Ever feel like you’re juggling too many financial balls in the air? Whether you run a small business, manage a bustling freelance career, or even just want to get a grip on your personal finances, knowing exactly who owes you money and who you owe can be a huge headache. It’s easy to lose track of invoices, forget about upcoming payments, and generally feel overwhelmed by the constant flow of funds.

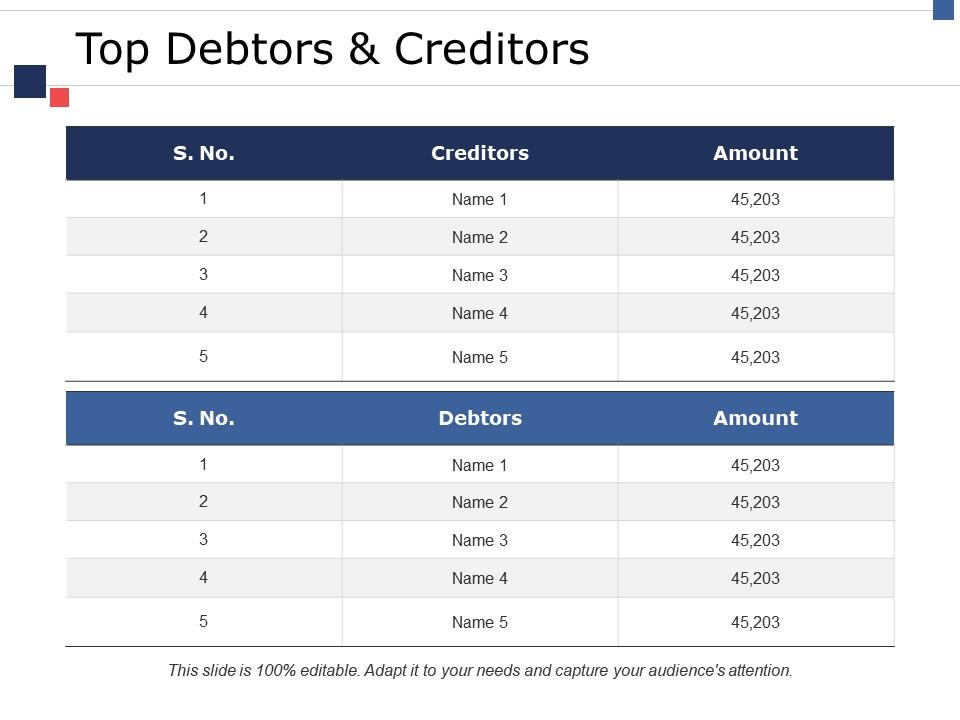

This is where a clear, organized system comes into play, and nothing simplifies this better than a well-designed debtors and creditors list template. It’s not just a fancy accounting tool; it’s a foundational piece of your financial puzzle, helping you visualize your financial commitments and receivables at a glance. Think of it as your personal financial scorecard, making sure every penny is accounted for.

Having a robust system in place to track these financial relationships is crucial for maintaining healthy cash flow and making informed decisions. It can be the difference between confidently expanding your business and constantly worrying about unpaid invoices or missed supplier payments. Let’s dive into why this tool is so indispensable and how you can make the most of it.

Why a Debtors and Creditors List is Your Financial Best Friend

In the fast-paced world of business, it’s all too common for financial records to become a tangled mess. You might have clients who are slow to pay, or perhaps you’re juggling multiple suppliers with different payment terms. Without a clear overview, these individual transactions can quickly pile up, leading to unexpected cash flow shortages or even damaging relationships with your vendors. It’s like trying to navigate a complex city without a map – you might get there eventually, but not without a lot of detours and potential frustration.

A debtors and creditors list fundamentally serves as that map. It clearly distinguishes between your “debtors” – the individuals or entities that owe money to you – and your “creditors” – the individuals or entities that you owe money to. This simple distinction, when properly tracked, provides immediate clarity on your financial position, helping you understand both your assets (what’s coming in) and your liabilities (what’s going out).

The benefits of maintaining such a list extend far beyond mere record-keeping. It’s about proactive financial management. By regularly updating and reviewing this information, you gain insights that can impact everything from your daily operational decisions to your long-term strategic planning. It transforms your financial data from a collection of numbers into actionable intelligence.

Key Benefits You’ll Love

- Better Cash Flow Management: Clearly see what’s due to come in and what needs to go out, allowing you to anticipate potential shortfalls or surpluses.

- Improved Financial Planning: Make more informed decisions about investments, expenses, and growth strategies based on a clear financial picture.

- Stronger Supplier Relationships: Avoid late payments and maintain good standing with your vendors, which can lead to better terms and discounts.

- Easier Tax Preparation: All the necessary data is organized, streamlining the process of filing taxes and reducing stress.

- Spotting Potential Issues Early: Identify slow-paying customers or emerging debt problems before they escalate into major crises.

Consider the impact on your cash flow alone. If you know exactly which invoices are overdue and by how much, you can follow up promptly, improving your chances of receiving payments on time. Conversely, if you have a clear list of upcoming payments to creditors, you can ensure funds are available, avoiding late fees or strained relationships. It’s about being in control, rather than being controlled by your finances.

Ultimately, having a comprehensive and up-to-date debtors and creditors list empowers you. It takes the guesswork out of financial management, providing a solid foundation for sustainable growth and peace of mind. Instead of reacting to financial surprises, you can anticipate and plan, giving you a significant advantage in managing your business or personal wealth effectively.

What to Include in Your Debtors and Creditors List Template

While the core concept of tracking who owes whom is straightforward, a truly effective template needs to capture specific details to be genuinely useful. Simply listing names isn’t enough; you need granular information that allows for quick assessment and action. The beauty of a template lies in its ability to standardize this information, ensuring consistency and preventing crucial details from being overlooked.

Think about the specific data points that would help you quickly answer questions like “How much is Client X overdue?” or “When is the payment due to Supplier Y?”. Each entry, whether for a debtor or a creditor, should tell a complete story about that particular financial relationship. This comprehensive approach is what elevates a basic list to a powerful financial management tool.

Here’s a breakdown of essential information you should aim to include in your debtors and creditors list template:

- For Debtors (Those who owe you):

- Debtor Name (Customer or client name)

- Invoice Number

- Original Amount Due

- Date Issued (When the invoice was sent)

- Due Date (When payment is expected)

- Amount Outstanding (How much is still owed)

- Payment Status (e.g., Paid, Partially Paid, Overdue, Awaiting Payment)

- Contact Information (Email, phone for follow-ups)

- For Creditors (Those you owe):

- Creditor Name (Supplier or vendor name)

- Bill/Invoice Number

- Original Amount Owed

- Date Received (When the bill arrived)

- Due Date (When the payment is due)

- Amount Outstanding (How much is still to be paid)

- Payment Status (e.g., Paid, Due, Overdue)

- Contact Information (For inquiries or payment arrangements)

Having these details organized means you won’t have to scramble through multiple documents to find what you need. A quick glance at your template will give you a full overview, enabling you to prioritize payments, chase overdue invoices efficiently, and maintain a clear, accurate financial picture at all times. It’s about making your financial life simpler and more manageable.

Taking control of your finances doesn’t have to be a daunting task. By consistently tracking who owes you and who you owe, you build a clear picture of your financial standing, allowing for better planning and reduced stress. It’s a simple yet powerful habit that can lead to significant improvements in your overall financial health, whether for your business or personal life.

So, don’t let financial details overwhelm you any longer. Start utilizing a reliable debtors and creditors list template today. This practical tool will not only help you organize your outstanding balances and obligations but also empower you to make more confident and informed financial decisions, paving the way for greater stability and growth.