When you’re buying or selling an item, especially one of significant value, it’s always a smart move to have things in writing. A standard bill of sale confirms a transaction has occurred, but what happens when the full payment isn’t made upfront? That’s where a bill of sale designed to include payment terms becomes incredibly valuable, providing a clear roadmap for both parties.

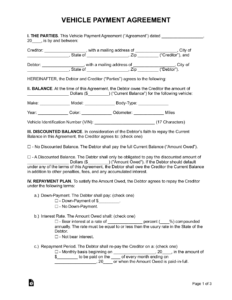

This type of document is more than just a receipt; it’s a legal agreement that outlines the terms of a sale when the buyer agrees to pay in installments over time, rather than a single lump sum. It ensures clarity and protection for both the seller, who wants to ensure they receive their money, and the buyer, who needs proof of their payments and eventual ownership. It acts as a formal record of the agreement, preventing misunderstandings down the line.

Why You Need a Bill of Sale with Payments

Entering into any agreement involving money and property requires careful documentation. A bill of sale with payments template serves as a robust legal framework, clearly delineating the responsibilities and expectations of both the buyer and the seller. It moves beyond a simple handshake agreement, providing a verifiable record that can be referenced should any dispute arise during the payment period. For sellers, it offers peace of mind by detailing the payment schedule, the amount of each installment, and the consequences of missed payments. This protects their interest in the item until the final payment is received.

On the buyer’s side, this document is equally crucial. It provides a clear, structured path to ownership, allowing them to budget and plan their finances accordingly. Each payment made is recorded against the agreement, building a transparent history until the purchase price is fully satisfied. It also specifies what happens once all payments are complete, usually outlining the formal transfer of title or full ownership. This transparency helps foster trust between the parties and ensures a smooth transaction from start to finish.

Ultimately, using a comprehensive bill of sale with payments template minimizes risk for everyone involved. It eliminates ambiguity regarding payment amounts, due dates, and the total purchase price. Without such a document, proving the terms of an installment agreement can become incredibly difficult, leading to potential financial loss or lengthy legal battles. It’s about ensuring a fair and equitable process for both sides of the transaction.

Essential Elements of a Payment Bill of Sale

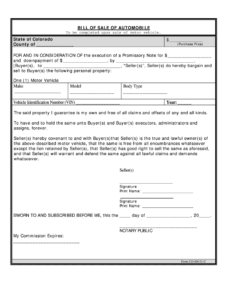

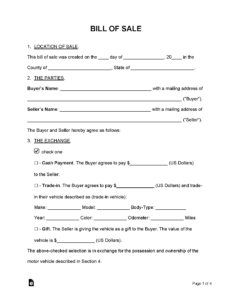

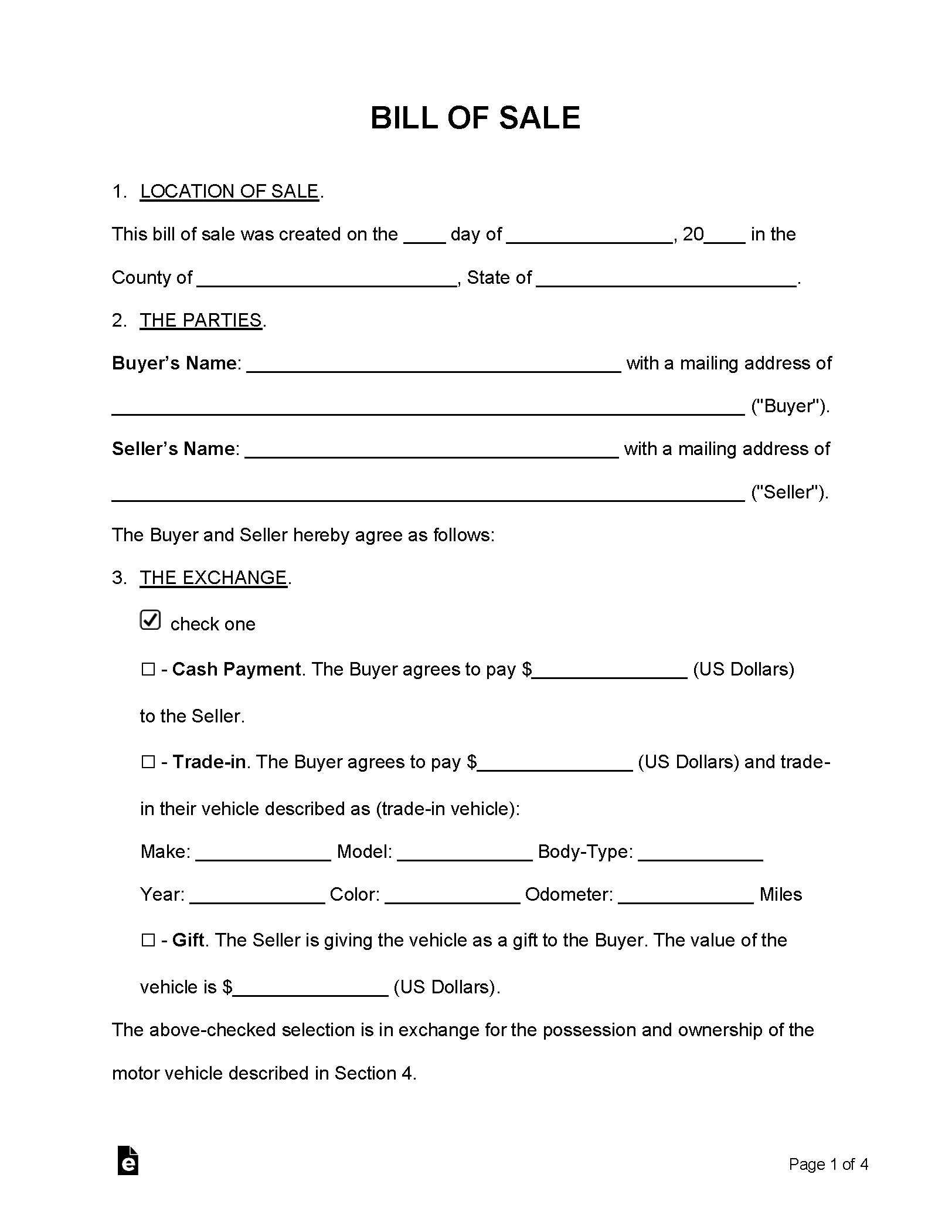

- Seller and Buyer Information: Full legal names, addresses, and contact details for all parties involved.

- Item Description: A detailed description of the item being sold, including make, model, year, VIN (for vehicles), serial number, and any unique identifiers.

- Purchase Price and Payment Schedule: The total agreed-upon price, the down payment amount (if any), the number of installments, the amount of each installment, and the frequency of payments (e.g., weekly, monthly).

- Payment Method and Due Dates: How payments will be made (e.g., bank transfer, check) and the exact due date for each installment.

- Default Clauses: What happens if a payment is missed or the buyer defaults on the agreement, including potential late fees or repossession terms.

- Signatures and Date: Signatures of both the buyer and the seller, dated, preferably with witnesses or notarization for added legal weight.

Common Scenarios for Using a Payment Bill of Sale

The utility of a payment bill of sale extends to numerous situations where a large, one-time payment isn’t feasible or desired. It’s particularly prevalent in private sales of high-value assets, bridging the gap between a seller who might not want to wait for a buyer to secure a loan and a buyer who prefers to pay incrementally rather than through traditional financing. This flexibility makes it an attractive option for both parties, facilitating sales that might otherwise not occur.

One of the most common applications is in the sale of used vehicles between private parties. Cars often represent a significant investment, and not every buyer has the full cash amount readily available. A payment bill of sale allows the buyer to take possession of the vehicle while making structured payments, with the seller retaining a security interest until the total amount is paid. This provides a legal framework for both the transfer of possession and the staggered payment process.

Beyond vehicles, this type of document is also frequently used for other personal property like boats, RVs, motorcycles, or even expensive equipment. Imagine selling a valuable piece of machinery or a collector’s item where the buyer needs time to pay. A detailed bill of sale ensures that all terms, including the payment schedule and what happens if payments are missed, are clearly understood and legally binding.

Ultimately, this document helps structure a responsible and legally sound transaction. It ensures that the seller has a clear path to receiving their money and the buyer has a transparent method for acquiring ownership over time. It’s a testament to good planning and clear communication, forming the bedrock of a successful sale.

Having a meticulously prepared agreement for your transaction is more than just good practice; it’s a vital safeguard. It solidifies the terms of the sale, detailing every aspect of the payment plan, from the initial deposit to the final installment. This level of detail provides both parties with a clear understanding of their obligations and rights, creating a sense of security throughout the payment period.

By taking the time to outline all conditions in writing, you ensure that the path to full ownership for the buyer and full payment for the seller is unambiguous. It acts as a professional and legally sound record, minimizing the potential for disagreements and providing a reference point should any questions arise in the future. Investing in a proper document makes for a smoother, more secure transaction for everyone involved.