When you’re involved in buying or selling a business, or even just significant assets from one, the paperwork can seem daunting. There are so many details to consider, from intellectual property to physical inventory, and making sure everything is properly documented is crucial. Without the right legal framework, disputes can arise, making what should be a straightforward transaction complicated and stressful for everyone involved.

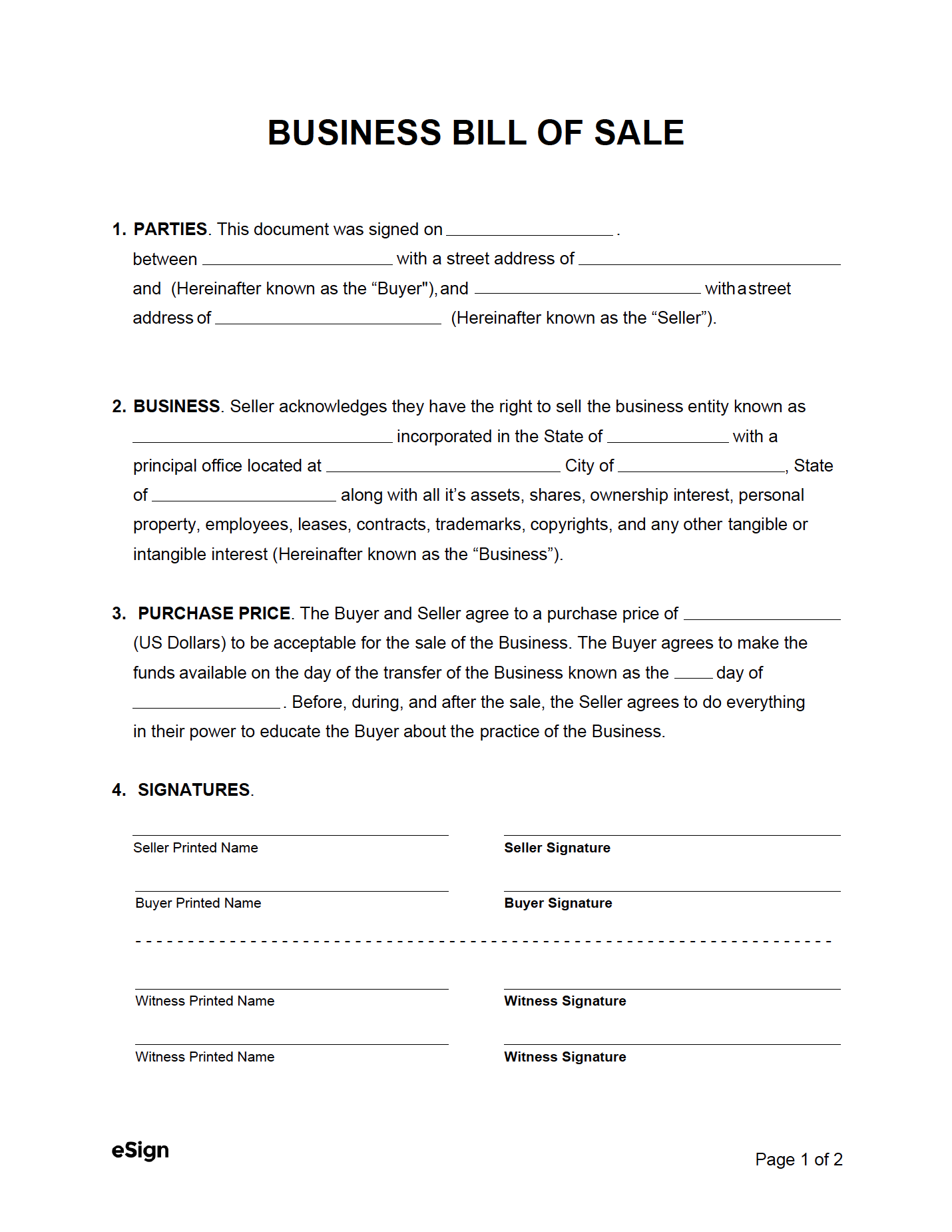

This is precisely where having a reliable business bill of sale form template becomes invaluable. It serves as your foundational document, providing a clear, legally sound record of the transaction. Think of it as your official receipt and agreement rolled into one, designed to protect both the buyer and the seller by clearly outlining the terms of the sale, the assets being transferred, and the agreed-upon price. It brings much-needed clarity and peace of mind to what can be a very intricate process.

Why You Need a Business Bill of Sale

A business bill of sale is far more than just a simple receipt; it’s a vital legal document that formalizes the transfer of ownership of a business or its assets from a seller to a buyer. It acts as concrete proof that the transaction took place, outlining the specific items or the entire entity that was sold, the date of the sale, and the amount exchanged. Without this detailed record, proving ownership or defending against future claims could become incredibly difficult.

Having this document provides immense peace of mind for both parties. For the buyer, it confirms legal ownership and ensures that the assets are free from any undisclosed liens or encumbrances. For the seller, it clearly marks the end of their responsibility for the assets, safeguarding them from future liabilities related to the items or business sold. It precisely defines what’s included and, just as importantly, what’s not, preventing misunderstandings down the line.

Key Components to Include

To be effective, your business bill of sale needs to be comprehensive. It should leave no room for ambiguity, ensuring all essential details of the transaction are meticulously recorded. Missing even a single piece of critical information could compromise its legal standing and lead to future complications.

When preparing or reviewing your document, ensure it contains the following crucial elements:

- Complete identification of both the buyer and the seller, including their full legal names, addresses, and contact information.

- A detailed and exhaustive description of the assets or the business being sold. This should specify everything from tangible property like equipment, inventory, and real estate, to intangible assets such as goodwill, customer lists, trademarks, and intellectual property.

- The agreed-upon purchase price and the specific terms of payment, including any down payments, payment schedules, or conditions.

- Warranties and representations made by the seller, such as assurances that the assets are free of liens or that the business is in good standing.

- The official date of the sale and the authenticated signatures of both the buyer and the seller, often witnessed or notarized for added legal weight.

Being thorough with each of these items is paramount. An asset description that’s too vague, or an incomplete payment schedule, can open doors for disputes. Remember, the clearer and more detailed your business bill of sale, the stronger its protection for everyone involved. A well-crafted document acts as a cornerstone for a smooth transition, protecting interests and preventing legal headaches down the line, ensuring that the transfer of ownership is legally sound and indisputable.

How to Use and Customize Your Template

Starting with a pre-made business bill of sale form template significantly streamlines the process compared to drafting a legal document from scratch. These templates are designed to cover the most common legal requirements, offering a solid framework that you can then tailor to the specifics of your unique transaction. It’s like having a professional guide for your complex sale, ensuring you don’t miss any crucial steps.

Once you have your template, the first step is usually to input the basic information about the buyer and seller. This includes their legal names, addresses, and any business registration numbers if applicable. Accuracy here is key, as these details form the legal identities of the parties involved in the agreement. Double-check spellings and ensure all contact information is up to date and correct.

Next, focus on the specific assets or business being transferred. This is where meticulous detail pays off. Instead of simply writing “office furniture,” list each item: “One (1) mahogany executive desk, serial number ABC123; four (4) ergonomic office chairs, model XYZ; etc.” If you’re selling an entire business, ensure the description covers all aspects, including intellectual property, inventory, customer lists, and even business goodwill. For extensive lists of assets, it’s often a good practice to create an itemized schedule or appendix and reference it within the main document.

The financial details require careful attention. Clearly state the total purchase price, how it will be paid (e.g., lump sum, installments), the payment method, and any conditions tied to the payment, such as escrow arrangements. This section is vital for preventing financial misunderstandings later on. Remember, while a template provides a strong foundation, every business transaction has its unique nuances that might require specific clauses or adjustments.

You might need to add specific provisions not covered in a generic template, such as non-compete clauses, agreements regarding outstanding debts, or special conditions related to intellectual property transfer. Consider the unique aspects of your business and the assets involved, and don’t hesitate to modify the template to reflect these.

- Thoroughly review all sections of the template, ensuring accuracy of all names, addresses, asset descriptions, and financial terms.

- Consider if any specific state laws or industry regulations might require additional clauses or disclosures not present in a standard template.

For particularly complex transactions, or if you are unsure about any legal jargon or specific clauses, consulting with a legal professional is always a wise decision. They can ensure your customized document fully protects your interests and complies with all applicable laws, providing an extra layer of security.

Having a robust, well-detailed document to formalize the transfer of assets or an entire enterprise is an absolute necessity. It serves not just as a record, but as a critical tool for minimizing risks and fostering clarity between parties. By taking the time to properly complete and customize such a document, you lay a solid foundation for a successful transition, ensuring all aspects of the sale are transparent and legally defensible.