When you’re buying or selling a significant asset like a car, boat, or even a piece of equipment, a bill of sale is your go-to document to formalize the transfer of ownership. It’s like shaking hands on paper, making sure everyone knows who owns what and for how much. But what happens when that asset isn’t entirely “yours” yet, meaning there’s still a loan or a lien attached to it? This is where things can get a bit more complicated than a standard transaction.

Navigating a sale when there’s an outstanding lien requires an extra layer of clarity and protection for both the buyer and the seller. You can’t just transfer ownership without addressing the money still owed. This specific scenario calls for a specialized document, a bill of sale with lien payoff template, which ensures that the lien is properly handled as part of the sale, giving both parties peace of mind and preventing future headaches.

Understanding the Basics of a Bill of Sale with a Lien

A lien, simply put, is a legal claim on an asset by a creditor (like a bank or a financing company) until a debt is paid off. Think of it as a security interest; if you don’t pay your loan, the lienholder has the right to repossess the asset. When you’re selling an item that has a lien on it, you’re not just selling the item, you’re also selling the responsibility to clear that lien, usually with funds from the sale itself. It’s crucial that this process is documented meticulously to avoid any legal ambiguities or financial surprises down the line.

A standard bill of sale is great for a straightforward transaction where the seller owns the item free and clear. It usually just lists the buyer, seller, item details, and purchase price. However, when a lien is involved, this basic document falls short. It doesn’t provide the necessary framework to acknowledge the existing debt, detail how it will be paid, and most importantly, confirm its release. Without addressing the lien directly in the sales agreement, the buyer could unwittingly inherit the seller’s debt, or the seller might remain liable for a debt they thought was settled.

This is precisely where a bill of sale with lien payoff template becomes indispensable. This document serves as a legally binding record that outlines not only the sale itself but also the specific agreement for satisfying the outstanding lien. It clarifies who is responsible for paying off the lienholder, the exact amount to be paid, and when this payment will occur. This level of detail protects the buyer by ensuring they receive clear title to the property, and it protects the seller by documenting that the proceeds from the sale were used to satisfy their financial obligation.

The complexities involved in selling an asset with a lien can be daunting. There are financial institutions to deal with, specific payoff amounts to confirm, and timelines to adhere to. Relying on verbal agreements or incomplete documentation is a recipe for potential disputes. A properly structured bill of sale with lien payoff is your best defense against such issues, providing a clear audit trail and legal proof that all financial obligations were met during the transfer of ownership. It brings professionalism and clarity to what could otherwise be a confusing and risky transaction.

Key Elements to Look for in a Bill of Sale with Lien Payoff

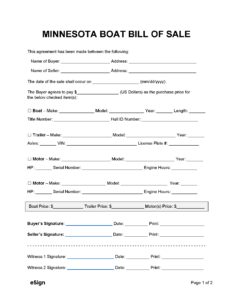

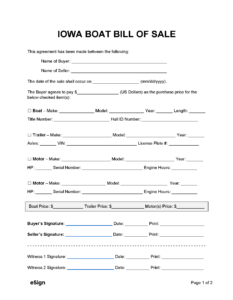

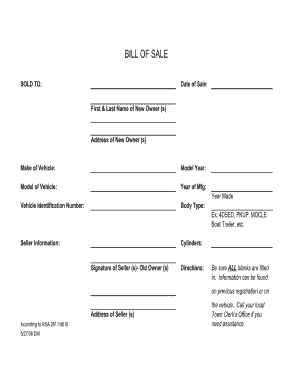

- Seller and Buyer Information: Full legal names, addresses, and contact details for both parties involved in the transaction.

- Vehicle/Item Description: Comprehensive details of the asset being sold, including make, model, year, color, and unique identifiers like a Vehicle Identification Number (VIN) for cars or a serial number for other items.

- Purchase Price and Payment Terms: The agreed-upon total sale price and how the payment will be made (e.g., cashier’s check, wire transfer, cash), including any specific payment schedule.

- Lienholder Information: Complete details of the financial institution or individual holding the lien, including their name, address, and the account number associated with the lien.

- Payoff Amount and Date: The exact amount required to satisfy the lien as confirmed by the lienholder, and the date by which this payoff must be completed. This is often accompanied by instructions on how the payoff will be handled (e.g., buyer pays lienholder directly, seller pays lienholder from sale proceeds).

- Witness Signatures: Spaces for witnesses to sign, which can add an extra layer of validity and security to the document, though not always legally required.

- Odometer Disclosure (for vehicles): A mandatory section for vehicle sales, stating the current mileage of the vehicle and whether it is accurate.

Why a Template is Your Best Friend for a Smooth Transaction

Imagine trying to draft a legal document from scratch, making sure you don’t miss any critical details, especially when money and ownership are on the line. It’s not just tedious; it’s risky. This is why using a pre-designed, comprehensive bill of sale with lien payoff template is incredibly advantageous. It takes the guesswork out of the equation, providing a structured framework that ensures all necessary information, particularly related to the lien, is included. You don’t have to remember every single clause or piece of data; the template prompts you for it, significantly reducing the chance of accidental omissions that could lead to future legal complications.

A well-crafted template simplifies what could otherwise be a complex and stressful process for both the buyer and the seller. For the buyer, it offers reassurance that the lien will be properly handled and they won’t inherit someone else’s debt. For the seller, it provides a clear roadmap for fulfilling their obligation to the lienholder and smoothly transferring ownership. This clarity fosters trust between the parties, minimizing confusion and potential disputes that often arise from unclear agreements. It allows everyone to focus on the excitement of the transaction rather than getting bogged down in legal minutiae.

While a template provides a solid foundation, it’s also flexible enough to be customized to your specific situation. You might need to add specific clauses about unique payment arrangements or particular terms related to the asset. The core elements, however, remain consistent and legally sound. This balance of standardization and adaptability makes a template an invaluable tool. It means you’re not starting from zero, but you still have the freedom to tailor the document to accurately reflect your individual agreement.

Most importantly, using a proper bill of sale with lien payoff template offers significant legal protection. This document serves as undeniable proof of the transaction, detailing the asset, the agreed-upon price, and critically, how the lien was addressed. Should any dispute arise after the sale, this comprehensive document stands as a verifiable record of what was agreed upon and executed. It acts as your legal safeguard, offering peace of mind that your transaction was conducted ethically and legally, protecting you from potential liabilities down the road.

Navigating the sale of an asset with an outstanding lien can seem daunting, but it doesn’t have to be. By leveraging a comprehensive bill of sale with lien payoff template, you empower yourself with a tool that ensures clarity, legal compliance, and security for everyone involved. This document transforms a potentially complicated transaction into a straightforward, transparent process, safeguarding both your financial interests and your peace of mind. Ultimately, it allows you to complete the transfer of ownership with confidence, knowing that all obligations have been properly addressed and recorded.