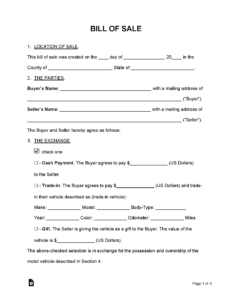

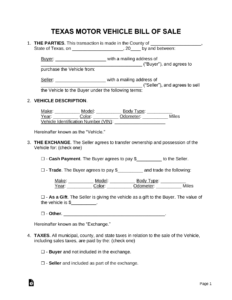

When you’re buying or selling an item, especially one of significant value, it’s always a smart move to have a clear record of the transaction. A standard bill of sale does a great job of documenting the transfer of ownership. However, what happens when the full payment isn’t made upfront? This is where things can get a little more complicated, and why a specialized document is incredibly useful.

If a buyer makes a partial payment, often called a down payment, before taking full ownership or completing the entire purchase, you need a document that accurately reflects this unique financial arrangement. This specific scenario calls for more than just a simple receipt; it demands a comprehensive `bill of sale with down payment template` to protect both parties involved. It’s about setting clear expectations and legally documenting the initial commitment, paving the way for a smooth transaction until the final balance is paid.

Why You Need a Bill of Sale with a Down Payment

Using a specific bill of sale when a down payment is involved is crucial for several reasons, primarily offering legal protection and clarity for both the buyer and the seller. Without it, disputes can easily arise regarding the amount paid, the remaining balance, or even the terms of the sale itself. Imagine a scenario where a buyer claims they paid more than they did, or a seller disputes the receipt of the down payment; a detailed document eliminates such ambiguity.

Specifically, the down payment aspect changes the nature of the transaction from a simple exchange to a staged process. The down payment signifies the buyer’s serious intent to purchase the item and usually secures the item, preventing the seller from offering it to others. For the seller, it provides assurance that the buyer is committed, reducing the risk of a last-minute withdrawal and potential loss of other interested parties.

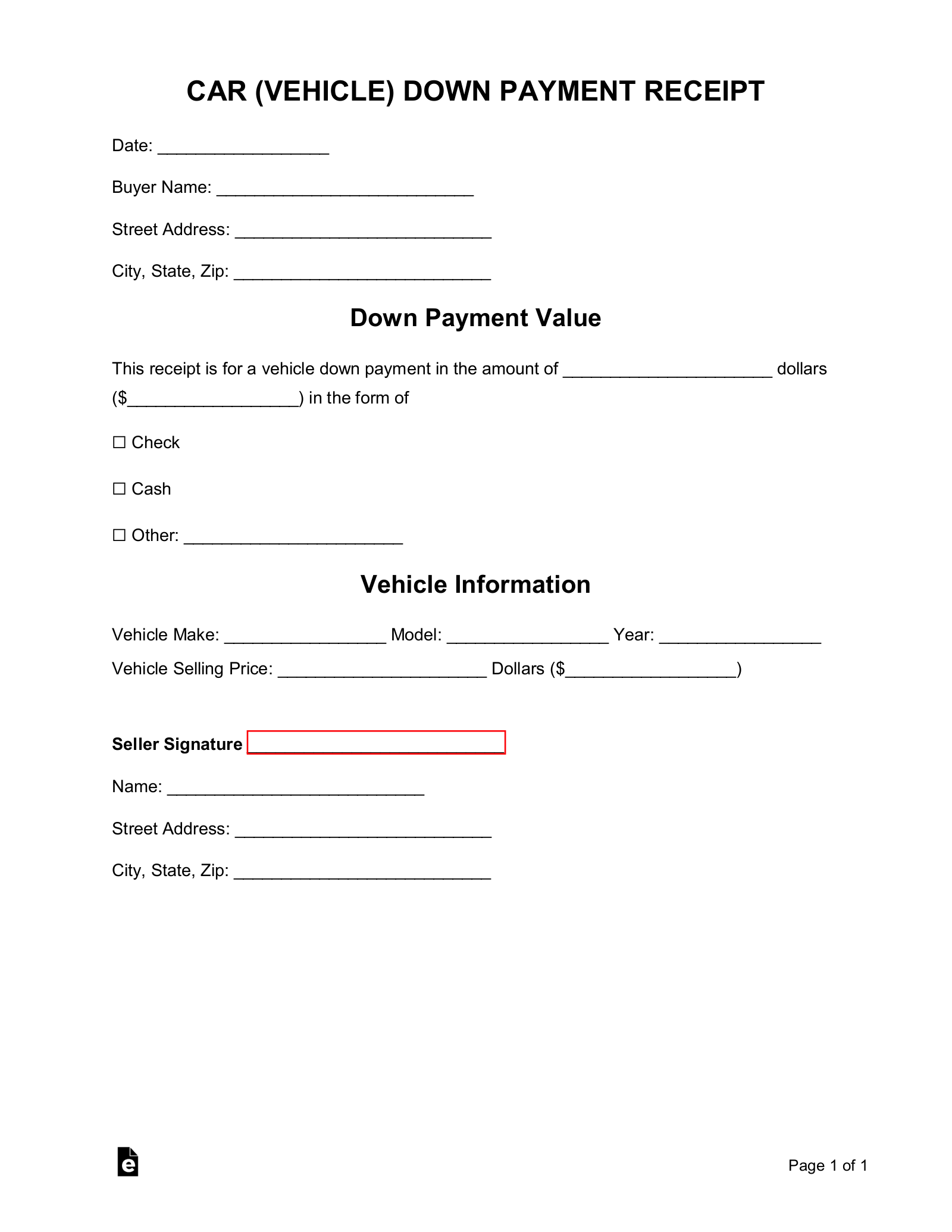

This template goes beyond just recording the total price. It meticulously details the exact amount of the down payment, the date it was received, and the method of payment. This level of detail is paramount, as it establishes a clear starting point for the financial agreement and clearly outlines the outstanding balance. It acts as a transparent ledger, preventing any future misunderstandings about what has been paid and what is still owed.

Furthermore, a well-structured bill of sale anticipates future payments, outlining the remaining balance and potentially a schedule for its completion. This forward-thinking approach ensures that the buyer understands their ongoing financial obligation and the seller has a documented agreement for receiving the rest of their funds. It’s a foundational document that supports a transparent and legally sound transaction from start to finish.

Essential Components of Your Template

- Buyer and Seller Information: Full legal names, current addresses, and contact details for both parties.

- Item Description: A comprehensive description of the item being sold, including make, model, year, serial number, VIN (for vehicles), color, and any unique identifying features. Its current condition should also be noted.

- Purchase Price: The total agreed-upon selling price of the item.

- Down Payment Details: The precise amount of the down payment, the date it was paid, and the method of payment (e.g., cash, check number, bank transfer reference).

- Remaining Balance: Clearly state the exact amount still owed after the down payment has been deducted.

- Payment Schedule (if applicable): If the remaining balance will be paid in installments, detail the amounts, due dates, and frequency of these payments.

- Terms and Conditions: Any specific agreements, such as “as-is” clauses, warranty information (or lack thereof), or conditions for the return or forfeiture of the down payment.

- Signatures: Legally binding signatures of both the buyer and the seller, along with the date of signing.

- Witness Signatures (optional but recommended): Signatures of independent witnesses can add an extra layer of validity and security to the agreement.

Navigating the Down Payment Process

The process of handling a down payment requires careful attention to detail, both for the person receiving the funds and the person making them. For the buyer, making a down payment is a significant step, committing a portion of their funds towards a purchase. It’s essential they receive a clear, documented receipt of this payment, which the `bill of sale with down payment template` inherently provides by integrating it into the core agreement. This ensures proof of payment and reduces the risk of any future disagreements regarding the amount tendered.

For the seller, accepting a down payment means holding the item for the buyer and potentially foregoing other offers. It’s important to clearly define the terms under which the down payment is accepted, such as whether it’s refundable or non-refundable if the sale falls through. This understanding needs to be explicitly stated within the document, protecting the seller from potential losses if the buyer decides not to proceed with the full purchase.

Using a comprehensive template allows both parties to easily fill in the necessary information, ensuring no critical details are overlooked. It guides them through capturing the specific financial arrangement, including the total price, the down payment amount, and the outstanding balance. This systematic approach ensures that the transaction is transparent from the start, minimizing any potential for miscommunication or dispute later on.

Ultimately, having a well-structured document, such as a robust bill of sale with down payment template, provides invaluable peace of mind. It acts as a definitive record, clearly outlining the initial financial commitment and the path to full ownership. It’s an essential tool for any transaction involving a partial upfront payment, guaranteeing that both buyer and seller are fully informed and legally protected throughout the entire purchasing process.

A properly executed bill of sale, especially one that accounts for a down payment, serves as irrefutable proof of the transaction’s terms. It simplifies the process, making it less daunting for individuals who might not be familiar with legal documentation. By clearly outlining all financial obligations and responsibilities, it allows both parties to enter into the agreement with confidence and ensures a smooth transfer of ownership once the full payment is completed.