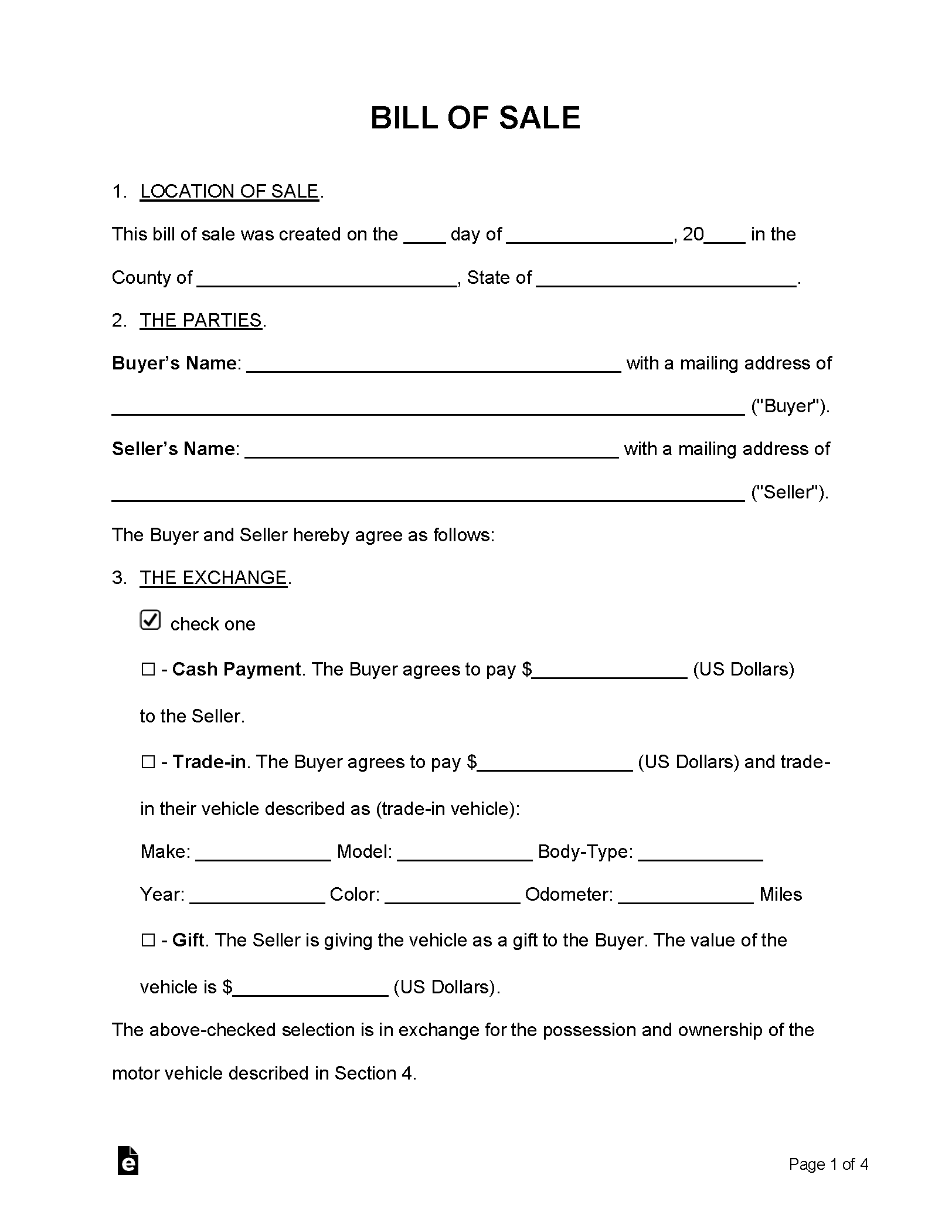

At its core, a bill of sale is a legal document that records the transfer of ownership of an item or property from one party to another. When we talk about a “fee bill of sale,” we’re referring to a more detailed version of this document that specifically outlines not just the primary purchase price, but also any additional charges, commissions, service fees, taxes, or incidental costs associated with the transaction. It’s designed to provide a crystal-clear financial breakdown, leaving no room for ambiguity about what was paid for and why.

Think of it as an itemized receipt on steroids, but with the legal weight of a bill of sale. For instance, if you’re buying a car, the fee bill of sale template wouldn’t just state the vehicle’s price; it would also list registration fees, documentation fees, extended warranty costs, or any custom accessory installation charges. This level of detail protects both the seller, by showing that all agreed-upon charges were disclosed, and the buyer, by confirming they paid only what was itemized and agreed to.

This type of bill of sale is particularly crucial in service-based industries or complex sales where the final cost isn’t just a single lump sum. Imagine a contractor completing a home renovation project. Beyond the labor costs, there might be fees for material procurement, permit applications, or specialized equipment rental. A comprehensive fee bill of sale would meticulously list each of these components, ensuring that the client understands every line item on their invoice is accounted for within the formal transfer of service or goods.

The primary purpose of incorporating these fee details into a bill of sale is to enhance transparency and mitigate disputes. By having all financial aspects formally recorded and acknowledged by both parties, it significantly reduces the likelihood of disagreements arising later regarding what was included in the price or what additional services were rendered. It creates an undeniable paper trail that serves as evidence in case of any future queries.

Key Components You’ll Find

-

Parties Involved: Full names and contact information for both the buyer and seller.

-

Item Description: A detailed description of the goods or services being transferred or rendered.

-

Base Purchase Price: The fundamental cost of the item or service.

-

Itemized Fees: A clear, separate listing of all additional charges, explaining what each fee is for (e.g., delivery fee, processing fee, tax, installation fee).

-

Total Amount Paid: The sum of the base price and all itemized fees.

-

Payment Method: How the payment was made (cash, check, card, etc.).

-

Date of Transaction: When the transfer occurred.

-

Signatures: Acknowledgment and agreement from both buyer and seller.

-

Warranty/As-Is Clause: Any conditions regarding the item’s state or guarantee.

Why is a Fee Bill of Sale Template Indispensable?

In today’s fast-paced world, efficiency is key, and that’s precisely where a dedicated template shines. Rather than drafting a new document from scratch for every transaction, a ready-to-use fee bill of sale template provides a standardized format that covers all the essential elements. This not only saves an immense amount of time but also ensures consistency across all your dealings, presenting a professional image to clients and customers alike.

Beyond time-saving, the most significant advantage of using a template is the reduction of errors and omissions. When you’re dealing with multiple fees and intricate details, it’s easy to overlook something important. A well-designed template acts as a checklist, prompting you to fill in all the necessary fields, from detailed service descriptions to every single fee component. This systematic approach guarantees that no crucial information is left out, which is paramount for legal validity and clarity.

Furthermore, using a standardized template provides a strong layer of legal protection for both parties. In the event of a dispute, having a clear, comprehensive, and mutually signed document that itemizes all financial aspects can be invaluable. It serves as concrete evidence of the terms agreed upon, preventing “he said, she said” scenarios. This clarity helps to uphold the integrity of the transaction and can be critical in resolving any disagreements efficiently and fairly, potentially avoiding costly legal battles.

For businesses, especially, integrating a fee bill of sale template into their operational workflow standardizes their contracting process. It ensures that every client receives the same level of detailed information, enhancing customer trust and satisfaction. This consistency builds a reputation for transparency and professionalism, which are vital for long-term business success. It’s not just about compliance; it’s about fostering positive relationships through clear communication and documentation.

Think of it as your safety net for complex transactions. Whether you are a small business owner offering varied services, an individual selling high-value items with additional charges, or simply someone who values clear communication, a template removes the guesswork. It empowers you to handle transactions with confidence, knowing that all financial aspects are explicitly stated and agreed upon, paving the way for smooth and successful exchanges.

Ensuring every financial detail is meticulously recorded is a cornerstone of responsible transactions. A carefully prepared document that outlines not just the main price but all associated charges serves as an indispensable tool for clarity and peace of mind. It’s about building trust and establishing a solid foundation for any exchange, large or small, by providing an unambiguous record for both parties involved.

By taking the time to properly document all costs, you effectively safeguard against future misunderstandings and strengthen the integrity of your agreements. This proactive approach to detailing every financial aspect ultimately contributes to smoother dealings, fostering transparency and ensuring that everyone walks away with a clear understanding of the full scope of their financial commitment and what they received in return.