Navigating the complexities of business transactions can often feel like a daunting task, especially when it involves the transfer of valuable assets. Whether you’re selling old equipment, divesting a business unit, or even transferring ownership of a whole company, documenting these exchanges properly is not just good practice, it’s essential for legal clarity and protection. A simple handshake, while traditional, simply won’t suffice in the modern business landscape where meticulous records are paramount.

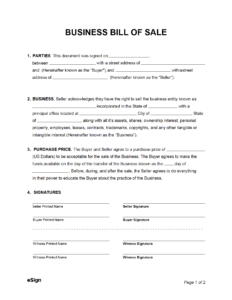

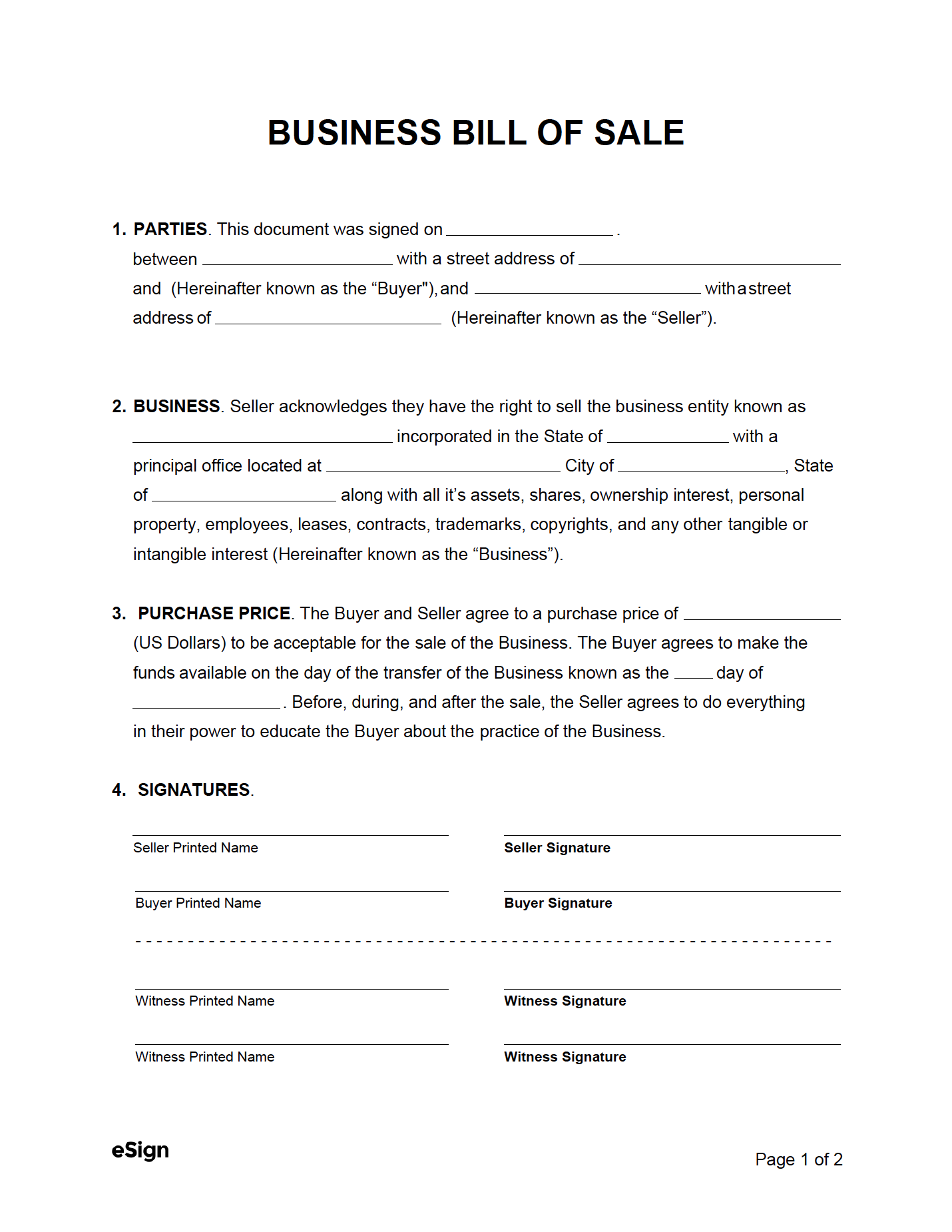

This is where a robust and reliable bill of sale comes into play. It serves as a vital legal document, formally recording the sale and transfer of ownership from one party to another. For businesses, having a clear, concise, and comprehensive document ensures that both the buyer and seller are protected, that all terms are understood, and that there’s a verifiable record for future reference, be it for accounting, legal, or tax purposes.

Why Your Business Needs a Company Bill of Sale

For any enterprise, regardless of its size, a properly executed bill of sale is more than just a formality; it’s a cornerstone of responsible business operations. It provides irrefutable proof of a transaction, outlining the details of what was sold, to whom, for how much, and under what conditions. Without this documentation, disputes can arise, tax liabilities can become unclear, and ownership questions can linger, leading to unnecessary headaches and potential legal battles down the line.

Consider the diverse range of assets a company might need to sell. This could include office furniture, vehicles from a fleet, specialized machinery, or even intellectual property. Each of these transfers carries significant financial and legal implications. A detailed bill of sale clarifies the exact items being transferred, preventing misunderstandings about what is included in the sale and ensuring that both parties agree on the precise scope of the transaction.

Beyond individual asset sales, a bill of sale becomes exponentially more critical when an entire business or a significant portion of its assets are being transferred. In such large-scale transactions, myriad details must be captured, from inventory lists to client relationships and existing contracts. This document acts as a safeguard, protecting both the seller from future claims regarding the condition of the sold items and the buyer by verifying their legal ownership.

Ultimately, having a comprehensive company bill of sale template readily available streamlines your processes and provides peace of mind. It acts as your legal compass, ensuring every asset transfer is handled with the diligence and precision it deserves.

Key Scenarios Where a Bill of Sale is Crucial

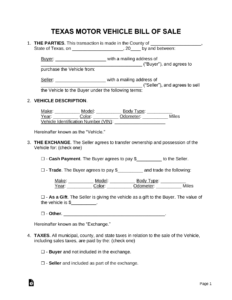

- Selling individual business assets like vehicles, heavy machinery, or office equipment.

- Transferring ownership of an entire business, including its goodwill, assets, and liabilities.

- Documenting the sale of intellectual property rights, such as patents or copyrights.

- Facilitating the sale of inventory in bulk to another business.

- Recording internal transfers of assets between subsidiaries or departments for accounting purposes.

Crafting an Effective Company Bill of Sale Template

Developing a strong company bill of sale template means including all the necessary components to ensure its legal standing and clarity. It’s not just about filling in the blanks; it’s about understanding what information is vital for protecting all parties involved in a transaction. The aim is to create a document that leaves no room for ambiguity and thoroughly details the agreement.

The most fundamental elements revolve around identifying the parties and the item being sold. This includes the full legal names and addresses of both the buyer and the seller, along with a comprehensive description of the asset. For physical goods, this might involve serial numbers, model numbers, and any unique identifiers. For intangible assets like intellectual property, a detailed description of the rights being transferred is essential.

Another critical section addresses the financial terms of the sale. This includes the agreed-upon purchase price, the payment method, and any specific payment schedule or conditions, such as deposits or installment plans. It’s also the place to specify if the sale is “as is” or if any warranties are being offered, outlining their scope and duration to prevent future misunderstandings about the item’s condition.

Finally, proper execution is key. This involves clear signature lines for both the buyer and seller, along with the date of the transaction. Depending on your jurisdiction and the nature of the asset, you might also need witnesses or a notary public to authenticate the signatures, adding an extra layer of legal validity. A well-prepared company bill of sale template will guide you through all these crucial steps seamlessly.

- Identification of Parties: Full legal names, addresses, and contact information for both the buyer and seller.

- Detailed Asset Description: A comprehensive explanation of the item(s) being sold, including serial numbers, makes, models, and any unique features.

- Purchase Price and Payment Terms: The agreed-upon sale amount, how payment will be made, and any specific payment schedule.

- “As-Is” Clause or Warranties: Clearly state whether the item is sold without warranty or if any specific guarantees are being offered.

- Governing Law: Specify the state or jurisdiction whose laws will govern the bill of sale.

- Signatures and Dates: Spaces for all involved parties to sign and date the document, often including witness or notary sections.

Having a meticulously prepared bill of sale for your business transactions is an investment in your company’s future security. It significantly reduces the risk of disputes, simplifies record-keeping, and ensures that every asset transfer is handled with the utmost professionalism. This foundational document provides peace of mind, knowing that your agreements are legally sound and clearly documented for all parties.