When you’re involved in buying or selling personal property, whether it’s a vehicle, a boat, or even something smaller, having clear documentation is absolutely crucial. It’s not just about shaking hands and exchanging money; it’s about creating a verifiable record of the transaction that protects both parties involved. This legal document serves as proof of ownership transfer and can prevent a lot of headaches down the road.

Specifically within the Bluegrass State, understanding the nuances of how these transactions are documented is key. A well-prepared bill of sale ensures that both the buyer and the seller have a legal leg to stand on, providing peace of mind and clarity about the terms of the sale. It’s an essential step that formalizes the transfer of property and helps navigate potential issues, from vehicle registration to disputes over property condition.

Why You Need a Bill of Sale in Kentucky

A bill of sale is far more than just a simple receipt; it’s a vital legal document that formalizes the transfer of ownership for personal property. In Kentucky, much like in other states, this document serves as a critical piece of evidence that a transaction has taken place, detailing who sold what to whom, for how much, and on what date. Without it, proving ownership or the specifics of a sale can become incredibly challenging, leading to potential disputes or legal complications for both the buyer and the seller.

For sellers, having a properly executed bill of sale is essential for limiting future liability. Once the property is sold and the document is signed, it legally transfers ownership and responsibility to the new owner. This can protect the seller from issues that arise after the sale, such as accidents involving a vehicle they no longer own or claims about the property’s condition after it has left their possession. It also provides a clear record for tax purposes, demonstrating when property was disposed of.

On the other side of the transaction, buyers heavily rely on a bill of sale to prove their new ownership. This is particularly critical for items like vehicles, boats, or other titled property, where the bill of sale is a prerequisite for registering the item with the state and obtaining a new title. Without it, the buyer might face significant delays or even be unable to legally register their purchase, which can prevent them from using the property as intended.

Beyond titling and registration, a comprehensive bill of sale offers buyers protection against fraud and confirms the details of their purchase. It outlines the agreed-upon price, the condition of the item at the time of sale, and confirms that the seller had the legal right to sell the property. This transparency is invaluable in fostering trust and preventing misunderstandings.

Key Information to Include

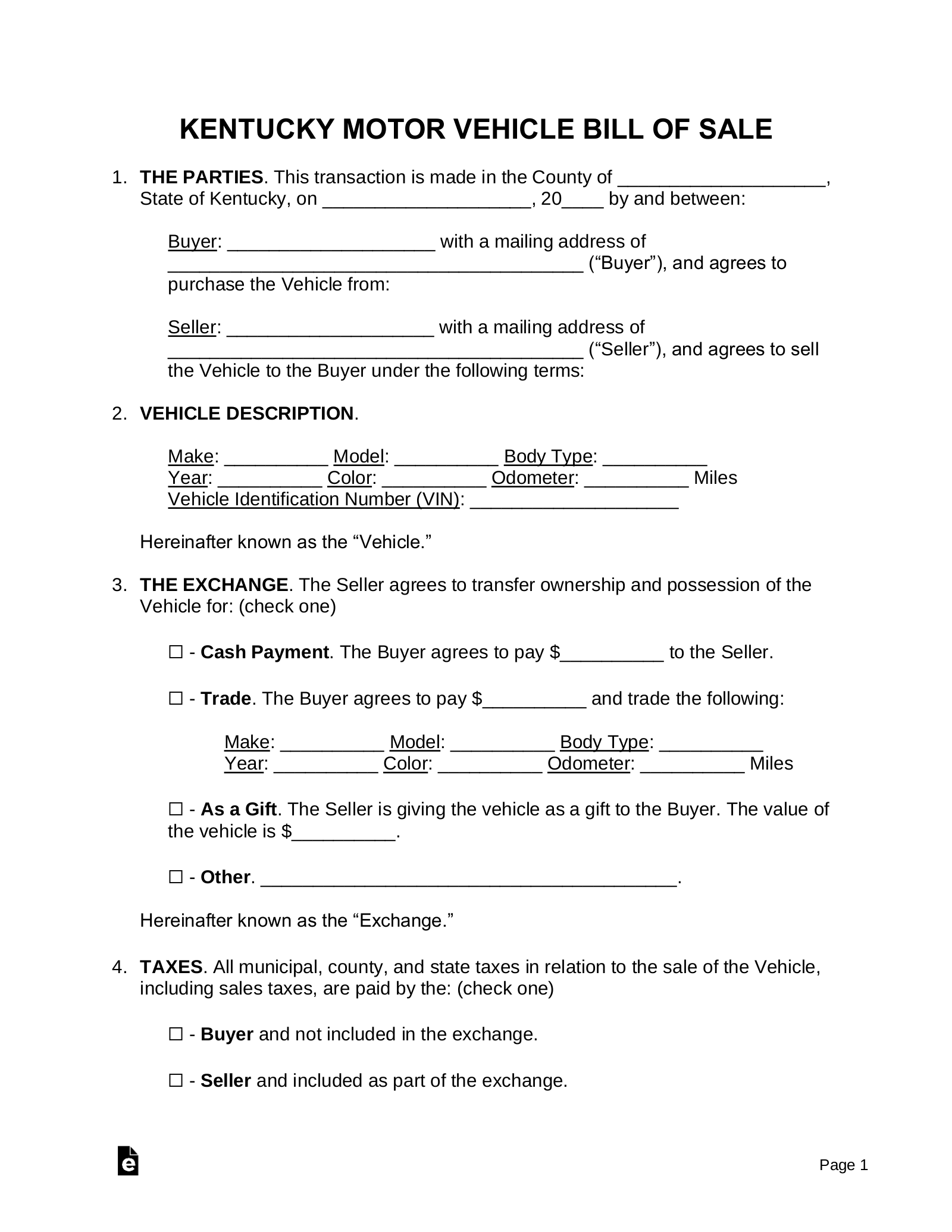

A robust bill of sale should always contain several critical pieces of information to ensure its validity and effectiveness:

- The full legal names and addresses of both the buyer and the seller.

- A detailed description of the property being sold, including make, model, year, vehicle identification number (VIN) if applicable, or any other unique identifiers.

- The agreed-upon purchase price of the property.

- The date of the sale.

- A statement indicating the property is being sold “as-is” or detailing any warranties if applicable.

- Signatures of both the buyer and the seller.

- Notarization, if required or desired, for added legal weight.

Navigating Your Kentucky Bill of Sale Template

Utilizing a pre-designed bill of sale kentucky template can significantly streamline the process of buying or selling personal property. These templates are often structured to include all the necessary legal language and fields specific to Kentucky’s requirements, helping you avoid errors and omissions that could invalidate the document or cause issues later on. Instead of drafting a document from scratch, which can be daunting and prone to mistakes, a template provides a clear roadmap to ensure all bases are covered.

When dealing with transactions in Kentucky, the specifics can vary depending on the type of property. For instance, selling a car requires different details than selling a piece of furniture. A good template will guide you to include crucial identifiers like a Vehicle Identification Number (VIN) for automobiles or a Hull Identification Number (HIN) for boats. It also prompts you to consider whether the sale is “as-is” or if any warranties are implied, a crucial detail that impacts both buyer and seller responsibilities post-sale.

It is always advisable to fill out the template with accurate and complete information. Any discrepancies or missing details could weaken the legal standing of the document. Both parties should carefully review the information before signing to ensure it reflects their understanding of the transaction. Having a witness present, and even considering notarization, can add an extra layer of security and credibility to the bill of sale, making it much harder to dispute in the future.

Once the bill of sale is completed and signed by all parties, it is essential that both the buyer and the seller retain copies for their records. The buyer will typically need their copy for registration purposes, especially for vehicles, while the seller should keep their copy as proof of ownership transfer and for tax records. This due diligence ensures that should any questions or disputes arise, both parties have immediate access to the signed agreement, providing clear evidence of the transaction.

By taking the time to properly complete and file a bill of sale, you are taking a proactive step in protecting your interests and ensuring a smooth, legally sound transfer of property. It solidifies the terms of the agreement, provides official documentation for government agencies, and helps prevent future disagreements or legal entanglements.