Buying or selling personal property, whether it’s a beloved old car, a trusty boat, or even a piece of furniture, often involves more than just a simple exchange of goods and money. To ensure a smooth, legally sound transaction, it’s wise to have a formal document in place. This is where a bill of sale comes into play, serving as a vital record that protects both the buyer and the seller.

For residents of the Old Dominion, understanding the nuances of such a document is particularly important. While not all transactions strictly require one by law, having a properly filled-out bill of sale can prevent future disputes, establish clear ownership, and even fulfill requirements for official registrations. This article will walk you through the essentials, helping you navigate the process with confidence and clarity.

Understanding the Basics of a Virginia Bill of Sale

A bill of sale is essentially a legal document that records the transfer of ownership of an item from a seller to a buyer. In Virginia, much like in other states, it acts as proof that a transaction occurred, detailing what was sold, for how much, and on what date. While you might think of it primarily for large purchases like vehicles, its utility extends to any significant personal property, offering a layer of protection that a simple handshake can’t.

For the seller, a bill of sale provides crucial evidence that they no longer own the item, potentially shielding them from liability after the sale. Imagine selling a car and then, weeks later, receiving a parking ticket or an accident notice; a bill of sale proves you were no longer the owner. For the buyer, it’s irrefutable proof of ownership, essential for registering the item, insuring it, or reselling it in the future. It clearly defines the condition of the item at the time of sale, preventing later claims of misrepresentation.

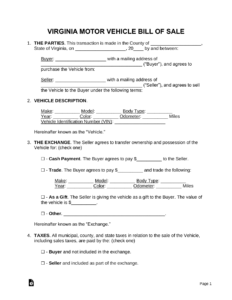

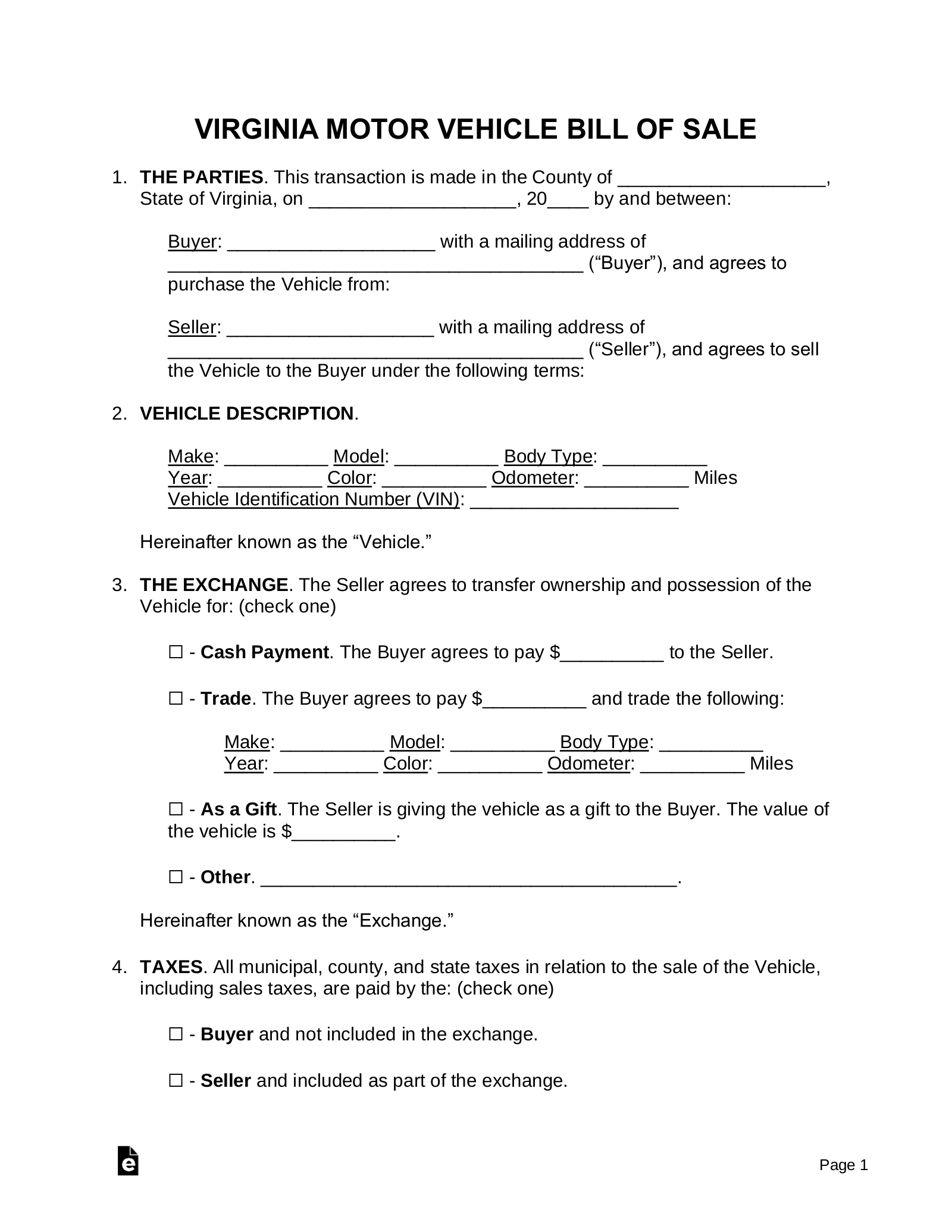

Key Information to Include for a Virginia Bill of Sale

A comprehensive bill of sale should contain several specific pieces of information to be effective and legally sound. Missing even one detail can lead to complications down the line.

- Date of Sale: This is critical for establishing when the transfer of ownership officially occurred.

- Buyer and Seller Information: Full legal names, addresses, and contact details for both parties. This clearly identifies who is involved in the transaction.

- Description of Property: A detailed description of the item being sold. For vehicles, this includes make, model, year, Vehicle Identification Number (VIN), odometer reading, and license plate number if applicable. For other items, be as specific as possible (e.g., brand, model number, serial number, color, condition).

- Purchase Price: The agreed-upon amount for which the item is being sold. This should be clearly stated in both numerical and written form.

- Payment Method: How the payment was made (e.g., cash, check, money order, electronic transfer).

- Signatures: Signatures of both the buyer and the seller. It’s often recommended, though not always required by law for personal property, to have these signatures notarized to add an extra layer of authenticity.

- "As-Is" Clause (Optional but Recommended): For most private sales, including an "as-is" clause indicates that the buyer accepts the item in its current condition with no implied warranties from the seller. This protects the seller from future claims about the item’s condition.

The accuracy and completeness of these details are paramount. Any ambiguity or error could invalidate the document or lead to disputes. Therefore, taking the time to fill out a bill of sale template Virginia style meticulously is a wise investment of time for any significant transaction.

When and Why You Need a Bill of Sale in Virginia

While a bill of sale is a good idea for almost any transaction involving the transfer of personal property, there are specific instances in Virginia where it becomes more than just a good idea—it’s often a necessity or highly recommended for your protection and compliance with state regulations. Understanding these scenarios can save you significant hassle and potential legal issues down the road.

One of the most common reasons to use a bill of sale in Virginia is for the sale or purchase of a motor vehicle. When you sell a car, the Virginia Department of Motor Vehicles (DMV) requires specific documentation to transfer the title. While a bill of sale might not be the only document needed, it serves as crucial supporting evidence for the sale price and date, which are vital for calculating sales tax and establishing the new owner’s liability. For the seller, it provides proof that you are no longer responsible for the vehicle, effectively cutting your ties with it regarding future tickets, accidents, or liability claims. Without it, you could face unexpected consequences.

Similarly, if you’re buying or selling a boat, a bill of sale is incredibly useful. The Virginia Department of Wildlife Resources (DWR) handles boat registration and titling. A properly executed bill of sale helps in demonstrating proof of ownership for registration purposes and can also specify details like the boat’s Hull Identification Number (HIN), make, model, and engine information, ensuring a clear transfer. This level of detail helps prevent fraud and establishes clear ownership in case of disputes or if the boat needs to be reported stolen.

Beyond vehicles and boats, a bill of sale is also highly advisable for other high-value personal property. This could include things like firearms, expensive electronics, unique art pieces, or even animals. For instance, when adopting or purchasing a pet, a bill of sale can outline the terms of the transfer, the pet’s health records, and any guarantees made by the seller. This document ensures that both parties have a clear record of the agreement, protecting against misunderstandings or disagreements about the item’s condition or true value. Ultimately, it provides peace of mind, knowing that the transaction is well-documented and legally sound, minimizing the chances of future headaches.

Having a clear, documented record of a transaction, especially when dealing with significant assets, is a smart practice. It provides a layer of legal protection for both parties, clarifying the terms of the sale and reducing the likelihood of future disputes. By ensuring all necessary details are accurately recorded, you can proceed with confidence, knowing that your interests are well-protected and the transfer of ownership is legally sound.